How I Built a Giving Legacy Without Losing Control

What happens when you want to give back but worry about losing hard-earned wealth? I’ve been there—planning charitable gifts felt risky, even emotional. One wrong move could mean wasted assets or family conflict. But over time, I discovered a smarter way: a clear system that protects wealth while supporting causes that matter. This isn’t about grand donations—it’s about smart, safe giving. Let me walk you through the real risks and how to avoid them.

The Hidden Risks Behind Charitable Giving

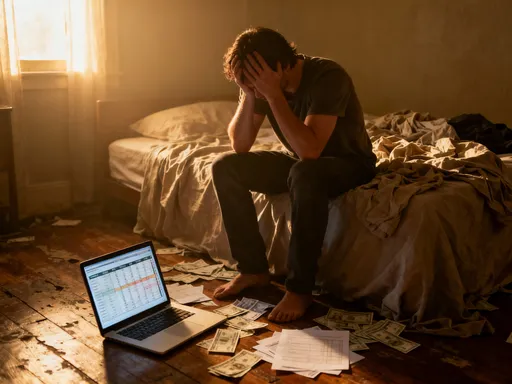

Many people assume donating is simple—just write a check or name a charity in your will. But without structure, even well-meaning gifts can backfire. Assets may be tied up in legal disputes, tax penalties can erase value, and unclear intentions may spark family disagreements. Some donors accidentally disinherit loved ones or trigger unnecessary audits. These risks aren’t rare—they’re common among those who give without planning. The truth? Generosity without guardrails can hurt both your legacy and your beneficiaries. That’s why recognizing these pitfalls early is the first real step toward responsible giving.

One of the most frequent missteps is the timing and type of asset donation. For example, giving highly appreciated stock directly to a charity can offer tax advantages, but doing so without proper documentation or valuation can lead to IRS scrutiny. If the donor fails to obtain a qualified appraisal for non-cash gifts over a certain threshold, the tax deduction may be disallowed entirely. This not only eliminates the expected benefit but can also result in penalties. The process seems straightforward on the surface, yet small oversights compound into significant consequences.

Another often-overlooked risk is the legal enforceability of verbal promises. Some individuals express intentions to support a cause during their lifetime, leading organizations to rely on those commitments. But without a written, legally binding arrangement, heirs or executors are under no obligation to honor them. This can damage relationships and leave nonprofits in financial distress. It also creates tension among family members who may disagree on whether to fulfill such informal pledges.

Additionally, changes in personal circumstances can invalidate a giving plan. A donor might name a local animal shelter as a beneficiary, only to find years later that the organization has merged, rebranded, or ceased operations. Without contingency language in estate documents, the gift may lapse, reverting to the estate or being distributed according to default rules—potentially contrary to the donor’s original intent. These hidden vulnerabilities reveal that intention alone is not enough. A thoughtful, documented strategy is essential to ensure that generosity achieves its purpose without unintended fallout.

Why a System Beats Spontaneous Giving

Random acts of generosity feel good, but lasting impact requires design. A giving system isn’t about reducing emotion—it’s about increasing effectiveness. Think of it like a financial GPS: it guides decisions, prevents detours, and keeps your values aligned with your actions. With a structured approach, you define goals, choose vehicles like donor-advised funds or charitable trusts, and set rules for distributions. This reduces impulsive decisions and ensures your money supports causes consistently. More importantly, a system helps you respond to life changes—like market shifts or family needs—without abandoning your mission. It’s not rigid; it’s resilient.

Spontaneous giving often lacks continuity. A one-time donation might address an immediate need, but it doesn’t build long-term capacity for a nonprofit. In contrast, a systematic approach allows for sustained support, enabling organizations to plan programs, hire staff, and measure outcomes. When donors commit to multi-year pledges or recurring contributions, they provide stability that can transform how a charity operates. This consistency benefits both the giver and the recipient, turning isolated gestures into meaningful partnerships.

A well-structured giving system also enhances personal clarity. It prompts you to reflect on what causes matter most and why. Is your focus on education, health, faith-based outreach, or environmental stewardship? Defining these priorities helps you evaluate opportunities and say no to requests that don’t align with your mission. Without such clarity, donors risk spreading resources too thin, diluting their impact across too many areas without achieving measurable results in any.

Moreover, a system supports adaptability. Life circumstances change—health, income, family dynamics—and your giving plan should be able to evolve with them. For instance, a market downturn might require scaling back contributions temporarily. A new grandchild might inspire a desire to leave a larger inheritance, prompting a rebalancing of charitable allocations. With a flexible framework in place, these shifts don’t derail your intentions; they inform them. You remain in control, adjusting your strategy while staying true to your core values. This balance between structure and responsiveness is what makes strategic giving both powerful and sustainable.

Mapping Out Key Risk Points in Legacy Giving

Every giving strategy has weak spots. One major risk is loss of control—once assets are transferred, reclaiming them can be impossible. Another is tax inefficiency: donating the wrong type of asset at the wrong time can trigger capital gains or reduce deductions. Family dynamics also play a role—children may feel neglected if charitable gifts overshadow inheritances. Legal gaps, like outdated beneficiary designations or missing documentation, can invalidate intentions. Even the choice of charity matters: not all nonprofits are financially stable or transparent. By identifying these risk zones early, you can build safeguards—like trusts with withdrawal rights or phased donation schedules—that protect both your wealth and your purpose.

Lack of control is one of the most significant concerns, especially with irrevocable arrangements. Once assets are placed into certain trusts or foundations, the donor typically cannot reclaim them, even if personal needs change. This becomes particularly relevant in later life, when healthcare costs or long-term care may require more liquidity than anticipated. To mitigate this, some donors opt for hybrid structures that allow retained income or limited withdrawal rights, ensuring financial security while still advancing charitable goals.

Tax inefficiency is another critical vulnerability. Donating cash is straightforward, but giving appreciated securities directly to a qualified charity can preserve more value by avoiding capital gains taxes. Conversely, donating assets with low appreciation or those subject to required minimum distributions—like traditional IRA funds—may not yield optimal tax benefits. Timing also matters: making gifts during high-income years can maximize deductions, while doing so in lower-earning years may offer little advantage. Strategic planning around tax brackets, income sources, and asset types is essential to optimize outcomes.

Family tensions often arise when charitable intentions are not communicated clearly. If children learn about large donations only after a parent’s passing, they may perceive the decision as unfair or impulsive. These feelings can erode family unity and lead to legal challenges. To prevent this, open conversations about values, intentions, and estate plans should occur well in advance. Including heirs in discussions—not to seek approval, but to foster understanding—can build trust and reduce the likelihood of conflict.

Finally, the stability of the chosen charity must be evaluated. Some organizations operate on narrow margins and may not survive economic downturns. Others may lack transparency in how they use donations. Conducting due diligence—reviewing financial statements, governance practices, and program effectiveness—helps ensure that your support reaches its intended destination. Using intermediaries like community foundations or donor-advised funds can also provide an added layer of oversight and continuity, especially when supporting smaller or emerging nonprofits.

Choosing the Right Tools for Safe and Strategic Giving

Not all giving vehicles are created equal. Donor-advised funds offer flexibility and immediate tax benefits while letting you recommend grants over time. Charitable remainder trusts allow you to receive income during life, then pass the rest to charity—great for appreciated assets. Private foundations provide maximum control but come with higher costs and reporting demands. Each tool has trade-offs in control, cost, and complexity. The key is matching the vehicle to your goals: do you want involvement now or later? Do you need income? Are you planning multi-generational involvement? Picking the right structure isn’t about prestige—it’s about fit.

Donor-advised funds (DAFs) have become increasingly popular due to their simplicity and tax efficiency. When you contribute cash, stock, or other assets to a DAF, you receive an immediate tax deduction, even if grants are distributed over many years. This allows you to ‘bunch’ deductions in a high-income year, maximizing tax savings. You retain advisory privileges over how funds are granted, though the sponsoring organization has final approval. DAFs require no ongoing compliance filings, making them far less burdensome than private foundations.

Charitable remainder trusts (CRTs) serve a different purpose. These irrevocable trusts let you transfer appreciated assets—like stocks or real estate—into a trust that pays you (or another beneficiary) a fixed or variable income for life or a set term. After the term ends, the remaining assets go to one or more charities. Because the trust is tax-exempt, it can sell the assets without triggering capital gains taxes, increasing the amount available for income and future giving. This makes CRTs particularly effective for donors holding long-term appreciated assets who also want supplemental retirement income.

Private foundations offer the highest level of control. You can name the foundation, set its mission, hire staff, and make grants directly. They also allow for family involvement across generations, turning philanthropy into a shared legacy. However, they come with significant responsibilities: annual excise taxes, detailed recordkeeping, and public disclosure requirements. They must distribute at least 5% of their assets each year and avoid self-dealing with family members or related entities. For many, the administrative burden outweighs the benefits unless the endowment is substantial and long-term engagement is a priority.

Other tools include charitable lead trusts, which reverse the CRT structure by paying income to charity first and returning assets to heirs later—useful for reducing estate taxes. Qualified charitable distributions (QCDs) allow individuals over 70½ to transfer up to $100,000 annually from an IRA directly to charity, satisfying required minimum distributions without increasing taxable income. Each option serves distinct financial and personal objectives. The best choice depends on your age, wealth level, income needs, and desired level of involvement. Consulting a financial advisor ensures you select the right vehicle for your unique situation.

Balancing Family, Values, and Financial Reality

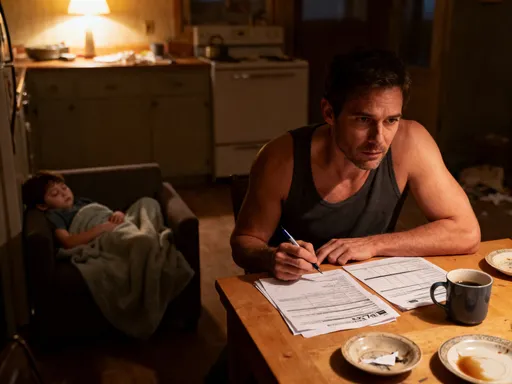

Legacy isn’t just about money—it’s about messages. How you give sends signals to your family about what you value. But imbalance can breed resentment. If charitable gifts consume most of the estate, heirs might feel sidelined. The solution? Transparency and proportion. Talk to family early about your intentions. Use life insurance or separate funding streams to support both causes and kin. Consider matching gifts—where your donation triggers a family contribution—to build shared purpose. Financially, ensure your personal needs and emergency reserves come first. Giving should enhance, not endanger, your security.

Many donors struggle with the emotional weight of dividing assets between family and charity. There is no universal rule for the ‘right’ balance—some choose 50/50, others 80/20, and some give everything to charity. What matters is alignment with your values and clear communication. When heirs understand the reasoning behind decisions, they are more likely to respect them, even if they disagree. Sharing stories about why certain causes matter—perhaps a personal experience with illness, education, or faith—can help loved ones see the deeper meaning behind the numbers.

One effective strategy is using life insurance to fund charitable bequests. By naming a charity as a beneficiary of a policy, you can make a significant gift without reducing the estate left to heirs. This allows you to support both family and causes without trade-offs. Similarly, setting up a donor-advised fund with a succession plan enables children or grandchildren to continue recommending grants, turning philanthropy into a multigenerational practice. This not only preserves your values but also strengthens family bonds through shared purpose.

Proportionality is key. If your estate is modest, large charitable gifts may leave heirs with insufficient resources. Conversely, if wealth is substantial, even generous giving can coexist with meaningful inheritances. A balanced approach considers both financial capacity and emotional impact. Some families establish a family foundation where younger members serve on the board, learning about grantmaking and responsibility. Others create a ‘legacy letter’—a non-binding document that explains the values behind estate decisions, helping heirs interpret intentions with compassion rather than confusion.

Ultimately, responsible giving starts with self-awareness. Your financial health must come first. Delaying retirement, underfunding healthcare, or depleting emergency savings to give more can backfire, leaving you dependent on others later. A sustainable plan ensures you maintain comfort and independence while still making a difference. When generosity flows from stability, it becomes a true expression of abundance—not sacrifice.

Avoiding Common Pitfalls: Real Stories, Real Lessons

I’ve seen a client donate company stock without checking tax basis—resulting in a six-figure capital gains bill for the charity. Another named a small charity in their will, but the organization dissolved years later, leaving the gift invalid. One woman set up a foundation without succession plans—when she passed, it collapsed due to inexperience. These aren’t outliers; they’re warnings. The fix? Always consult independent advisors, update documents regularly, and stress-test your plan against worst-case scenarios. Even small oversights can have big consequences.

The case of the unintended capital gains tax illustrates how technical details matter. The donor owned shares in a privately held business that had grown significantly in value over decades. Believing that gifting the stock to a charity would be tax-free, he transferred it directly. However, because the organization was not a public charity but a private operating foundation, it did not qualify for the usual capital gains exemption. The sale of the stock triggered a taxable event, leaving the charity with a massive tax bill and far less funding than expected. This could have been avoided with proper classification and planning.

In another case, a widow named her local food pantry as a 50% beneficiary of her IRA. She had volunteered there for years and wanted to ensure its survival. But she never updated her beneficiary form after moving to a new state, and the organization’s name had changed slightly. When her estate was settled, the financial institution could not verify the intended recipient, and the funds were held in dispute for months. The delay caused hardship for the charity and frustration for her heirs. This highlights the importance of precise naming and regular reviews of beneficiary designations.

The foundation that collapsed after the founder’s death is a cautionary tale about governance. She established the foundation with deep passion and personal involvement, making all decisions herself. There was no board, no bylaws, and no training for her children, who were named as successors. After her passing, they struggled to manage compliance, grantmaking, and reporting. Within two years, the foundation lost its tax-exempt status and shut down. This could have been prevented with a transition plan, professional guidance, and gradual leadership development.

These examples underscore a simple truth: intention is not enough. Even well-meaning plans fail without structure, documentation, and expert input. Regular reviews—at least every three to five years or after major life events—are essential. Circumstances change, laws evolve, and organizations shift. A plan that works today may not work tomorrow. By treating your giving strategy as a living document, you protect both your legacy and your loved ones from avoidable harm.

Building a Legacy That Lasts—and Protects

True legacy giving isn’t measured by size, but by sustainability. The goal isn’t just to give, but to give wisely, consistently, and securely. That means creating a living system—reviewed annually, adjusted when needed, and communicated clearly. Include trusted advisors, involve family in discussions, and document your reasoning. Over time, this approach builds trust, minimizes conflict, and maximizes impact. Your wealth becomes more than a number—it becomes a force for good, guided by clarity, not chance.

A lasting legacy requires more than money—it requires intentionality. It means defining what success looks like for your giving. Is it improving literacy in your community? Supporting medical research? Strengthening your place of worship? Whatever the mission, clarity allows you to measure progress and stay focused. It also helps future stewards honor your vision without guesswork. A written statement of purpose, even if informal, can serve as a guiding light for generations.

Annual reviews are a cornerstone of sustainable giving. They allow you to assess performance, rebalance assets, and respond to new opportunities or challenges. Did a grant achieve its intended outcome? Has a charity’s leadership changed? Has your financial situation shifted? These questions should be part of a regular check-in, just like reviewing an investment portfolio. This habit ensures your plan remains relevant and effective over time.

Communication is equally vital. Too many estate plans fail because they are kept secret until it’s too late. When family members are included in conversations early and often, they develop ownership and respect for the process. These discussions don’t have to be formal—dinner table reflections, holiday letters, or shared volunteer experiences can all convey values. The goal is to normalize generosity as a family tradition, not a surprise in a legal document.

Finally, remember that legacy is not a destination—it’s a journey. Your values may evolve, your priorities may shift, and new causes may capture your heart. A rigid plan can become outdated, but a flexible, well-documented system can adapt. By combining structure with compassion, prudence with purpose, you create something enduring. Your giving becomes a reflection of who you are—not just what you owned. And that is the true measure of a legacy well built.