How I Slashed My Language Learning Costs Without Losing Quality

Ever felt like language courses are draining your wallet faster than your progress? I’ve been there—paying premium prices for lessons that promised fluency but delivered little. After burning through cash on overpriced tutors and flashy apps, I started digging for smarter ways to cut costs. What I discovered wasn’t just cheaper—it was better. This is how I mastered cost control in language training, and how you can too, without sacrificing results or sanity. Language learning doesn’t have to be a financial burden. With the right approach, it can be both affordable and effective. The key lies not in spending more, but in spending wisely—aligning every dollar with real progress.

The Hidden Price of Language Fluency

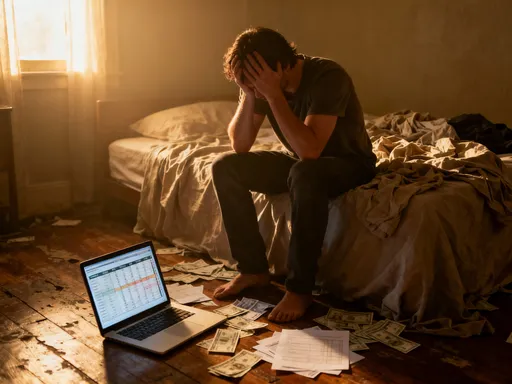

Many people assume that mastering a new language requires a significant financial investment. It’s easy to believe that higher costs translate into better outcomes—after all, premium tutors, branded apps, and certified programs come with impressive promises. But the truth is, expensive options often deliver far less value than they claim. The emotional appeal of quick results or elite branding can lead learners to overspend on services that don’t accelerate progress as expected. Private tutors, for instance, may charge $50 or more per hour, yet offer generic lessons that could be replicated through free online resources. Subscription-based language apps, while convenient, often lock essential features behind paywalls, pushing users into long-term commitments for marginal gains.

Another major cost driver is certification exams like TOEFL, DELE, or JLPT, which can cost hundreds of dollars and require months of preparation. While these credentials serve a purpose, especially for academic or immigration goals, many learners pursue them without a clear need, simply because they feel it’s the “right” path. This tendency to follow conventional wisdom without questioning its relevance leads to unnecessary spending. Additionally, impulse purchases after motivation spikes—such as signing up for a six-month course during New Year’s resolution season—often result in unused subscriptions and abandoned goals. The emotional high fades, but the financial obligation remains.

What makes these expenses particularly damaging is their recurring nature. Unlike a one-time purchase, language learning costs often accumulate silently over time. A $15 monthly app fee doesn’t seem like much, but over three years, it adds up to $540—enough to fund several in-person immersion experiences. The problem isn’t just the amount spent, but the lack of return on that investment. Many learners find themselves further from fluency despite consistent payments, realizing too late that they were paying for access, not advancement. Recognizing this pattern is the first step toward regaining control over your language learning budget.

Rethinking Value: What You’re Actually Paying For

To make smarter financial decisions, it helps to break down what language learning truly requires. At its core, acquiring a new language involves four key components: input (listening and reading), output (speaking and writing), feedback, and structure. Each plays a role, but not all require spending money. Understanding the difference between essential and optional expenses allows you to allocate funds where they matter most. For example, consistent input can be obtained for free through podcasts, YouTube videos, and public libraries. Similarly, reading materials—news articles, books, subtitles—are widely available at no cost in most major languages.

Output practice, particularly speaking, is where many learners feel they need paid support. However, free language exchange platforms connect native speakers who want to learn your language with those learning theirs. These mutual exchanges provide authentic conversation practice without a price tag. Writing can be improved using free online communities where volunteers offer corrections and suggestions. Even grammar study, often seen as requiring formal instruction, can be mastered through open-access websites and educational videos that explain rules clearly and systematically.

Where spending becomes justified is in personalized feedback and structured guidance. A qualified tutor can identify pronunciation errors, correct grammatical misunderstandings, and tailor lessons to your pace and goals—services that free resources typically can’t match. But this doesn’t mean every interaction needs to be paid. Strategic use of paid sessions—such as weekly check-ins instead of daily lessons—can dramatically reduce costs while maintaining quality. The goal is not to eliminate spending, but to ensure that every dollar supports measurable improvement. When you evaluate tools and services based on actual learning impact rather than convenience or branding, you begin to see where your money truly earns its place.

The Power of Layered Learning on a Budget

Instead of relying on a single, costly solution, the most effective learners build a layered approach that combines multiple affordable or free resources. This method, known as a “learning stack,” maximizes exposure and practice while minimizing financial strain. Think of it like building a house: each layer serves a specific function, and together they create a strong, stable structure. In language learning, one layer might be daily vocabulary practice using a free app like Anki, another could be listening to native content through public radio stations, and a third might involve weekly conversation with a tutor for targeted feedback.

Consider the case of Maria, a mother of two who wanted to learn French for travel and personal enrichment. Rather than enrolling in a $300 course, she created her own stack: she used a free grammar website to study verb conjugations, listened to a French news podcast during her commute, joined a local language meetup for speaking practice, and hired a tutor on a freelance platform for one hour every two weeks. Within eight months, she was comfortably conversing with native speakers—achieving results comparable to formal students at a fraction of the cost. Her success wasn’t due to spending less alone, but to spending strategically.

The strength of a learning stack lies in its flexibility and efficiency. Free tools handle foundational skills, while paid resources are reserved for areas where human interaction adds the most value—like correcting subtle pronunciation issues or navigating complex grammar points. This hybrid model also allows for continuous adjustment. If a particular resource stops being useful, it can be replaced without financial penalty. Unlike rigid programs that charge for an entire curriculum regardless of relevance, a layered system puts you in control. You decide what to keep, what to change, and when to invest more—making progress both sustainable and budget-friendly.

Timing Your Spending for Maximum ROI

One of the most overlooked aspects of cost-effective language learning is timing. Just as investing in the stock market too early or too late can affect returns, spending on language resources at the wrong stage can lead to wasted money. For example, hiring a private tutor when you’re still mastering basic vocabulary may not be the best use of funds. At this stage, your needs are largely about exposure and repetition—things that free apps and audio resources can provide effectively. Paying for personalized instruction before you’re ready to engage in meaningful conversation means you’re not getting full value for your investment.

On the other hand, delaying feedback for too long can result in entrenched mistakes. Imagine practicing pronunciation incorrectly for months without correction—by the time you seek help, those habits are harder to fix. This creates a paradox: spend too soon, and you waste money; wait too long, and you pay a higher price in effort to correct errors. The solution lies in phased investment—aligning your spending with specific learning milestones. For instance, the early phase should focus on building vocabulary and listening comprehension through free materials. Once you can form simple sentences and understand common phrases, that’s the ideal time to begin occasional paid sessions for speaking practice.

Another smart timing strategy is to reserve intensive spending for moments of high motivation or real-world application. If you’re planning a trip to Spain in three months, it makes sense to increase your investment during that window—hiring a tutor weekly, joining a short-term course, or using a premium app with travel-specific content. This ensures your spending coincides with urgency and purpose, increasing both engagement and retention. By mapping your learning journey and identifying key thresholds—such as reaching A2 or B1 level on the CEFR scale—you turn random purchases into calculated steps. This approach transforms language learning from a financial drain into a targeted, results-driven process.

Avoiding the Trap of “Premium” Branding

Some of the most expensive language tools aren’t superior—they’re simply better marketed. Big-name platforms often charge higher prices not because their methods are more effective, but because they invest heavily in branding, celebrity endorsements, and sleek user interfaces. These elements create a perception of quality, even when the actual learning outcomes are no better than free alternatives. For example, a well-known app might charge $12.99 per month for a polished design and gamified lessons, while a lesser-known but equally effective tool offers the same core features for free. The difference is aesthetics, not efficacy.

Marketing tactics like “proven systems,” “scientifically designed,” or “used by millions” are common, yet rarely backed by independent research. Many of these claims are vague and unverifiable, relying on emotional appeal rather than measurable results. A closer look often reveals that user progress depends more on consistency and effort than on the app itself. In fact, studies comparing popular language apps have found minimal differences in learning outcomes when usage time and learner motivation are controlled. This suggests that the brand name you pay for may not be accelerating your fluency at all.

To avoid falling for overpriced hype, shift your evaluation criteria from appearance to performance. Look for tools with strong user communities, transparent progress tracking, and real-world application. Free platforms like Tandem, LibreLingua, or language subreddits often have active users sharing tips, correcting exercises, and offering encouragement—features that rival paid services. When considering a paid option, ask: Does it offer something I can’t get elsewhere? Is the feature worth the monthly cost? Will it significantly speed up my progress? By answering these questions honestly, you can redirect funds from flashy branding to high-impact learning. Saving $15 a month on an overpriced app could mean affording a live conversation class or a cultural immersion event—investments that deliver real value.

Leveraging Community and Exchange Smartly

One of the most powerful—and often underused—tools in language learning is community. Local meetups, online forums, and language exchange partnerships offer authentic practice without any cost. These interactions expose learners to natural speech patterns, regional accents, and everyday expressions that textbooks often miss. Unlike scripted lessons, real conversations require quick thinking, listening comprehension, and adaptive communication—skills that are essential for true fluency. Yet many learners overlook these opportunities, assuming that only formal instruction leads to progress.

The key to making community-based learning effective is structure. Unstructured exchanges often fail because one person dominates the conversation, or the interaction lacks clear goals. To prevent this, establish ground rules from the start. For example, in a language exchange, agree to split time evenly—15 minutes in one language, 15 in the other. Use a timer to stay on track. Prepare topics in advance, such as travel, food, or family, so the conversation flows naturally. You can even use free tools like Google Docs to share vocabulary lists or correct sentences together after the session.

Online communities add another layer of support. Platforms like Meetup.com host language practice groups in cities worldwide, often organized by volunteers. These gatherings provide a low-pressure environment to practice speaking and build confidence. Similarly, Reddit’s language learning communities and Facebook groups connect thousands of learners who share resources, ask questions, and offer encouragement. Participating actively—not just lurking—increases your chances of forming study partnerships and receiving feedback. When used intentionally, these networks become more than social spaces; they become zero-cost accelerators that complement your self-study routine.

Building Your Personal Cost-Control Framework

The final step in mastering language learning affordability is creating a personalized financial framework. This isn’t about cutting every expense, but about spending with purpose. Start by defining your budget—how much you’re realistically willing to spend each month without strain. Next, assess your current level using a standard like the CEFR (Common European Framework of Reference for Languages). Are you a beginner (A1-A2), intermediate (B1-B2), or advanced (C1-C2)? This helps determine which resources will be most useful at your stage.

Then, map out your learning goals. Do you want to travel, read literature, or communicate with family? Your objective shapes your resource mix. For travel, prioritize speaking and listening; for reading, focus on vocabulary and grammar. Based on this, select a combination of free and paid tools. For example, use free apps and podcasts for daily input, join a local meetup for speaking practice, and schedule a paid tutor session every two weeks for feedback. This balanced approach ensures progress without overspending.

Finally, review your progress monthly. Track milestones like “held a 10-minute conversation” or “understood a full podcast episode.” If you’re advancing, your system is working. If not, adjust—maybe you need more speaking practice or better feedback. The goal is continuous improvement, not perfection. Over time, this framework becomes a sustainable habit, turning language learning into a manageable, rewarding journey. You’ll gain fluency not because you spent the most, but because you spent the smartest—proving that financial wisdom and linguistic success can go hand in hand.