How I Stopped Chasing Returns and Started Building Real Wealth

For years, I thought smart investing meant picking the hottest stocks or jumping on trending funds. I chased high returns, only to feel stressed and stuck. Then I realized—true financial progress isn’t about luck or timing. It’s about how you manage your money daily. This shift in mindset changed everything. Here’s the practical, no-nonsense approach I used to take control of my finances and build lasting stability—without gambling on the market. It wasn’t a sudden windfall or a secret tip that transformed my situation. Instead, it was a series of deliberate, disciplined choices focused not on maximizing gains, but on minimizing avoidable losses. The journey from anxiety to confidence didn’t require complex strategies or insider knowledge. It began with admitting that chasing returns had left me vulnerable, and that real wealth isn’t built in moments of excitement, but in the quiet consistency of sound money management.

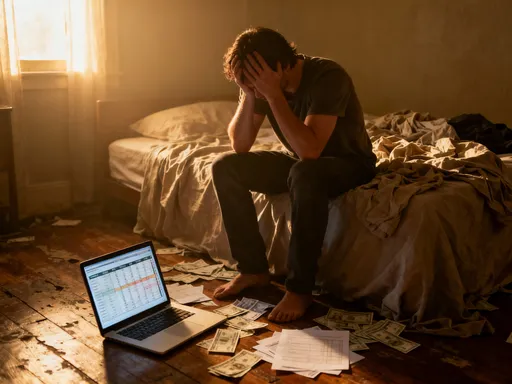

The Wake-Up Call: When My Portfolio Blew Up

There was a time when I believed the key to financial success lay in bold moves and quick decisions. I poured a significant portion of my savings into a single technology sector, convinced by headlines and social media buzz that it was the future. I watched daily as the value climbed, feeding my confidence. I told myself I was being strategic, forward-thinking. But what I was really doing was speculating. When the market corrected—sharply and unexpectedly—my portfolio lost nearly 40% of its value in a matter of weeks. The financial hit was painful, but the emotional toll was worse. I felt foolish, anxious, and uncertain about every financial decision I had ever made. That moment was a turning point. I began to see that investing without a structure was not investing at all—it was gambling with my future. I had confused aggression with strategy, and momentum with safety. The truth was, I hadn’t built wealth; I had exposed myself to unnecessary risk without a plan to protect what I had.

This experience forced me to confront a fundamental question: What is the real purpose of investing? Is it to chase the highest possible return, no matter the cost? Or is it to grow and preserve capital over time, in a way that supports long-term life goals? The answer became clear. Sustainable financial progress depends more on risk management than on return maximization. A 15% return means little if a 40% loss wipes out years of progress. What matters most is consistency, protection, and resilience. I realized I needed a system that didn’t rely on being right about the market, but one that could withstand being wrong. That meant shifting my focus from what could go right to what could go wrong—and preparing for it. This mindset shift was the foundation of everything that followed.

Emotional decision-making had been my downfall. Fear and greed had driven my choices, not logic or planning. I had ignored basic principles like position sizing, stop-loss strategies, and portfolio balance because they felt too cautious, too slow. But caution, I learned, is not the enemy of growth—it is its protector. The most important lesson from that loss was not about which stock to buy or sell, but about the need for a framework. A good financial plan doesn’t eliminate risk, but it defines it, measures it, and keeps it within manageable limits. From that point on, I committed to building a strategy based on discipline, not excitement, and on protection, not just performance.

Asset Allocation Isn’t Boring—It’s Your Safety Net

In the years before my setback, I treated asset allocation like an afterthought—an academic concept that didn’t apply to someone like me who wanted real results. I assumed that if I picked the right assets, the rest would take care of itself. But I was wrong. Asset allocation, the practice of dividing investments among different asset classes like stocks, bonds, cash, and real estate, is not a passive or dull exercise. It is, in fact, one of the most powerful tools available to individual investors. Studies have shown that over the long term, asset allocation accounts for the majority of a portfolio’s return variability—far more than individual stock selection or market timing. Yet, many people overlook it, chasing performance instead of building balance.

After my loss, I began studying how different assets behave under various market conditions. I learned that stocks offer growth potential but come with volatility. Bonds tend to be more stable and provide income, though with lower long-term returns. Cash offers safety and liquidity, while real estate can provide both income and inflation protection. No single asset class performs well all the time, but when combined thoughtfully, they can offset each other’s weaknesses. For example, when stock markets fall, bonds often hold steady or even rise in value. Real estate may remain stable during periods of inflation when other assets struggle. By spreading money across these categories, I wasn’t trying to predict the future—I was preparing for uncertainty.

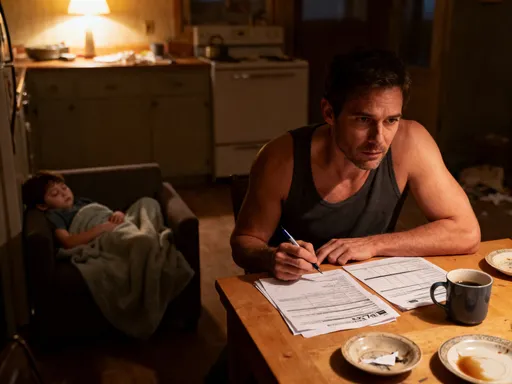

I tailored my allocation to my life stage, risk tolerance, and financial goals. At 42, with two children and a mortgage, I didn’t need maximum growth—I needed stability with room for growth. I settled on a mix that weighted equities moderately, included a meaningful bond component, kept a cash reserve, and added a small exposure to real estate through a REIT fund. This wasn’t a fixed formula, but a living framework I adjusted as my circumstances changed. During a particularly volatile year, this balance proved its worth. While my stock holdings dipped, my bond and cash positions remained stable, preventing panic-driven decisions. I didn’t make the highest possible return that year, but I avoided catastrophic loss—and that was the real win.

Asset allocation is not a one-size-fits-all solution. A young professional with decades until retirement might accept more stock exposure, while someone nearing retirement may prioritize capital preservation. The key is alignment: your portfolio should reflect your timeline, your responsibilities, and your emotional capacity to handle risk. When done right, asset allocation acts as a financial shock absorber, smoothing out the bumps in the market and keeping you on track toward your goals. It’s not about avoiding risk entirely—it’s about managing it wisely, so you don’t have to choose between growth and peace of mind.

The Hidden Power of Cash: Why Holding Money Isn’t Wasting It

For most of my early investing years, I viewed cash as dead money. I believed every dollar not invested was losing value to inflation, and I felt guilty keeping funds in savings. I thought real investors kept everything working at all times. But that mindset changed when I saw close friends forced to sell investments at a loss just to cover unexpected expenses—a medical bill, a home repair, a job transition. They had no emergency fund, no buffer, and when life disrupted their plans, they had no choice but to liquidate assets at the worst possible time. Watching them struggle taught me a crucial lesson: liquidity is not the opposite of investing—it’s a part of it.

I now treat cash as a strategic component of my financial plan, not a failure to act. I maintain a cash reserve equal to six to nine months of essential living expenses, held in a high-yield savings account. This isn’t money I expect to grow significantly, but it serves a vital purpose: it gives me freedom. Freedom to wait for better opportunities. Freedom to avoid selling stocks in a downturn. Freedom to handle life’s surprises without derailing my long-term goals. In volatile markets, this cushion allows me to stay calm and patient, while others are forced into reactive moves. Cash, in this sense, is not idle—it’s ready. It’s like having spare tires in your garage; you don’t drive on them, but you’re glad they’re there when you need them.

Beyond emergencies, cash also creates optionality. When markets decline, many investors are too stretched to take advantage of lower prices. But with cash on hand, I can selectively add to positions I believe in, buying quality assets at discounted values. This is the quiet power of liquidity: it turns market downturns from threats into opportunities. I don’t try to time the market, but I position myself to act when conditions are favorable. This approach requires discipline—resisting the urge to deploy every dollar immediately—but the payoff is resilience. Over time, I’ve found that the ability to stay invested through downturns, thanks to my cash buffer, has contributed more to my wealth than any single stock pick.

Some worry that holding cash means falling behind inflation. That’s a valid concern, but it’s also a reason to be intentional. I don’t keep all my money in cash—I keep only what I might need in the near term. The rest remains invested according to my long-term plan. The goal isn’t to eliminate cash, but to use it wisely. By treating it as a tool rather than a liability, I’ve gained control over my financial decisions. I no longer feel pressured to take unnecessary risks just to stay fully invested. Cash, once seen as a sign of inaction, has become a symbol of preparedness and strength.

Rebalancing: The Habit That Keeps You on Track

After setting my initial asset allocation, I assumed it would stay balanced on its own. I was wrong. Over time, certain assets outperformed others, and their share of my portfolio grew disproportionately. Within a few years, stocks—which I had initially allocated at 60%—had risen to over 80% of my holdings, simply because they had done well. I hadn’t made any new aggressive bets; the market had done it for me. But the result was the same: my risk level had increased without my consent. When a correction came, I felt the full impact. That experience taught me the importance of rebalancing, the process of periodically adjusting your portfolio back to your target allocation.

Rebalancing is often overlooked because it feels counterintuitive. It means selling assets that have done well and buying those that have underperformed. In a rising market, this can feel like leaving money on the table. But the truth is, rebalancing is one of the few strategies that systematically enforces the principle of “buy low, sell high.” When a stock-heavy portfolio grows too large, rebalancing forces you to sell some of those gains and reinvest in areas that may be temporarily undervalued. It’s not about predicting which asset will rebound, but about maintaining discipline and avoiding concentration risk.

I now rebalance my portfolio every six months. The process is simple: I review my current allocations, compare them to my target, and make adjustments as needed. If stocks have risen beyond my target range, I sell a portion and shift the proceeds into bonds or cash. If bonds have outperformed, I may do the reverse. I don’t aim for perfection—small deviations are normal—but I correct significant drifts. This habit has several benefits. First, it keeps my risk level consistent. Second, it removes emotion from the equation; I’m not reacting to market noise, but following a predefined rule. Third, it promotes long-term discipline, reinforcing the idea that investing is a marathon, not a sprint.

Some investors worry that rebalancing will reduce returns during strong bull markets. That may be true in the short term, but history shows that portfolios that are regularly rebalanced tend to have better risk-adjusted returns over time. They avoid the danger of becoming overexposed to a single asset class just before a correction. Rebalancing doesn’t guarantee profits, but it does provide structure and control. It’s like tuning a musical instrument—small, regular adjustments keep the whole system in harmony. For me, it’s become a non-negotiable part of my financial routine, a quiet act of maintenance that ensures my portfolio stays aligned with my goals, not the market’s whims.

Diversification Done Right: Beyond Just “Don’t Put All Eggs in One Basket”

I used to think I was diversified because I owned ten different stocks across various industries. Then a broad market downturn hit, and nearly all my holdings fell together. I realized my diversification was superficial. True diversification isn’t just about owning multiple assets—it’s about owning assets that respond differently to the same economic forces. If everything drops when interest rates rise or inflation spikes, you’re not diversified; you’re just spread thin. Real diversification means including assets with low correlation, so when one struggles, another may hold steady or even gain.

I began looking deeper than company names. I examined the underlying drivers of performance: geography, economic sector, currency exposure, and market sensitivity. For example, U.S. large-cap tech stocks may move together, but emerging market bonds or international real estate might behave very differently. I added global equity funds, Treasury Inflation-Protected Securities (TIPS), and commodities like gold to reduce reliance on any single market force. I also paid attention to hidden overlaps—owning multiple mutual funds that hold the same top ten stocks doesn’t provide real diversification. I reviewed fund holdings to ensure I wasn’t duplicating exposure.

This deeper approach transformed my portfolio’s resilience. During periods of inflation, my TIPS and real estate holdings helped offset stock losses. When U.S. markets stalled, international funds provided growth. Diversification didn’t eliminate volatility, but it smoothed the ride. I stopped expecting everything to go up at once, and instead focused on reducing the severity of downturns. This doesn’t mean chasing every asset class—it means selecting a thoughtful mix that aligns with long-term goals and risk tolerance. Over time, this approach led to more consistent returns and less emotional stress. I learned that diversification is not a guarantee, but a risk management tool—one of the most reliable ways to protect wealth over decades.

Automate to Avoid Emotion: How Systems Beat Willpower

For years, I managed my investments manually, checking balances daily and reacting to news headlines. I transferred money when I remembered, adjusted contributions based on mood, and made impulsive trades during market swings. It was exhausting, and worse, it was ineffective. My emotions—fear during drops, greed during rallies—led to poor timing and costly mistakes. I knew I needed discipline, but relying on willpower alone wasn’t working. Then I discovered automation. I set up automatic transfers from my paycheck to my investment accounts, scheduled recurring contributions, and used rule-based tools to manage rebalancing. Almost overnight, investing became effortless.

Automation removed the emotional component from my financial decisions. I no longer had to decide when to invest or how much to save—I had already decided, in advance, through a system. This consistency had a powerful effect. By investing the same amount regularly, I naturally bought more shares when prices were low and fewer when they were high, a strategy known as dollar-cost averaging. I didn’t need to time the market; the system did it for me. Over time, this led to smoother entry points and better long-term results.

More importantly, automation protected me from myself. During market downturns, when panic might have driven me to sell, my contributions continued automatically. This not only prevented losses but allowed me to accumulate assets at lower prices. In bull markets, I didn’t get carried away with overconfidence. The system kept me on track, regardless of market noise. I still review my plan annually and make adjustments as needed, but the day-to-day decisions are handled by rules, not reactions. This shift—from willpower to systems—has been one of the most impactful changes in my financial life. It turned investing from a source of stress into a quiet, reliable process.

Building Wealth Is a Process, Not a Home Run

For too long, I waited for a big win—a hot stock, a lucky break, a sudden windfall—to transform my finances. I thought wealth was something that happened to people, not something they built. But the truth is, real wealth is rarely the result of a single event. It’s the product of consistent habits, disciplined choices, and long-term thinking. The strategies I’ve adopted—thoughtful asset allocation, maintaining liquidity, regular rebalancing, true diversification, and automation—aren’t flashy or exciting. But they are effective. They don’t promise overnight riches, but they do provide stability, control, and steady growth.

What changed most wasn’t my portfolio size, but my peace of mind. I no longer feel the need to chase returns or react to every market move. I trust the process. I know that by managing risk, staying consistent, and focusing on what I can control, I am building something durable. The power of compounding works best when left undisturbed, and my new approach allows that to happen. Small, smart decisions, repeated over time, create outsized results. I’ve learned that the best financial outcomes come not from being the smartest investor, but from being the most disciplined.

For anyone feeling overwhelmed by the complexity of investing or discouraged by past losses, I offer this: you don’t need to be perfect. You just need to be consistent. Start with a clear plan, protect your capital, and let time work in your favor. Wealth isn’t built in a moment—it’s built every day, through choices that prioritize long-term security over short-term excitement. By shifting my focus from chasing returns to building a resilient financial foundation, I didn’t just grow my portfolio—I gained confidence, clarity, and freedom. And that, more than any number on a screen, is the true measure of real wealth.