How I Tackle Rising Care Costs Without Stress—A Real Talk on Smart Planning

Let’s be real—no one likes thinking about needing care later in life. But I learned the hard way that ignoring it costs way more than planning for it. After watching my parents struggle with unexpected expenses, I dug into the market, studied trends, and tested strategies. What I found? The care cost wave is real, but with the right approach, you can stay ahead. This is my honest take on protecting your future—without the finance jargon or fear-mongering. It’s not about predicting crises; it’s about building resilience. And the best time to start isn’t when a diagnosis comes—it’s now, while you still have choices.

The Hidden Bill No One Talks About

Long-term care is one of the most significant financial obligations many families will face, yet it remains one of the least discussed. Unlike retirement savings or college funds, which are commonly prioritized, long-term care planning often falls through the cracks. This silence comes at a cost. According to recent data from the U.S. Department of Health and Human Services, about 70% of people turning 65 today will require some form of long-term care during their lifetime. This care can include a range of services—assisted living facilities, in-home nursing aides, adult day programs, physical therapy after surgery, or memory care units for conditions like dementia. These are not short-term needs; the average duration of care lasts around three years, though many require support for five years or more. The financial burden of such extended care can quickly deplete retirement savings, especially when costs are not anticipated.

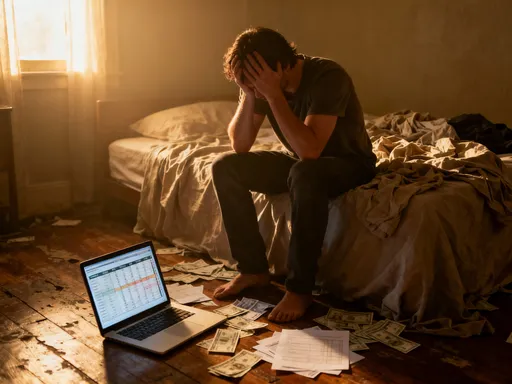

What makes this expense particularly dangerous is how quietly it emerges. A person may feel healthy at 70, only to experience a minor stroke or fall that limits mobility. Suddenly, help is needed—not just for medical treatment, but for daily tasks like bathing, dressing, or meal preparation. At that point, families often scramble to find solutions, usually at premium prices due to urgency. A home health aide, for example, can cost between $25 and $30 per hour, adding up to over $50,000 annually for part-time help. Assisted living facilities average $5,000 per month nationwide, with higher rates in urban areas. These figures are not outliers—they represent the new normal. Yet, a 2023 survey by the Employee Benefit Research Institute found that fewer than 30% of Americans have even tried to estimate their future care costs. Most assume Medicare will cover these expenses, but that’s a critical misunderstanding. Medicare provides limited long-term care benefits, primarily for short-term rehabilitation after hospitalization, not ongoing personal or custodial care.

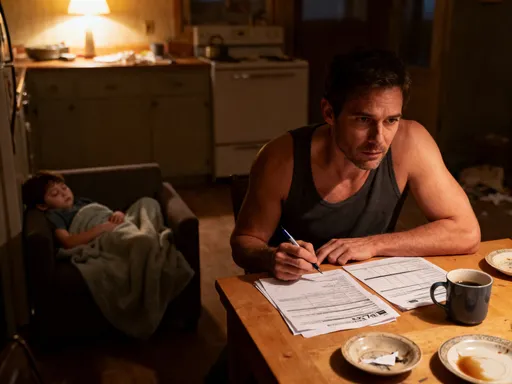

The reality is that long-term care is less a medical issue and more a financial planning challenge. It’s not just about illness—it’s about longevity. People are living longer, and while that’s a triumph of modern medicine, it also increases the likelihood of needing support in later years. Ignoring this fact doesn’t make it disappear; it simply shifts the burden to family members or public programs. Some rely on spouses or adult children to provide care, but this too has hidden costs—lost wages, emotional strain, and reduced quality of life for caregivers. Without a plan, the financial and emotional toll can be overwhelming. The first step toward protection is awareness: recognizing that care costs are not an anomaly, but a probable part of the aging journey. Once this is accepted, smarter decisions become possible.

Why the Market’s Changing—and What It Means for You

The landscape of long-term care is evolving rapidly, shaped by demographic, economic, and structural forces. At the heart of this shift is an aging population. By 2030, all baby boomers will be 65 or older, increasing the number of Americans in that age group to over 70 million. This surge in demand is outpacing the supply of care providers, leading to rising prices and tighter availability. Facilities are expanding, but not fast enough. In many regions, waiting lists for quality assisted living communities stretch for months, even years. At the same time, the healthcare workforce is shrinking in key areas. Nursing shortages, high turnover among home care aides, and increasing training requirements have made it harder to staff services adequately. These labor challenges directly affect costs, as providers raise wages to attract workers—and pass those increases on to consumers.

Geographic disparities further complicate the picture. In major metropolitan areas like Boston, San Francisco, or Miami, the cost of care can be double that of rural regions. A private room in a nursing home may exceed $12,000 per month in high-cost cities, while the same service might cost $6,000 elsewhere. However, access is not always better in urban centers. Competition for spots is fierce, and not all facilities offer the same level of quality. Rural areas face a different problem: limited options. Many small towns have no assisted living facilities at all, forcing families to choose between long-distance caregiving or relocating loved ones far from home. This lack of access can lead to delayed care or reliance on informal, unpaid family support—which again, carries its own financial and emotional costs.

Another major shift is the growing privatization of care services. As government programs like Medicaid remain strained, private companies are stepping in to fill the gap. While this has led to innovation—such as tech-enabled home monitoring systems or concierge-style care coordination—it has also made affordability a bigger concern. Private pay models dominate the market, meaning those without savings or insurance often face difficult trade-offs. Some newer care models, like life plan communities (also known as continuing care retirement communities), offer a continuum of services under one roof, from independent living to skilled nursing. These can provide peace of mind, but they often require large entrance fees—sometimes exceeding $500,000—followed by monthly service charges. While these communities may be cost-effective over time, the upfront barrier is prohibitive for many middle-income families.

These market trends signal a clear message: long-term care is no longer a niche concern. It is a mainstream financial issue that demands proactive attention. Waiting until care is needed means accepting whatever options are available, often at the highest price. Understanding these shifts allows individuals to plan with greater foresight. It’s not about fear—it’s about recognizing that the system is changing, and personal strategy must evolve with it. Those who anticipate these challenges can position themselves to make choices based on preference, not desperation.

The Biggest Mistakes People Make (And How to Dodge Them)

Despite growing awareness, many people still make preventable errors when it comes to long-term care planning. One of the most common is delaying action until a health crisis occurs. This reactive approach severely limits options. For example, someone who waits until they need full-time care to research facilities may end up choosing the only available spot, regardless of quality or cost. By then, negotiating pricing, understanding contracts, or exploring insurance is no longer possible. Timing matters: the best plans are made when there is still time to assess needs, compare providers, and build financial safeguards. Procrastination doesn’t reduce risk—it increases it.

Another widespread mistake is underestimating how long care might last. Many assume they’ll only need help for a year or two, but data shows otherwise. The U.S. Department of Health and Human Services estimates that 20% of people turning 65 will need care for more than five years. Some may require support for a decade or longer, especially with conditions like Alzheimer’s disease or chronic mobility issues. Planning for a short-term need can leave families financially exposed when care extends far beyond expectations. A budget based on two years of assistance may collapse under the weight of a seven-year journey. This is why realistic forecasting is essential. It’s better to overestimate than to be caught off guard.

Overreliance on Medicare is another costly misconception. While Medicare is a vital program, it does not cover long-term custodial care. It may pay for up to 100 days in a skilled nursing facility, but only if the stay follows a qualifying hospitalization and is deemed medically necessary for recovery. Once that period ends, or if the need is for ongoing personal care rather than rehabilitation, Medicare stops paying. Families who assume otherwise often face sudden, unexpected bills. Similarly, Medicaid does cover long-term care, but only for those with very low income and assets. Qualifying typically requires spending down savings, which defeats the purpose of a lifetime of financial planning. Relying on either program as a primary strategy is risky and often results in loss of control over care choices.

Perhaps the most emotionally difficult mistake is assuming that family members will be able to provide care. While many adult children step up to help parents, this arrangement is rarely sustainable long-term. Full-time caregiving can interfere with employment, strain marriages, and lead to burnout. The emotional toll is significant, and the financial impact is real: caregivers often reduce work hours or leave jobs entirely, sacrificing income, retirement contributions, and career advancement. A 2022 AARP report estimated that the average unpaid caregiver loses over $450,000 in wages and benefits over their lifetime. While family support is valuable, it should not be the cornerstone of a financial plan. A better approach is to view family involvement as a complement to, not a replacement for, formal planning.

Building a Defense: My Step-by-Step Strategy

Smart long-term care planning doesn’t require a finance degree—just discipline, clarity, and a willingness to act early. The first step is assessing personal risk. This involves evaluating family health history, current lifestyle, and retirement goals. For example, someone with a family history of heart disease or dementia may face a higher likelihood of needing extended care. Lifestyle factors like smoking, physical inactivity, or obesity also influence future health needs. While no one can predict the future, these indicators help shape a more accurate picture of potential risk. From there, it’s important to research the types of care that might be needed and their associated costs in your area. Local Area Agencies on Aging often provide free resources, including cost comparisons and provider directories.

Next comes budgeting. This isn’t about guessing—it’s about building a realistic financial model. Start by estimating the cost of different care scenarios: in-home care, assisted living, or nursing home care. Multiply those monthly figures by the number of years you might need support—three, five, or even seven. Add inflation at a conservative 3% per year to account for rising prices. The resulting number may seem daunting, but it’s not meant to scare—it’s meant to inform. Once you know the potential cost, you can integrate it into your overall retirement plan. This means adjusting savings goals, delaying retirement if necessary, or reallocating investments to ensure liquidity when care is needed.

One effective tool is the hybrid insurance model. These policies combine life insurance or annuities with long-term care benefits. If care is needed, the policyholder can access a portion of the death benefit to pay for services. If not, the balance goes to heirs. This approach offers more flexibility than traditional long-term care insurance, with lower risk of lost premiums. Health savings accounts (HSAs) are another valuable resource. Funds in an HSA can be used tax-free for qualified medical and long-term care expenses, making them a powerful tool for those eligible. Even if you’re not currently contributing, existing HSA balances can be preserved specifically for future care needs.

Finally, open communication is key. Talk to your spouse, children, or trusted advisors about your wishes. Discuss preferences: Would you rather receive care at home? Are there specific facilities you’d consider? These conversations can be difficult, but they prevent confusion and conflict later. Consider putting legal documents in place—such as a durable power of attorney and advance care directives—to ensure your choices are respected. Planning is not a one-time event; it’s an ongoing process. Revisit your strategy every few years, especially after major life changes. The goal is not perfection—it’s preparedness.

When Insurance Isn’t the Answer (And What Is)

Long-term care insurance has long been promoted as the go-to solution, but it’s not the right fit for everyone. Premiums can be high, often increasing with age and health status. A healthy 55-year-old might pay $2,500 to $3,500 annually for a policy, with costs rising significantly for those who wait until their 60s or 70s to apply. Even then, coverage is not guaranteed. Insurers evaluate medical history carefully, and pre-existing conditions can lead to denial or higher rates. Policies also come with limitations: they may only cover a set number of years, require a waiting period before benefits begin, or exclude certain types of care. In some cases, people pay premiums for decades only to find their needs aren’t fully covered when the time comes.

Because of these drawbacks, many are turning to alternative strategies. One approach is self-funding—setting aside dedicated savings specifically for care expenses. This requires discipline and sufficient assets, but it offers complete control. There’s no risk of policy denial, no coverage gaps, and no premium hikes. Funds can be used flexibly, whether for home modifications, private aides, or facility payments. For those with home equity, a reverse mortgage can provide another source of funds. While not a traditional loan, it allows homeowners aged 62 and older to convert part of their equity into cash, which can be used to cover care costs. The debt is repaid when the home is sold, usually after the owner passes away.

Annuities with long-term care riders are also gaining popularity. These financial products provide a guaranteed income stream and include an option to accelerate payments if care is needed. For example, a $100,000 annuity might allow the owner to access five times that amount—$500,000—for qualifying care expenses. This leverages the investment to cover potential needs without losing the underlying value. Another option is reallocating existing assets. Some retirees choose to downsize their homes, using the proceeds to fund a portion of future care. This not only frees up capital but can also reduce ongoing maintenance costs and property taxes.

The key is not to chase trends, but to make informed, personalized choices. Insurance may work well for someone with moderate risk and stable health, while self-funding might suit those with substantial savings. The goal is alignment: matching the strategy to your financial situation, health outlook, and personal values. There is no single right answer—only the right decision for you.

Planning Beyond Money: Access, Quality, and Peace of Mind

Financial preparation is essential, but it’s only part of the story. Money opens doors, but foresight determines what kind of experience lies on the other side. Early planning gives you the power to choose not just where you receive care, but how. You can visit facilities in advance, ask about staffing ratios, check inspection records, and talk to current residents. You can decide whether you prefer aging in place with home modifications or moving to a community that offers social engagement and structured support. These choices matter—not just for comfort, but for dignity.

Access is another critical factor. High-quality care providers often have waiting lists, sometimes lasting over a year. If you wait until care is urgent, you may have to settle for the first available spot, regardless of fit. But if you’ve researched options early, you can get on waiting lists proactively, improving your chances of securing a preferred location. This is especially important for specialized care, such as memory support units or rehabilitation centers with strong outcomes. Preparation also includes organizing legal and medical documents. Having a durable power of attorney, living will, and healthcare proxy in place ensures that your wishes are followed, even if you’re unable to communicate them.

Equally important is emotional readiness. Care planning involves confronting difficult questions about independence, vulnerability, and legacy. But avoiding these conversations doesn’t protect loved ones—it puts them in a harder position. When families are unprepared, decision-making often falls to the most available person, not the most informed one. This can lead to stress, guilt, and conflict. By contrast, clear communication fosters unity. It allows adult children to understand their parents’ values and reduces the burden of guesswork during emotional times. Planning becomes an act of love—a way to protect both financial security and family harmony.

Staying Flexible in an Uncertain Future

No plan is foolproof. Health changes, market conditions shift, and personal priorities evolve. That’s why flexibility is one of the most important qualities in long-term care planning. A strategy that makes sense at 60 may need adjustment at 70. Regular reviews—every three to five years, or after major life events—are essential. Did a new diagnosis change your outlook? Has a spouse’s health declined? Have care costs in your area risen faster than expected? These are moments to reassess and adapt. Working with a financial advisor who understands elder care can help you stay on track without overreacting to short-term fluctuations.

Technology and policy changes also play a role. Telehealth, remote monitoring devices, and AI-assisted care tools are making home-based support more effective and affordable. These innovations may reduce the need for institutional care in the future. At the same time, legislative proposals at the federal and state levels could reshape how care is funded and delivered. Staying informed—through trusted news sources, nonprofit organizations, or community workshops—helps you anticipate shifts and take advantage of new opportunities.

Ultimately, the goal of planning is not to eliminate uncertainty, but to reduce its power over your life. Preparation isn’t about fear—it’s about freedom. It’s the freedom to make choices on your terms, to age with dignity, and to protect the people you love from unnecessary stress. You don’t need to have all the answers today. You just need to start the conversation, take one step, and keep moving forward. Because the best time to prepare for the future isn’t when it arrives—it’s now, while you still have the power to shape it.