Why Your Home Is a Risk You Can’t Ignore – And What to Do About It

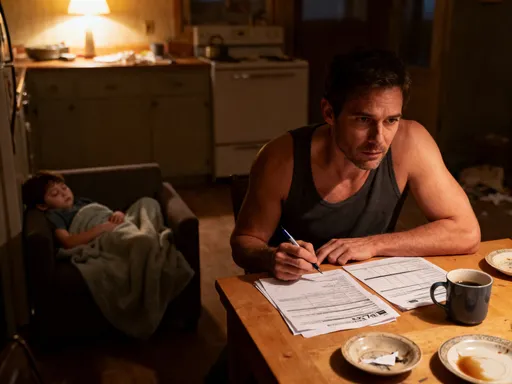

You’ve probably never thought of your home as a financial risk. But what if a storm wiped out your roof tomorrow? Or a pipe burst and ruined everything? I learned the hard way that peace of mind doesn’t come from hoping for the best—it comes from planning for the worst. Home insurance isn’t just paperwork; it’s a shield. Let me walk you through how protecting your biggest asset can save your finances, sanity, and future. Most families pour their life savings into a home, viewing it as stability, comfort, and long-term security. Yet few stop to consider how quickly that security can unravel when the unexpected strikes. A fire, a fallen tree, or even a visitor slipping on the front steps could lead to tens of thousands in costs—costs that fall entirely on you without proper protection. This article isn’t about fear. It’s about clarity, control, and the quiet confidence that comes from knowing you’ve built more than walls—you’ve built resilience.

The Hidden Risk in Your Biggest Investment

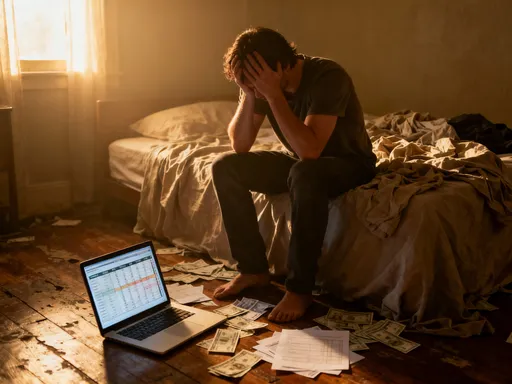

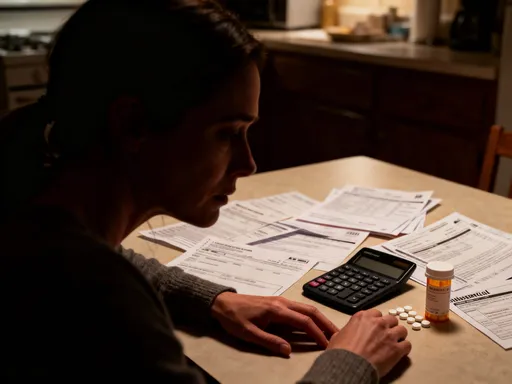

For most people, a home is the largest financial commitment they will ever make. It represents decades of savings, careful budgeting, and long-term dreams. But with that investment comes exposure to risks that are often overlooked until it’s too late. Unlike stocks or savings accounts, a home is a physical asset—vulnerable to weather, accidents, theft, and natural wear. These aren’t rare events. According to data from the Insurance Information Institute, homeowner insurance companies paid out over $50 billion in claims in a single recent year, primarily due to wind, hail, fire, and water damage. These numbers reflect real households facing real financial strain.

Consider the case of a midwestern family whose basement flooded after a heavy spring storm. Because their policy did not include flood coverage, they were left with $35,000 in repair costs and replacement of ruined furniture, electronics, and personal belongings. Another example: a homeowner in California whose garage was destroyed by a wildfire. Even though the main house survived, the cost to rebuild the detached structure and replace the car inside exceeded $70,000. These are not outliers. They are reminders that property ownership carries inherent financial responsibility. The roof won’t last forever. Pipes will eventually fail. Trees may fall. And when they do, the financial burden falls squarely on the homeowner.

Many people assume their mortgage lender’s requirements are enough. After all, lenders require insurance to protect their interest in the property. But that doesn’t mean the coverage is sufficient for the homeowner’s needs. A policy that covers the loan balance may not account for the full cost of rebuilding, especially with rising construction prices. Inflation in building materials and labor has increased reconstruction costs by nearly 20% in some regions over the past five years. This means a home insured for its mortgage value could still leave the owner with a significant out-of-pocket gap if a total loss occurs. The risk, then, isn’t just in the event itself—but in the mismatch between expectations and reality.

Another often underestimated risk is liability. If a guest is injured on your property—say, by tripping on an uneven sidewalk or being bitten by a pet—the homeowner could face medical bills and even a lawsuit. Standard home insurance includes personal liability coverage, typically starting at $100,000, but many experts recommend at least $300,000 to $500,000, especially for homes with features like pools or trampolines. Without adequate coverage, a single incident could jeopardize retirement savings or future income. The truth is, every home carries unseen financial exposures. Recognizing them is the first step toward managing them wisely.

What Home Insurance Really Covers (And Where It Falls Short)

At its core, a standard home insurance policy is designed to protect against sudden and accidental damage. Most policies include four key components: dwelling coverage, personal property protection, liability insurance, and additional living expenses. Dwelling coverage pays to repair or rebuild the structure of your home if it’s damaged by a covered peril like fire, windstorms, or vandalism. Personal property coverage helps replace belongings—furniture, clothing, electronics—that are stolen or destroyed. Liability protection kicks in if someone is injured on your property and you’re found legally responsible. And additional living expenses (ALE) cover the cost of temporary housing, meals, and other essentials if your home becomes uninhabitable during repairs.

However, not every type of damage is included. Standard policies typically exclude certain high-risk events, the most common being floods and earthquakes. These require separate policies or endorsements. For example, flood insurance is available through the National Flood Insurance Program (NFIP) or private insurers, but it must be purchased separately and often has a 30-day waiting period. Similarly, earthquake coverage is an optional add-on in most states, particularly those in seismically active zones. Homeowners who assume their standard policy covers all natural disasters may be in for a painful surprise when a claim is denied.

Other exclusions include damage from poor maintenance, such as a roof that collapses due to long-term neglect, or sewer backups that result from blocked pipes over time. Wear and tear is not considered a covered peril, which means insurers will not pay for gradual deterioration. This is why routine home maintenance is not just a practical responsibility—it’s a financial safeguard. Additionally, high-value items like jewelry, art, or collectibles may have coverage limits under a standard policy. A $2,000 ring might be covered up to $1,500 unless you schedule it for additional coverage. This gap can leave homeowners underinsured when they need it most.

The fine print matters. Policies vary by insurer, location, and even construction type. Some older homes with knob-and-tube wiring or wood-burning stoves may face higher premiums or require upgrades before coverage is approved. Others in wildfire-prone areas may need defensible space or fire-resistant roofing to qualify for certain policies. Understanding your specific policy details—what’s included, what’s excluded, and what requires extra cost—is essential. It’s not enough to know you have insurance. You need to know what it actually does for you when disaster strikes.

Why Risk Avoidance Beats Crisis Management

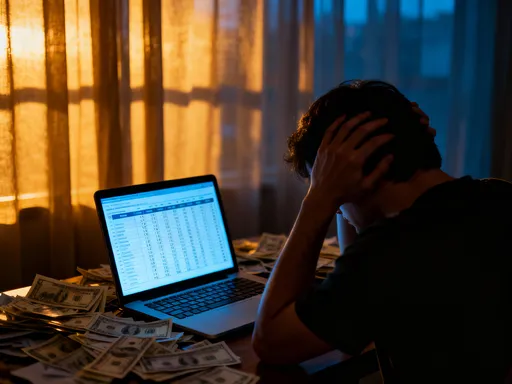

When disaster strikes, the instinct is to react. Call the insurer. File the claim. Start repairs. But by then, the damage is done—both to the home and to the household budget. The smarter approach is risk avoidance: taking steps to prevent or minimize damage before it happens. This isn’t about living in fear. It’s about making informed choices that reduce both financial and emotional stress. Studies show that homeowners who invest in preventive measures not only lower their chances of filing a claim but also experience faster recovery when incidents do occur.

Consider the cost comparison. Replacing a roof after a storm can cost $10,000 or more. But installing impact-resistant shingles before disaster strikes might add only 10% to 20% to the initial cost while reducing long-term risk and potentially lowering insurance premiums. Similarly, a sump pump with a battery backup might cost $500 to install, but it can prevent tens of thousands in water damage from a single basement flood. These are not expenses—they are investments in resilience. The same logic applies to smoke detectors, fire extinguishers, and carbon monoxide alarms. Simple, low-cost devices can prevent catastrophic outcomes.

Psychologically, the benefits are just as significant. Homeowners who have experienced a major claim often report high levels of stress, sleep disruption, and family tension during the recovery process. Dealing with contractors, insurers, and temporary living arrangements takes time and energy that many families simply don’t have. In contrast, those who take preventive action report greater peace of mind and a sense of control over their environment. They sleep better knowing their home is fortified against common threats. This emotional stability is a valuable, if intangible, return on investment.

Moreover, insurers recognize the value of prevention. Many offer discounts for homes with security systems, deadbolts, fire alarms, and storm shutters. Some even provide credits for completing home safety checklists or attending risk education programs. These incentives reflect a broader truth: the insurance industry prefers fewer claims. And so should you. By shifting from a reactive to a preventive mindset, you align your interests with your insurer’s—reducing risk for everyone involved. Over time, this approach leads to lower premiums, fewer disruptions, and a stronger financial foundation.

Assessing Your Actual Exposure: A Step-by-Step Guide

No two homes face the same risks. A beachfront property in Florida has different concerns than a suburban house in Ohio. An older home with original plumbing presents different challenges than a newly constructed one with modern materials. That’s why a one-size-fits-all insurance policy rarely makes sense. To truly protect your home, you need to assess your unique risk profile. This process starts with asking the right questions and gathering relevant information about your property, location, and lifestyle.

Begin with location. Is your home in a high-risk area for hurricanes, tornadoes, wildfires, or flooding? You can check official maps from FEMA, the U.S. Geological Survey, or local emergency management offices to determine your exposure. Even if you’re not in a designated flood zone, heavy rains or poor drainage can still cause water damage. Next, consider the age and condition of your home. Older homes may have outdated electrical systems, plumbing, or roofing that increase the likelihood of problems. A 40-year-old water heater, for example, is more likely to fail than a new one. Knowing these vulnerabilities helps you prioritize upgrades and inform your insurance decisions.

Look at your neighborhood as well. Are crime rates rising? Is there recent construction nearby that could affect drainage or tree stability? Homes in areas with strong community watch programs or gated access may qualify for lower premiums. Lifestyle factors also matter. Do you work from home and have expensive equipment? Do you rent out a room or host frequent guests? These activities can increase liability exposure and may require additional coverage. Even something as simple as owning a dog breed considered high-risk by insurers could affect your policy terms.

Take inventory of your personal belongings. Most policies cover personal property at 50% to 70% of the dwelling value, but this may not be enough if you own high-value items. Walk through each room and make a list of electronics, furniture, clothing, and valuables. Use photos or videos to document everything. This record will be invaluable if you ever need to file a claim. Finally, review your current policy annually. Coverage needs change over time—renovations, inflation, and market shifts can all affect the cost to rebuild. By conducting a regular risk assessment, you ensure your insurance keeps pace with your real-world circumstances.

Smart Upgrades That Lower Risk and Premiums

Modern homes are more than shelters—they’re systems. And like any system, they can be optimized for safety, efficiency, and cost savings. Many homeowners don’t realize that certain upgrades not only improve daily living but also reduce insurance premiums. Insurers reward properties that are less likely to experience claims. That means every improvement that lowers risk can translate into lower monthly costs and stronger protection.

One of the most effective upgrades is a security system. Homes with monitored alarms are up to 300% less likely to be burglarized, according to studies by the University of North Carolina. Most insurers offer a discount of 5% to 20% for homes with burglar alarms, especially those connected to a central monitoring station. Adding deadbolts, window locks, and motion-sensor lighting further enhances security and may qualify for additional savings. Similarly, fire safety improvements like smoke detectors in every bedroom, a fire extinguisher in the kitchen, and a sprinkler system can reduce premiums and, more importantly, save lives.

Roofing is another key area. A sturdy, well-maintained roof is your home’s first defense against storms. Impact-resistant shingles, reinforced trusses, and proper flashing can prevent wind and hail damage. In hurricane-prone areas, storm shutters or impact-resistant windows can prevent broken glass and water intrusion. Some insurers offer discounts of up to 30% for homes with these features. Even simple steps like trimming overhanging branches or cleaning gutters can reduce the risk of storm-related damage.

Plumbing and electrical systems also offer opportunities for savings. Replacing old polybutylene or galvanized pipes with PEX or copper reduces the risk of leaks and bursts. Upgrading outdated electrical panels prevents fire hazards and may be required for policy approval in older homes. Installing a sump pump with a backup battery protects against basement flooding, while a water leak detection system can shut off the main supply automatically when a leak is detected. These technologies not only prevent damage but also demonstrate to insurers that you’re proactive about risk management.

The return on investment is clear. While some upgrades require upfront costs, the long-term savings on premiums, reduced repair bills, and increased home value often outweigh the initial expense. More importantly, these improvements give you greater control over your home’s safety and your financial well-being.

Navigating Claims: How to Avoid Common Pitfalls

Filing a home insurance claim should be a straightforward process, but many homeowners encounter delays, denials, or underpayments. The reason often isn’t fraud or malice—it’s miscommunication, incomplete documentation, or misunderstanding of policy terms. Knowing how to navigate the claims process can make the difference between a smooth recovery and a frustrating ordeal.

The first step is preparation. Before any incident occurs, create a detailed home inventory. Include photos, videos, receipts, and serial numbers for major items. Store this information in a secure cloud account or external drive, not in your home. If a fire or flood destroys your house, you’ll still have access to the records. This documentation proves ownership and value, making it easier to receive fair compensation.

When damage occurs, act quickly but carefully. Contact your insurer as soon as possible. Most policies require prompt reporting. Take photos of the damage before making temporary repairs—like covering a broken window or leaking roof. These images serve as evidence. Keep receipts for all emergency expenses, such as hotel stays, tarping services, or water extraction. These may be reimbursable under additional living expenses or emergency repair coverage.

Be honest and thorough in your claim submission. Insurers may send an adjuster to inspect the property. Cooperate fully, but don’t accept the first settlement offer without reviewing it carefully. Adjusters may undervalue repairs or overlook certain damages. If you disagree, request a detailed explanation and provide additional documentation. You have the right to dispute the assessment and ask for a second opinion.

Communication is key. Keep a log of all interactions—dates, names, and summaries of conversations. Follow up in writing when necessary. If the process becomes overwhelming, consider hiring a public adjuster, a professional who works on your behalf to negotiate with the insurer. While they charge a fee, often a percentage of the claim, their expertise can result in a significantly higher payout.

Finally, understand that not all claims are worth filing. Small incidents, like a $500 kitchen fire, might cost you more in the long run if they lead to premium increases or loss of claims-free discounts. Weigh the cost of the damage against your deductible and future rate impact. For minor issues, paying out of pocket may be the smarter financial choice.

Building a Complete Protection Strategy Beyond the Basics

Standard home insurance provides a solid foundation, but it’s not the final layer of protection. For many households, supplemental coverage is essential to close gaps and ensure comprehensive security. These additional policies are not one-size-fits-all—they should be tailored to your specific risks and financial situation.

Flood insurance is one of the most commonly overlooked yet critical additions. Standard policies do not cover flooding, even from heavy rains or overflowing rivers. Yet floods are among the most frequent and costly natural disasters in the U.S. The NFIP offers policies with coverage limits up to $250,000 for the structure and $100,000 for contents. Private insurers may offer higher limits and broader terms. If you live near water, in a low-lying area, or in a region with poor drainage, flood insurance is not optional—it’s essential.

Earthquake insurance is another important consideration for those in active zones. It covers structural damage, personal property loss, and sometimes additional living expenses. Premiums vary based on location, home construction, and deductible levels. While it may seem expensive, the cost is minor compared to rebuilding after a major quake. Similarly, sewer backup coverage protects against water damage from clogged or overwhelmed municipal systems. This endorsement is relatively low-cost and can prevent tens of thousands in cleanup and repair.

Umbrella insurance is a powerful tool for liability protection. It provides an extra layer of coverage—often $1 million or more—above and beyond your home and auto policies. This is especially valuable for homeowners with significant assets, frequent guests, or high-risk features like swimming pools. A single lawsuit could wipe out savings and future earnings. Umbrella policies are surprisingly affordable, often costing less than $200 per year for $1 million in coverage.

Finally, consider inflation guard or guaranteed replacement cost coverage. These options ensure your policy keeps pace with rising construction costs, so you’re not underinsured in the event of a total loss. As building materials and labor continue to increase, standard policies based on outdated valuations can leave you short. By layering these supplemental protections, you create a complete risk management strategy that goes beyond the basics.

Security Starts Before the Storm

True financial resilience doesn’t come from reacting to crises—it comes from preparing for them. Your home is more than a place to live. It’s a cornerstone of your financial life, a store of value, and a legacy for your family. Protecting it isn’t about fear. It’s about responsibility, foresight, and the quiet confidence that comes from knowing you’ve done everything possible to safeguard what matters most. Insurance is not an expense. It’s a strategic tool—one that, when combined with smart upgrades, regular assessments, and informed decisions, forms a powerful shield against uncertainty. By treating risk management as a priority, not an afterthought, you ensure that your home remains a source of strength, stability, and peace for years to come.