How I Built My Comeback Plan: Smart Investing After Coming Home

Returning home after years abroad feels like restarting life with a suitcase full of memories—and financial questions. What happens to your money? Where should you invest now? I’ve been there, overwhelmed and unsure. But through trial, error, and real talk with local experts, I found a path that balanced safety, growth, and simplicity. This is how I rebuilt my financial footing—and how you can too, without the stress or guesswork. Coming back isn’t just a change of address; it’s a financial reset. The systems you knew may no longer apply, and the rules of investing have likely shifted. This journey isn’t about chasing quick wins. It’s about laying a foundation that supports your family, protects your future, and gives you peace of mind in a new chapter of life.

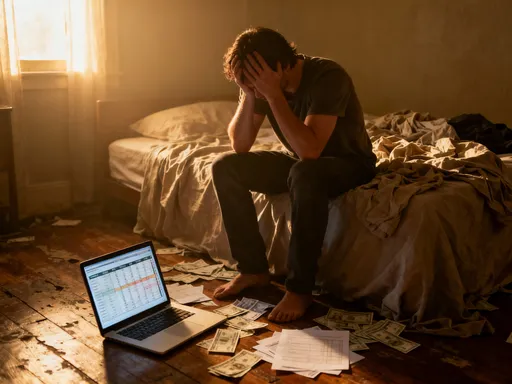

The Reality Check: Coming Home Isn’t Just Emotional—It’s Financial

Returning to your home country after living overseas often begins with a wave of emotion—familiar sights, warm reunions, the comfort of speaking your native language. But beneath the surface, a complex financial transition is already unfolding. Many returnees assume that because they’re coming “home,” their financial decisions will naturally fall into place. This belief, while comforting, can lead to serious missteps. The truth is, your financial environment has changed, even if the streets have not. Income earned abroad may no longer be stable or even accessible in the same way. Savings built in foreign currencies face conversion challenges. Tax obligations may now apply in multiple jurisdictions. These are not minor details—they are foundational shifts that require immediate attention.

One of the most common shocks returnees experience is the erosion of purchasing power. Money saved abroad, especially in stronger currencies, can seem substantial on paper. But when converted and spent in a local economy with different inflation rates and cost-of-living structures, that same amount may not stretch as far as expected. A family that lived comfortably in a mid-sized city abroad might find that their savings struggle to cover housing and education costs back home. This gap between expectation and reality can trigger panic, leading to rushed investment decisions—like buying property too quickly or putting money into high-risk ventures simply because they sound promising. Emotional attachment to the idea of “home” often amplifies this risk. People may feel pressure to prove their success by making visible financial moves, such as purchasing a large house or funding extended family members, without first securing their own financial base.

Tax implications are another often-overlooked challenge. Some countries impose exit taxes on residents who have lived abroad and accumulated assets. Others require reporting of foreign income or bank accounts, even after return. Failing to comply can result in penalties or audits. At the same time, local tax incentives for returnees—such as reduced capital gains rates or special savings programs—may exist but go unnoticed without proper research. The key is to treat your return not as a homecoming, but as the start of a new financial phase. This means pausing before acting, gathering information, and seeking advice from professionals who understand both international and local financial systems. Only by acknowledging these realities can you begin to build a strategy that protects what you’ve worked so hard to earn.

Mapping Your Financial Landscape: What You Own vs. What You Need

Before making any investment decision, you must first answer a simple but critical question: What do you actually have? Many returnees carry a mental list of their assets—savings accounts, retirement funds, maybe a property abroad—but rarely have a complete, organized picture. Without this clarity, even well-intentioned choices can go wrong. The process of mapping your financial landscape is not just about numbers; it’s about understanding what belongs in your new life and what might be better left behind. This step separates emotional attachments from practical needs, helping you avoid the trap of bringing everything home only to realize it doesn’t fit your current reality.

Start by listing all your assets in one place. Include bank accounts, investment portfolios, real estate holdings, pension plans, and any business interests. For each, note the currency, current value, access restrictions, and tax implications. Some retirement accounts, for example, may not allow early withdrawal or may lose tax advantages if transferred. Real estate abroad might generate rental income, but managing it from afar adds complexity and cost. The goal is not to liquidate everything, but to assess what serves your goals now. A condominium in a foreign city might be a good long-term holding, but if it’s underperforming and difficult to manage, selling it could free up capital for more strategic use at home.

Next, consider how to transfer funds across borders. International wire transfers often come with fees, exchange rate markups, and reporting requirements. Using reputable financial institutions or specialized money transfer services can reduce costs and ensure compliance. Some countries have limits on how much money you can bring in without declaration, so understanding local regulations is essential. Opening a local bank account early in the process provides a landing zone for your funds. Look for banks that offer multi-currency accounts or have international branches, as these can simplify management. At the same time, don’t rush to close all overseas accounts. Maintaining one or two abroad can be useful for ongoing income, travel, or as part of a diversified financial strategy.

Real-life examples show the importance of this step. One woman returned after 15 years abroad with savings in three different currencies. By consolidating her accounts and converting funds strategically—timing transfers to favorable exchange rates—she preserved nearly 8% more value than if she had moved everything at once. Another returnee kept his retirement fund in the country where he worked, allowing it to continue growing tax-deferred while he built a new income stream at home. These decisions weren’t made overnight. They came from careful review, professional advice, and a willingness to delay action until the full picture was clear. Your financial map is your compass. Without it, even the best intentions can lead you off course.

Where to Park Your Money First? Building a Safe Landing Zone

When you first return, the most important investment you can make is not in stocks, real estate, or businesses—it’s in stability. Your immediate goal should be to create a financial buffer, a safe landing zone where your money can rest while you adjust to your new environment. This is not the time to chase high returns. It’s the time to protect what you have. A well-structured short-term safety net gives you breathing room to learn the local economy, understand banking practices, and make informed decisions without pressure. Think of it as a financial pause button—necessary, temporary, and incredibly valuable.

The core of this landing zone should be liquid, low-risk accounts. Local savings accounts are often the first choice. They offer easy access, minimal risk, and are insured up to certain limits by government deposit protection schemes. While interest rates may be modest, their primary purpose is security, not growth. Fixed deposits, also known as term deposits, offer slightly higher returns in exchange for locking up funds for a set period. These can be useful for portions of your savings that you don’t need immediately. Money market funds are another option. They invest in short-term government and corporate debt, offering better returns than regular savings accounts while maintaining high liquidity and low volatility.

Each of these instruments has trade-offs. Savings accounts offer full access but may lose value to inflation over time. Fixed deposits provide better returns but penalize early withdrawal. Money market funds strike a balance but are not always covered by deposit insurance. The key is to diversify within your safety net. For example, keep three to six months of living expenses in a savings account for emergencies. Place another portion in fixed deposits with staggered maturity dates—this is known as a laddering strategy—so you always have access to some funds while earning higher interest on others. Allocate a smaller share to money market funds if you’re comfortable with slight fluctuations for the sake of better returns.

Building this foundation prevents emotional decision-making. Without a safety net, a single unexpected expense—a medical bill, a home repair—could force you to sell investments at a loss or take on debt. With one in place, you can stay calm and strategic. One returnee, a teacher who came back after a decade abroad, kept 40% of her savings in a mix of fixed and savings accounts for the first year. This allowed her to explore job opportunities without financial stress and eventually invest in a small home-based tutoring business with confidence. Your landing zone isn’t permanent. It’s a temporary base camp. Once you’re settled, you can begin moving funds into longer-term investments. But rushing past this step is like building a house on sand. Stability first, growth later.

Investing in the Local Game: Understanding the Rules Before You Play

The local investment market may feel familiar, but don’t assume you know the rules. Economic conditions, regulatory frameworks, and market behaviors often shift significantly, especially over the years you’ve been away. What once seemed like a safe real estate market might now be overvalued. A government bond that was reliable in the past could now offer returns that don’t keep up with inflation. Stocks that were stable may now be more volatile due to global trade changes or domestic policy shifts. Jumping in without understanding these new dynamics is like playing a game with updated rules but using an old strategy—you’re likely to lose.

Start by researching the current state of the economy. Look at inflation rates, interest rate trends, and employment data. These indicators shape investment performance. High inflation, for example, erodes the value of cash and fixed-income investments, making assets like equities or real estate more attractive despite their risks. Low interest rates might make savings accounts less appealing but could boost stock and property markets. Understanding these forces helps you align your choices with reality, not nostalgia. Visit official financial regulatory websites, read reports from central banks, and follow reputable financial news sources. Avoid relying solely on word-of-mouth advice, which can be outdated or biased.

Next, explore the available investment vehicles. Local stock markets may offer opportunities through direct stock purchases or exchange-traded funds (ETFs). ETFs are particularly useful for returnees because they provide instant diversification across sectors or industries. Unlike individual stocks, which depend on the performance of a single company, ETFs spread risk. A local market ETF might track the top 50 companies in the country, giving you broad exposure without needing deep expertise. Government savings schemes, such as national development bonds or pension-linked investment plans, often provide tax benefits and moderate returns with low risk. Real estate remains a popular choice, but it’s not without pitfalls. Property prices can be inflated in certain areas, and rental yields may not justify the investment. Additionally, maintenance costs, property taxes, and legal complexities can eat into profits.

The key is to evaluate each option not by how familiar it seems, but by how well it fits your goals and risk tolerance. For instance, if you’re nearing retirement, high-volatility stocks may not be suitable, even if the market is booming. If you’re focused on your children’s education, a dedicated savings plan with guaranteed returns might be smarter than speculative investments. One returnee, a former engineer, spent six months studying the local stock market before investing. He started with a small amount in a broad-market ETF, monitored its performance, and gradually increased his allocation as his confidence grew. This patient approach allowed him to learn the rhythm of the market without risking his entire savings. Knowledge is your greatest tool. The more you understand the local financial landscape, the better your decisions will be.

Diversification Beyond Borders: Keeping a Global Safety Net

Just because you’ve returned home doesn’t mean your investments should become entirely local. In fact, limiting your portfolio to one country increases your exposure to specific risks—economic downturns, currency devaluation, political instability, or sector-specific crashes. Diversification is not just a buzzword; it’s a proven strategy for protecting wealth. By maintaining some international exposure, you create a financial safety net that can withstand local shocks. This doesn’t mean moving all your money abroad. It means keeping a balanced, globally diversified portfolio that reflects your long-term goals and risk tolerance.

There are several ways to maintain global exposure. International mutual funds and global ETFs allow you to invest in markets around the world without needing foreign bank accounts. These funds pool money from investors and allocate it across different countries and asset classes. For example, a global equity fund might hold stocks from the U.S., Europe, Asia, and emerging markets, providing broad diversification. Offshore investment accounts, where permitted by local laws, offer another option. They allow you to hold assets in foreign currencies and invest directly in international markets. While these accounts may require additional reporting, they can protect against currency risk and provide access to more mature financial systems.

Currency diversification is another important benefit. If your home currency weakens, having assets in stronger currencies like the U.S. dollar or euro can help preserve your purchasing power. For instance, during periods of high inflation or economic uncertainty, local money may lose value quickly. But if part of your savings is in a stable foreign currency, that portion remains protected. This doesn’t mean predicting currency movements—no one can do that reliably. It means reducing dependence on a single currency, just as you wouldn’t put all your savings in one bank.

Real examples highlight the value of this approach. A family that returned after 12 years abroad kept 25% of their investment portfolio in a global index fund. When their home country experienced a temporary market downturn, their international holdings continued to perform, offsetting the losses and keeping their overall portfolio stable. Another returnee used a multi-currency account to hold a portion of savings in U.S. dollars, which later helped cover unexpected medical expenses abroad without incurring high conversion fees. The message is clear: home is where you live, but your money can have multiple homes. Diversification isn’t about distrust—it’s about wisdom. It’s recognizing that the world is interconnected, and your financial strategy should reflect that reality.

Avoiding the Traps: Common Mistakes Returnees Make (And How to Dodge Them)

Even well-prepared returnees can fall into financial traps. Some are obvious, like falling for high-return scams. Others are subtle, like making decisions based on sentiment rather than strategy. The most dangerous mistakes are often the ones that feel right at the time—buying property because “it’s a sure thing,” investing in a family business because “it supports the relatives,” or trusting an advisor because “they went to school with my cousin.” These choices may seem harmless, even noble, but they can erode wealth quickly if not evaluated critically.

One of the most common errors is rushing into real estate. Property is visible, tangible, and often tied to cultural ideas of success. But not all real estate is a good investment. Overpaying, buying in declining areas, or underestimating maintenance and tax costs can turn a dream home into a financial burden. Another trap is informal investing—putting money into unregulated schemes promoted by friends or extended family. These often promise high returns with no risk, which is a red flag. No legitimate investment guarantees profits without risk. Always verify the credentials of any financial product or advisor. Check if they are registered with the national securities regulator or banking authority. If information is hard to find, walk away.

Underestimating taxes is another frequent oversight. Some returnees assume they no longer owe taxes abroad, but many countries tax worldwide income or require reporting of foreign assets. Failing to file correctly can lead to penalties. At the same time, missing out on legal tax benefits—such as deductions for retirement contributions or incentives for first-time homebuyers—means leaving money on the table. The solution is due diligence. Work with a qualified tax advisor who understands cross-border financial issues. Keep detailed records of all transactions, both past and present. Transparency protects you.

Finally, avoid the trap of overconfidence. Just because you managed money successfully abroad doesn’t mean the same strategies will work at home. Markets, regulations, and economic conditions differ. Stay humble, stay curious, and keep learning. Ask questions. Seek second opinions. Test small before going big. Financial discipline isn’t about knowing everything—it’s about knowing what you don’t know and acting accordingly.

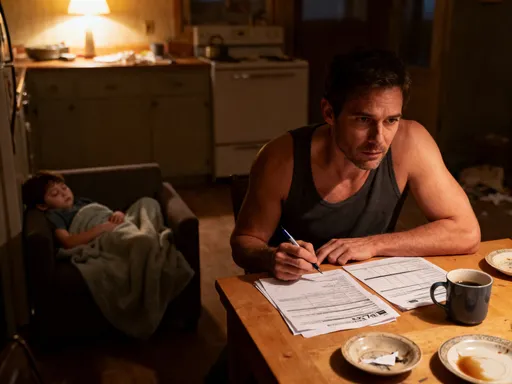

Building Long-Term Wealth: A Step-by-Step Strategy That Grows With You

With your foundation in place—clear financial awareness, a safety net, and an understanding of local and global markets—you’re ready to build long-term wealth. This isn’t about getting rich quickly. It’s about creating a strategy that evolves with your life, protects your family, and supports your goals over time. The most successful financial plans are not the most aggressive—they are the most consistent. They balance caution with opportunity, discipline with flexibility, and short-term needs with long-term vision.

Start with goal-based planning. Identify your major financial objectives: funding your children’s education, saving for retirement, buying a home, or building an emergency fund. Assign timeframes and target amounts to each. Then, allocate your investments accordingly. Short-term goals (1–3 years) should use low-risk instruments like savings accounts or fixed deposits. Medium-term goals (4–10 years) can include balanced funds or dividend-paying stocks. Long-term goals (10+ years) can tolerate more risk, making equities and real estate more suitable. This approach ensures that your money is working for specific purposes, not just sitting in generic accounts.

Adopt a phased investment strategy. Begin conservatively, especially in the first two years after return. As you gain confidence and stability, gradually increase your exposure to growth-oriented assets. Use dollar-cost averaging—investing a fixed amount regularly—to reduce the impact of market volatility. This method buys more shares when prices are low and fewer when they’re high, smoothing out returns over time. Rebalance your portfolio annually to maintain your desired asset mix. If stocks have grown too large a share, sell some and reinvest in bonds or cash to restore balance.

Finally, make financial review a habit. Set aside time every quarter to assess your progress, adjust for life changes, and ensure your strategy still aligns with your goals. Life evolves—children grow, careers shift, health needs change. Your financial plan should too. By staying engaged, informed, and disciplined, you build not just wealth, but lasting security. Coming home is a new beginning. With the right financial plan, it can also be the start of your most stable, confident, and prosperous chapter yet.