Passing the Torch: Building a Legacy-Ready Investment Portfolio

When I first realized my business wasn’t just mine—but something I’d one day pass on—I panicked. How do you protect wealth while keeping it alive for the next generation? I’ve tested strategies, fallen into traps, and learned what really works. This is about more than money; it’s about stability, vision, and responsibility. Let me walk you through how to build an investment portfolio that supports both your company and your legacy. It’s not just about growing assets, but about preparing them to endure change, transition, and time. The goal isn’t sudden gains, but sustained strength across decades.

The Hidden Challenge of Business Succession

Many entrepreneurs pour their energy into building a thriving business, yet give little thought to what happens when they step away. The transition from one generation to the next is one of the most fragile moments in a family enterprise. Statistics show that fewer than one-third of family businesses survive the shift to the second generation, and only about 10% make it to the third. The reasons are rarely about lack of effort or dedication. Instead, the root cause often lies beneath the surface—financial instability, unclear roles, and inadequate investment planning.

Succession is not simply an organizational reshuffling. It is a financial transformation. When leadership changes hands, the business may face cash flow demands, new investment needs, or even disputes over asset division. Without a strong financial foundation, these pressures can force difficult decisions—like selling off parts of the business or taking on high-interest debt. The emotional weight of letting go can cloud judgment, leading to rushed choices that compromise long-term sustainability. A well-structured investment portfolio acts as a buffer during this vulnerable phase, ensuring that the business does not bear the full burden of the transition.

Moreover, the absence of a financial roadmap can create tension among heirs. Siblings may have different levels of involvement or interest in the business, yet expect equal treatment in asset distribution. Without external investments to balance the equation, the only way to achieve fairness might be to liquidate company equity—putting operational continuity at risk. A legacy-ready portfolio allows for equitable outcomes without disrupting the core business. It provides options: one child can inherit the company, while others receive non-business assets of comparable value. This balance preserves both family harmony and enterprise stability.

Why Your Investment Portfolio Is the Backbone of Legacy Transfer

The heart of any enduring legacy is not the business itself, but the financial structure that supports it. An investment portfolio, when properly designed, becomes the backbone of intergenerational wealth transfer. It serves multiple critical functions: generating liquidity, diversifying risk, and funding life transitions without disrupting business operations. Think of it as the reservoir that feeds the engine during times of change. When leadership shifts, the business should not have to be sold, downsized, or strained to meet personal financial needs.

Liquidity is one of the most overlooked aspects of succession planning. Many founders assume their business can be easily sold or refinanced when the time comes. In reality, market conditions, industry shifts, or internal performance can drastically affect valuation. Relying solely on the business for financial distribution is risky. A diversified portfolio filled with income-producing assets—such as dividend-paying stocks, rental real estate, or fixed-income securities—can provide steady cash flow. This income can support the retiring generation’s lifestyle while allowing the incoming leaders to focus on growing the business, not on immediate financial survival.

Diversification is equally vital. When a family’s wealth is concentrated in a single business, they are exposed to what financial experts call “concentrated risk.” If the industry declines or competition intensifies, the entire family’s financial security is threatened. By allocating a portion of wealth into external investments, families insulate themselves from sector-specific downturns. These assets act as a hedge, preserving capital even if the business faces temporary setbacks. Over time, this balance reduces stress and increases confidence during the handover process.

Additionally, a strong portfolio enhances strategic flexibility. It allows families to make decisions based on vision, not necessity. For example, if the next generation wants to expand into new markets or invest in technology upgrades, the business doesn’t need to carry all the financial weight. Funds can be drawn from investment returns or carefully structured withdrawals, preserving the company’s balance sheet. In this way, the portfolio doesn’t just protect wealth—it enables growth.

Balancing Control and Liquidity: The Founder’s Dilemma

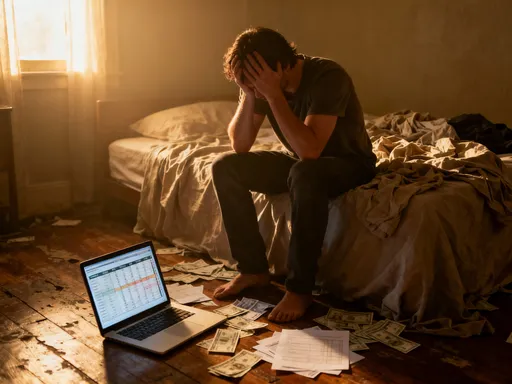

One of the most persistent challenges for business owners is the tension between control and liquidity. Founders often equate their identity with their company. Their net worth is tied up in its success, and their influence is rooted in ownership. Letting go—even partially—can feel like losing control. Yet, holding onto every share and reinvesting every dollar back into the business creates a dangerous imbalance. The founder becomes financially overexposed, with little room to maneuver when personal or family needs arise.

Consider the case of a manufacturing business owner who, after decades of reinvestment, had nearly 90% of his wealth locked in company equity. When he decided to retire, his only option for generating income was to sell a significant stake. However, no buyer was willing to pay full value without assuming management control—something he wasn’t ready to give up. The result? A stalemate that delayed retirement, strained family relationships, and ultimately led to a fire sale during an economic downturn. This scenario is more common than many realize. Without external investments, the business becomes both the source of wealth and the obstacle to enjoying it.

The solution lies in gradual diversification. Founders don’t need to sell their company overnight, but they should begin redirecting a portion of profits into liquid, income-generating assets. This can be done systematically—by setting aside a percentage of annual earnings or using life insurance policies with cash value components. The key is to build a parallel financial structure that grows alongside the business. Over time, this external portfolio reduces dependence on company equity, giving the founder more freedom to plan retirement, fund education, or support family members without jeopardizing operations.

Importantly, diversification does not mean surrendering influence. A founder can retain majority ownership and leadership while still building a separate investment base. In fact, having personal wealth outside the business can strengthen decision-making. When financial security isn’t tied solely to the company’s performance, leaders can make bolder, more strategic choices—such as pursuing long-term innovation or weathering short-term losses—without fear of personal collapse.

Designing a Multi-Generational Asset Mix

A legacy-ready portfolio must be designed not for one person, but for multiple lifetimes. The investment needs of a 60-year-old founder preparing for retirement differ significantly from those of a 30-year-old successor focused on growth. A one-size-fits-all approach will fail. Instead, the portfolio should reflect a phased strategy that evolves with each generation’s goals, risk tolerance, and time horizon.

For the outgoing generation, capital preservation and income stability are paramount. They need reliable returns to support their lifestyle without eroding principal. Conservative assets like high-quality bonds, dividend-focused equity funds, and income-producing real estate play a central role. These investments offer lower volatility and predictable cash flow, which is essential for retirees who cannot afford major market setbacks. At the same time, a modest allocation to growth-oriented assets ensures that inflation does not erode purchasing power over time.

For the incoming generation, the focus shifts toward long-term appreciation. Younger heirs typically have a higher risk tolerance and a longer investment horizon. They can benefit from strategic exposure to equities, particularly in sectors with strong growth potential. This doesn’t mean reckless speculation, but rather disciplined participation in broad market trends—such as technology, healthcare, or sustainable energy. A balanced mix of index funds, exchange-traded funds (ETFs), and select individual stocks can provide both diversification and upside potential.

The challenge is to blend these differing needs into a single, cohesive strategy. One effective approach is to structure the portfolio in layers. The core layer consists of stable, income-generating assets that serve both generations. A second layer includes growth-oriented holdings managed separately, perhaps within a trust or family investment entity. This allows younger members to gain experience with investing while protecting the overall capital base. Regular rebalancing ensures that the portfolio remains aligned with changing objectives and market conditions.

Risk Management: Protecting Wealth from Blind Spots

Even the most carefully constructed portfolios can fail if hidden risks are ignored. In family business transitions, common blind spots include overconcentration, market timing errors, tax inefficiencies, and lack of legal safeguards. Addressing these vulnerabilities requires more than just asset selection—it demands a proactive, comprehensive risk management strategy.

Overconcentration remains the single biggest threat. When too much wealth is tied to one business or asset class, a single downturn can trigger a chain reaction. Regular portfolio reviews help identify concentration risks early. Rebalancing—selling portions of overperforming assets and reinvesting in underrepresented areas—maintains diversification and reduces exposure. This discipline prevents emotional decision-making, such as holding onto a beloved stock long after fundamentals have changed.

Tax efficiency is another critical factor. Poorly timed sales or uncoordinated gifting strategies can result in significant tax liabilities, eroding wealth unnecessarily. Strategies such as step-up in basis, charitable remainder trusts, or Roth conversions—when appropriate—can help minimize tax burdens. Working with tax professionals ensures that transfers occur in the most efficient manner possible, preserving more value for heirs.

Insurance also plays a vital role in risk mitigation. Life insurance policies, especially permanent ones with cash value, can provide liquidity at the time of death, preventing the need to sell business assets to cover estate taxes. Disability insurance protects against the loss of income if a key leader becomes incapacitated. Umbrella liability policies guard against legal claims that could threaten personal or business assets. These tools don’t generate returns, but they prevent catastrophic losses—making them essential components of a resilient financial plan.

Practical Steps to Align Investments with Business Transition

Knowledge is only valuable when it leads to action. Building a legacy-ready portfolio requires a clear, step-by-step process. The first step is conducting a comprehensive assessment of current assets. This includes not only investment accounts but also real estate, retirement funds, and business equity. Understanding the full picture allows families to identify gaps, overlaps, and opportunities for improvement.

The next step is defining intergenerational goals. What does success look like for the next generation? Is it financial independence, business expansion, or community impact? These conversations should involve all key stakeholders, including spouses and adult children. Open dialogue builds trust and ensures that the investment strategy reflects shared values. Goals should be specific, measurable, and time-bound—such as “fund two college educations by 2035” or “generate $50,000 in annual passive income by 2030.”

Selecting trusted advisors is equally important. Families should work with fee-only financial planners, estate attorneys, and tax professionals who specialize in multi-generational planning. These experts bring objectivity and experience, helping to avoid emotional decisions and regulatory pitfalls. It’s crucial to choose advisors who communicate clearly and act in the family’s best interest, not their own commission.

Finally, families must establish a schedule for regular portfolio reviews—ideally every six to twelve months. These meetings should assess performance, rebalance allocations, and update goals as life circumstances change. Consistency turns planning from a one-time event into an ongoing discipline. Over time, this rhythm builds confidence and ensures that the portfolio remains aligned with both financial objectives and family dynamics.

The Mindset Shift: From Builder to Steward

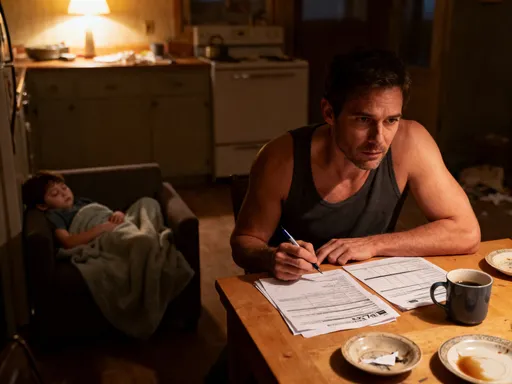

Perhaps the most profound change required in legacy planning is not financial, but psychological. Founders are, by nature, builders. They thrive on growth, control, and visible results. But preparing for succession demands a shift from builder to steward—a person who preserves, protects, and prepares for the future. This transition is not about stepping back, but about stepping forward with wisdom.

As a steward, the focus moves from personal achievement to collective well-being. Decisions are no longer judged by short-term gains, but by long-term resilience. This mindset encourages patience, discipline, and humility. It means resisting the urge to micromanage the next generation, even when their approach differs from your own. It means accepting that control will gradually transfer, not because of failure, but because of success.

This shift also requires emotional preparation. Letting go of financial control can be deeply unsettling, especially for those who have spent decades building their empire. Counseling or peer support groups for business owners can provide valuable guidance during this transition. Open conversations with family members about values, expectations, and fears help align everyone around a common vision.

Ultimately, stewardship is about responsibility. It’s recognizing that wealth is not just a reward for hard work, but a tool to empower others. When managed with care, it can fund education, launch new ventures, and support charitable causes. It becomes a force for good that extends far beyond the original business.

A Legacy That Lasts Beyond You

A well-structured investment portfolio is more than a collection of assets—it is a promise. It says that the work you’ve done, the risks you’ve taken, and the values you’ve lived by will continue to matter. It ensures that your business can thrive under new leadership, that your family can remain secure, and that your impact can endure. This kind of legacy doesn’t happen by accident. It requires foresight, discipline, and the courage to plan for a future you may never see.

By starting early, diversifying wisely, and aligning financial strategy with family goals, you transform personal success into lasting significance. You create not just wealth, but stability. Not just a business, but a legacy. And in doing so, you pass on more than money—you pass on peace of mind, opportunity, and the confidence that the future is prepared.