How I Built Real Wealth Without Chasing Quick Wins

What if financial freedom isn’t about getting rich fast—but about staying steady, smart, and in control? I used to chase high returns, only to learn the hard way that lasting wealth comes from discipline, not shortcuts. This is the approach I wish I’d known earlier: a clear, balanced strategy focused on growing value, managing risk, and avoiding costly mistakes. Let’s walk through the real principles behind long-term wealth—no hype, just substance. It’s not about flashy gains or overnight success stories. It’s about making consistent choices that compound quietly over time, protecting what you’ve earned, and aligning your money with your life’s purpose. This is the quiet power of sustainable wealth building.

The Myth of Fast Money

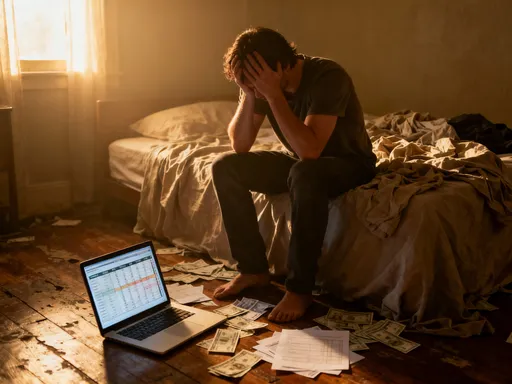

Many people believe that building wealth means capturing big wins—landing the right stock at the right time, investing in the next tech unicorn, or catching a market surge. The image of sudden riches is deeply embedded in popular culture, often amplified by media stories of young entrepreneurs becoming millionaires overnight. But these narratives are outliers, not blueprints. For every success story, there are countless others who took similar risks and lost everything. The truth is, chasing quick returns is one of the most common—and costly—mistakes in personal finance. It shifts focus from long-term planning to short-term speculation, where emotions often override reason. When investors prioritize speed over stability, they expose themselves to high volatility, poor timing, and the psychological trap of regret avoidance.

Market behavior consistently shows that short-term trading rarely outperforms disciplined, long-term investing. Studies from reputable financial institutions have demonstrated that even professional fund managers struggle to beat the market consistently over time. For individual investors, the odds are even steeper. Transaction costs, taxes, and behavioral biases like overconfidence and loss aversion further erode returns. More importantly, the pursuit of fast money often leads to neglecting the fundamentals: budgeting, saving, and asset allocation. Instead of building a foundation, investors gamble on quick fixes. This mindset treats money as a scorecard rather than a tool for security and freedom. The result is a cycle of stress, disappointment, and financial instability.

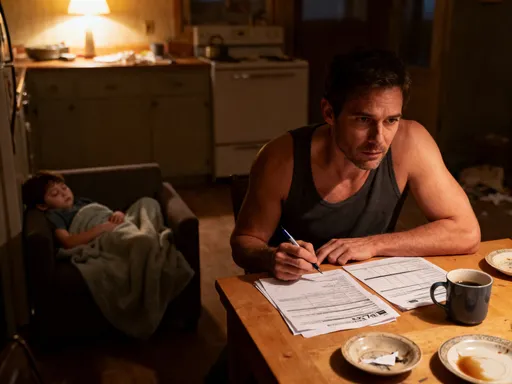

The shift from speculation to stewardship begins with a change in perspective. Wealth is not built in moments—it’s built in months and years, through consistent habits and thoughtful decisions. Rather than asking “What can make me rich fast?”, a better question is “What can help me grow steadily and safely?” This reframing encourages patience and responsibility. It aligns financial goals with real life—providing for family, preparing for unexpected expenses, and securing future comfort. Sustainable wealth favors consistency over volatility, and time in the market over timing the market. By rejecting the myth of fast money, investors free themselves from the pressure of constant performance and open the door to lasting financial health.

Wealth as a System, Not a Number

True financial freedom is not measured by a single number in a bank account. It’s measured by the reliability and resilience of the entire financial system behind that number. Think of wealth like a house: the balance sheet is the visible structure, but the foundation—comprising income, expenses, savings, and investment strategy—is what determines whether it stands firm during storms. A large balance means little if it’s built on risky bets or unsustainable spending. Conversely, a modest but well-structured portfolio can generate long-term security and peace of mind. This systems-based approach emphasizes balance, sustainability, and control over sheer size.

At the core of any strong financial system are three pillars: income generation, expense management, and asset allocation. Income provides the fuel, expenses determine how much fuel is consumed, and asset allocation decides how the surplus is invested. Each component must work in harmony. For example, earning a high income means little if spending consumes it all. Similarly, aggressive investing is risky without a buffer of liquid assets. A balanced system includes multiple layers of protection and growth. Cash reserves ensure liquidity for emergencies, equities offer long-term growth potential, and real estate can provide both income and diversification. The goal is not to maximize returns in one area, but to create stability across the entire structure.

Diversification is often misunderstood as simply spreading money across different investments. In reality, it’s about managing exposure to different types of risk. A well-diversified portfolio considers asset class, geography, time horizon, and correlation between investments. For instance, stocks and bonds often move in opposite directions during market stress, providing a natural hedge. Real estate may hold value when inflation rises, while cash loses purchasing power. By understanding how each asset behaves under different conditions, investors can build a portfolio that adapts rather than collapses. This is not about eliminating risk—risk cannot be eliminated—but about controlling it intelligently. A strong financial system doesn’t avoid risk; it anticipates and manages it.

Earning Smarter: The Role of Income in Wealth Building

While cutting expenses is important, long-term wealth is primarily driven by income growth. Saving $100 a month is valuable, but increasing income by $1,000 a month creates far greater potential for investment and security. This is not a call to work endlessly, but to work strategically—focusing on building skills, advancing careers, or developing side ventures that align with personal strengths. Financial independence is rarely achieved by frugality alone; it requires a steady increase in earning power. The more income available, the more can be saved, invested, and protected for the future.

Increasing earning potential begins with self-awareness. What skills are in demand? What industries offer stability and growth? How can existing talents be leveraged into higher-value roles or businesses? For many, this means investing in education, certifications, or networking opportunities. For others, it means identifying market needs and offering solutions—whether through consulting, freelancing, or small-scale entrepreneurship. The key is to treat income not as a fixed number, but as a dynamic part of the financial system that can be improved over time. Unlike market returns, which are uncertain, income growth is largely within an individual’s control.

Once income increases, the next step is to reinvest the surplus wisely. This is where compounding begins to work powerfully. Even modest contributions, when invested consistently and left to grow, can accumulate into substantial sums over decades. For example, investing $500 a month at a 6% annual return yields over $200,000 in 20 years. The earlier this starts, the greater the effect. But timing matters less than consistency. Missing a few months due to life events is normal, but the habit of regular contribution is what builds momentum. Aligning income growth with disciplined saving creates a virtuous cycle: more income leads to more investment, which generates passive income, which further supports financial stability.

Risk Control: The Hidden Engine of Success

Most investors focus on returns, but experienced wealth builders know that risk control is the true foundation of long-term success. Gains get attention, but losses can derail progress. A 50% loss requires a 100% gain just to break even—an imbalance that underscores why protecting capital is essential. Risk is not just the possibility of market declines; it includes inflation eroding purchasing power, poor timing due to emotional decisions, and overexposure to a single asset or strategy. Effective risk management treats these threats as central to planning, not afterthoughts.

One of the most practical tools for risk control is position sizing—limiting how much capital is allocated to any single investment. Even the most promising opportunities carry uncertainty, so spreading exposure reduces the impact of any single failure. Rebalancing is another key strategy. Over time, some assets grow faster than others, shifting the portfolio’s balance. Regularly adjusting holdings to maintain target allocations ensures that risk levels stay aligned with goals. For example, if stocks rise significantly, they may represent a larger share of the portfolio than intended, increasing exposure to market swings. Selling some and reinvesting in underweight areas restores balance.

Equally important is managing behavioral risk. Fear and greed are powerful forces that lead to buying high and selling low—a pattern that destroys wealth over time. To counter this, many successful investors use mental checklists or predefined rules. These might include criteria for buying or selling, such as valuation metrics or time-based triggers. By removing emotion from decisions, investors avoid impulsive actions that feel right in the moment but hurt performance in the long run. Risk control is not about avoiding all danger—it’s about making informed choices that allow for steady progress without catastrophic setbacks.

The Psychology of Long-Term Thinking

Sticking to a financial plan through market ups and downs requires more than knowledge—it requires emotional resilience. Behavioral finance has shown that people are not always rational when it comes to money. Cognitive biases like loss aversion, confirmation bias, and recency bias distort judgment and lead to poor decisions. For example, investors often sell during downturns out of fear, locking in losses, then miss the recovery because they wait for “certainty” that never comes. The ability to stay the course, even when emotions scream otherwise, is what separates successful investors from the rest.

Building patience starts with setting clear rules and expectations. When goals are defined in terms of process—such as “invest $X every month” or “rebalance annually”—it becomes easier to ignore short-term noise. Focusing on actions within control, rather than outcomes influenced by markets, reduces anxiety and increases consistency. Avoiding constant market monitoring also helps. The 24-hour financial news cycle thrives on drama and urgency, but most of it is irrelevant to long-term investors. Limiting exposure to sensational headlines creates mental space for disciplined decision-making.

The goal is to cultivate an owner’s mindset, not a gambler’s. Owners think in terms of years, not days. They understand that businesses and markets go through cycles, and they trust the process of compounding. They don’t panic when prices dip; they see it as an opportunity to acquire value at a discount. This mindset is reinforced by structure—automated contributions, diversified portfolios, and regular reviews. Over time, these habits become second nature, reducing the need for willpower. Long-term thinking is not a personality trait; it’s a skill that can be developed with practice and the right environment.

Practical Tools for Everyday Investors

You don’t need a finance degree or a private advisor to manage wealth effectively. What matters most are simple, repeatable habits that support long-term success. Budget tracking is one of the most powerful tools—knowing where money goes allows for intentional choices. Automated investing removes the burden of decision fatigue, ensuring contributions happen consistently regardless of mood or market conditions. Periodic reviews—quarterly or annually—help assess progress, adjust goals, and rebalance portfolios without overreacting to short-term movements.

Technology has made these tools more accessible than ever. Mobile apps can sync bank accounts, categorize spending, and send alerts when budgets are exceeded. Robo-advisors offer low-cost, diversified portfolios with automatic rebalancing. Even basic spreadsheet templates can help track net worth and investment performance over time. The key is not complexity, but consistency. A simple plan followed diligently will outperform a sophisticated strategy abandoned halfway through.

Small adjustments can have outsized impacts over time. For example, reducing investment fees by just 0.5% annually can save tens of thousands in costs over a 30-year period. Changing the timing of contributions—investing at regular intervals rather than trying to time the market—can improve returns through dollar-cost averaging. Even minor improvements in tax efficiency, such as using retirement accounts or holding investments longer to qualify for lower capital gains rates, add up. These are not flashy tactics, but they are effective. The power lies in their repetition and reliability.

Putting It All Together: A Sustainable Path to Financial Freedom

Building lasting wealth is not about finding a single secret or making a brilliant move. It’s about integrating income growth, risk management, and disciplined habits into a cohesive system. When these elements work together, they create a self-reinforcing cycle of progress. Earnings fuel investment, investment generates returns, and risk controls protect gains. Over time, this system compounds not just money, but confidence and freedom. Financial security becomes less about hitting a specific number and more about having choices—whether that’s spending time with family, pursuing passions, or retiring with peace of mind.

Perfection is not the goal. No plan survives every life event unchanged. The important thing is to keep moving forward, even with setbacks. Missing a contribution, experiencing a market drop, or facing an unexpected expense doesn’t mean failure. What matters is returning to the plan, adjusting as needed, and continuing. Progress, not perfection, builds wealth. And because the journey is long, the habits must be sustainable—simple enough to maintain, flexible enough to adapt.

Ultimately, financial freedom is not a destination reached at a certain age or balance. It’s a way of living—calm, intentional, and in control. It’s waking up without money anxiety, making decisions based on values rather than pressure, and knowing that the future is prepared for. This kind of freedom doesn’t come from luck or shortcuts. It comes from showing up, making smart choices, and staying the course. The path may be quiet, but its results are profound. By focusing on what truly matters—consistency, protection, and purpose—anyone can build real wealth, one steady step at a time.