When the Market Whispers, I Listen: My Real Talk on Timing Investments for Financial Freedom

What if the secret to financial freedom isn’t what you invest in, but when you do it? I used to chase hot stocks and miss every turning point—until I learned to read the market’s rhythm. It’s not about perfection; it’s about patience, preparation, and spotting those quiet moments before the storm. This is how I shifted from reacting to leading, using timing as a tool, not a gamble. My journey wasn’t marked by overnight wins, but by slow, deliberate shifts in mindset. I stopped trying to outsmart the market and started learning its language. And once I did, everything changed—not just my portfolio, but my sense of control, confidence, and peace.

The Moment That Changed Everything: How I Learned to Stop Chasing Returns

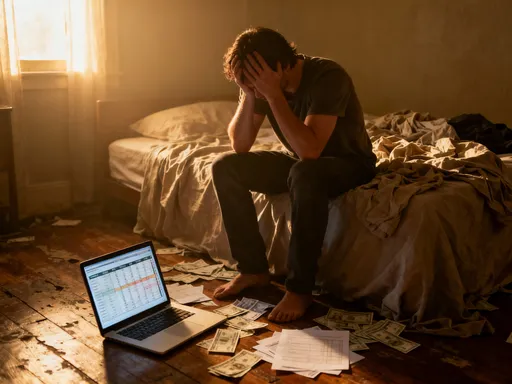

There was a time when I believed the loudest voices in the room held the keys to wealth. I remember vividly the summer I poured a significant portion of my savings into a fast-rising tech stock after seeing glowing headlines and endless social media buzz. The stock had surged 80% in two months, and it felt like everyone was getting in. I told myself I was being smart—joining a winning trend before it peaked. But within three weeks, the stock began to unravel. A slightly weaker-than-expected earnings report sent shockwaves through investor sentiment, and the price dropped sharply. I held on, hoping for a rebound, but the losses deepened. By the time I sold, I had lost nearly 40% of my initial investment.

That loss stung—not just because of the money, but because it exposed a deeper flaw in my approach. I wasn’t investing; I was reacting. I had confused momentum with strategy and emotion with insight. The market hadn’t betrayed me; I had failed to understand its timing. That experience became a turning point. I stepped back and asked myself a simple but powerful question: Was I really in control of my financial future, or was I just following the crowd? The answer was uncomfortable, but clear. I needed a new framework—one that didn’t rely on hype or headlines, but on discipline and observation.

Instead of focusing on which stock might be the next big thing, I began studying when to act. I started reading about market cycles, investor psychology, and the role of macroeconomic indicators. I realized that successful investing isn’t about catching lightning in a bottle; it’s about being ready when the window opens. That shift—from chasing returns to mastering timing—laid the foundation for everything that followed. It didn’t make me immune to market swings, but it gave me a compass when others were lost in the noise.

Why Timing Beats Picking Winners—The Hidden Power of Market Rhythm

Many people believe that wealth in the stock market comes from identifying the next Amazon or Apple before anyone else. While picking strong companies matters, research consistently shows that timing—knowing when to enter and exit—plays an even greater role in long-term financial outcomes. A study by Dalbar Inc., for example, found that over a 20-year period, the average investor earned significantly less than the S&P 500 index, not because they chose bad funds, but because they bought high and sold low, driven by emotion rather than strategy. This behavior gap highlights a critical truth: market timing, when done thoughtfully, can be more powerful than stock selection alone.

Markets are not random. They move in rhythms shaped by economic data, interest rate policies, corporate earnings, and, perhaps most unpredictably, human emotion. When fear dominates, prices often fall below intrinsic value. When greed takes over, assets become overvalued. Recognizing these patterns doesn’t require complex algorithms or insider knowledge. It requires patience and perspective. For instance, during periods of widespread pessimism—such as the early months of the pandemic—many优质 assets were available at deeply discounted prices. Investors who had prepared in advance and acted calmly were able to buy low and benefit from the recovery that followed.

Conversely, entering the market at moments of peak optimism often leads to disappointment. Consider the cryptocurrency surge in late 2017 or the meme stock frenzy of 2021. Investors who bought at the height of enthusiasm faced steep declines in the months that followed. Timing allows you to avoid these emotional traps. It shifts your focus from short-term excitement to long-term value. When you align your decisions with the broader market rhythm—buying when others are fearful and holding back when others are euphoric—you position yourself for sustainable growth. This isn’t about market prediction; it’s about pattern recognition and disciplined execution.

The Three Signals I Watch Before Making Any Move

Over the years, I’ve developed a simple but reliable framework for evaluating when to invest. It rests on three pillars: market sentiment, underlying fundamentals, and personal financial readiness. These signals don’t guarantee success, but they help me avoid costly mistakes and stay aligned with my long-term goals. I’ve learned that no investment decision exists in a vacuum. Even the strongest company can be a poor buy at the wrong time, and even a weak market can offer opportunities—if you’re looking in the right places.

The first signal I monitor is market sentiment. When consensus is overwhelmingly positive or negative, it often signals a potential turning point. For example, when financial news is dominated by stories of endless gains and “this time is different” narratives, I grow cautious. High levels of investor optimism, as measured by surveys like the AAII Investor Sentiment Survey, have historically preceded market corrections. On the flip side, when headlines are filled with fear and uncertainty, and retail investors are pulling money out of the market, I start to look for entry points. Extreme sentiment doesn’t tell me exactly when a reversal will happen, but it tells me to pay closer attention.

The second signal is fundamentals. I examine whether the broader economic environment and company-specific metrics support the current market trend. Are corporate earnings growing? Is inflation under control? Are interest rates moving in a direction that supports business investment? For individual stocks, I look at price-to-earnings ratios, revenue growth, and debt levels. A company may be fundamentally strong even if its stock price is falling due to temporary market fear. In such cases, a downturn can be an opportunity rather than a warning. Conversely, a stock rising on hype without earnings to back it up is a red flag. Fundamentals ground my decisions in reality, not speculation.

The third and perhaps most personal signal is my own financial readiness. No market opportunity is worth taking if I’m not prepared to handle the risk. I ask myself: Do I have an emergency fund? Is my debt under control? Can I afford to leave this money invested for the long term? If the answer to any of these is no, I wait. I’ve seen too many people jump into investments they can’t afford to lose, only to panic and sell at the worst possible time. Timing isn’t just about the market—it’s about your life. I only act when all three signals align: sentiment suggests opportunity, fundamentals support value, and I am personally ready to commit.

Downturns Aren’t Disasters—They’re Doorways (If You’re Ready)

For years, I viewed market downturns as threats—something to fear and avoid at all costs. I would watch my portfolio shrink with anxiety, convinced that every drop meant I had made a mistake. But my perspective changed when I studied the long-term performance of the stock market. I realized that every major recovery was preceded by a period of pain. The investors who built lasting wealth weren’t those who avoided downturns; they were the ones who prepared for them and acted when others retreated.

Take the global financial crisis of 2008–2009. The S&P 500 lost nearly 50% of its value at its lowest point. It was a terrifying time. But for those who had cash on the sidelines and the courage to invest, the following decade delivered extraordinary returns. Similarly, in early 2020, when markets plunged due to the pandemic, many优质 assets became available at steep discounts. Investors who bought then—calmly and selectively—were rewarded as the economy rebounded. These moments weren’t exceptions; they were reminders that volatility is a feature of the market, not a flaw.

Today, I no longer fear downturns. I prepare for them. One of my most important habits is maintaining a “dry powder” reserve—a portion of my portfolio kept in cash or short-term bonds, specifically earmarked for market dips. This reserve isn’t idle; it’s strategic. When volatility spikes, I don’t react emotionally. I assess whether fundamentals remain strong and whether prices have fallen to attractive levels. If so, I begin deploying funds gradually, focusing on high-quality assets. This approach removes the pressure to time the exact bottom. Instead, it allows me to participate in the recovery without overextending myself. Downturns test discipline, but for those who are ready, they open doors to long-term growth.

The Trap of Waiting for “Perfect” Timing—And How I Broke Free

One of my biggest obstacles wasn’t market risk—it was my own perfectionism. I spent months waiting for the “perfect” moment to invest, convinced that if I just waited a little longer, I could buy at the absolute lowest price. But the market doesn’t operate on my schedule. While I hesitated, rallies unfolded without me. I missed opportunities not because I made bad decisions, but because I made no decision at all.

This paralysis taught me a crucial lesson: perfect timing is a myth. No one can consistently predict the exact top or bottom of a market cycle. Even professional investors rarely achieve it. What matters isn’t precision—it’s participation, done wisely. To break free from this trap, I adopted a strategy called phased investing, a disciplined approach that allows me to enter the market gradually, reducing both risk and emotional strain.

Here’s how it works: Instead of trying to invest a lump sum all at once, I divide my intended investment into smaller portions. I set predefined triggers—such as a 10% decline in a stock or index—and buy a portion each time that trigger is met. For example, if I plan to invest $10,000 in a broad market ETF, I might buy $2,500 at the current price, another $2,500 if it drops 10%, and so on. This method, sometimes called dollar-cost averaging with a tactical edge, ensures that I’m buying more shares when prices are low and fewer when they’re high, lowering my average cost over time.

More importantly, it keeps me engaged without requiring perfection. I don’t have to guess where the bottom is. I just need to stick to my plan. This strategy has given me the confidence to act even when the future is uncertain. It turns market volatility from a source of anxiety into a structured opportunity. Over time, the results have been clear: I’ve avoided the regret of waiting too long, and my portfolio has grown more steadily than it did when I tried to time the market perfectly.

Building a Personal Investment Calendar: Syncing Moves with Life Goals

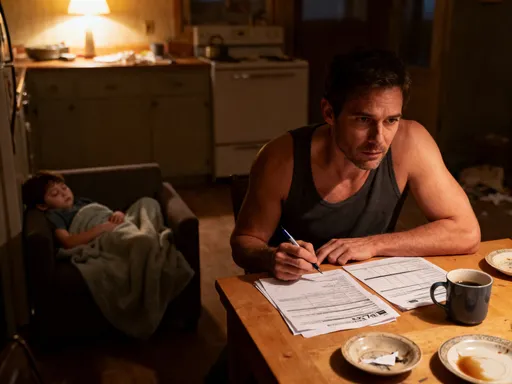

Investing isn’t just about numbers on a screen—it’s about life. I used to make decisions based on market noise, reacting to daily headlines and quarterly earnings reports. But I’ve learned that the most powerful timing comes not from watching the market, but from understanding my own life timeline. Now, I build a personal investment calendar that aligns my financial moves with my real-world goals.

For example, if I’m saving for a down payment on a home in five years, I focus on capital preservation and moderate growth. I avoid high-volatility assets and prioritize stability. But for goals 15 or 20 years away—like retirement—I can afford to take on more risk and focus on long-term accumulation. My calendar includes not just when to buy, but when to review. I schedule quarterly check-ins to assess my portfolio, rebalance if needed, and ensure I’m still on track. These reviews are deliberate and calm, not reactive. They happen on a set date, not in response to a market swing.

This calendar has transformed my relationship with investing. It turns emotional impulses into planned actions. When the market drops and fear spreads, I don’t panic. I consult my calendar. If my goals haven’t changed and my plan is sound, I stay the course—or, if appropriate, I deploy dry powder according to my phased strategy. The calendar also helps me avoid overtrading. Without it, I might feel compelled to “do something” when the market moves. With it, I know that sometimes the best move is no move at all.

Most importantly, this approach gives me a sense of control. I’m not at the mercy of market timing; I’m using timing as a tool to serve my life. Whether I’m preparing for a major purchase, planning for retirement, or saving for a child’s education, my calendar keeps me focused, disciplined, and grounded.

From Reacting to Leading—How Timing Gave Me Control and Peace

Looking back, my biggest financial win wasn’t a single stock that doubled or a lucky market call. It was the quiet transformation in how I approach money. I used to feel anxious, always wondering if I was doing the right thing at the right time. I chased returns, feared losses, and let short-term noise dictate my decisions. Today, I feel calm, confident, and in control. I don’t chase. I wait. I prepare. And when the moment is right, I act—calmly, deliberately, and with purpose.

Mastering the art of timing didn’t make me rich overnight. But it did help me avoid costly mistakes, reduce stress, and grow my wealth steadily over time. It taught me that financial freedom isn’t about hitting a magic number or retiring early. It’s about making consistent, thoughtful decisions that compound over years. It’s about sleeping well at night, knowing you have a plan and the discipline to follow it.

The market will always whisper. Sometimes it murmurs warnings. Other times, it hints at opportunity. The key is learning to listen—not with fear, but with preparation. When you stop reacting and start leading, you take back control. You stop being a passenger and become the driver of your financial future. That shift in mindset didn’t just change my portfolio. It changed my life. And if I can do it, so can you.