How I Turned My Spa Habit Into a Smarter Investment – Without the Risk

We all deserve a little pampering, but spa visits can quietly drain your wallet. I used to treat myself weekly, thinking it was self-care—until I realized I was sacrificing long-term financial peace. What if you could enjoy luxury wellness without compromising your financial goals? This is the story of how I restructured my spa spending using simple, risk-aware strategies that prioritize both well-being and wealth protection. It’s not about cutting back—it’s about spending smarter. By rethinking when, how, and why I indulged, I preserved the joy of self-care while redirecting thousands into more secure financial outcomes. This journey wasn’t about denial; it was about clarity, intention, and long-term value.

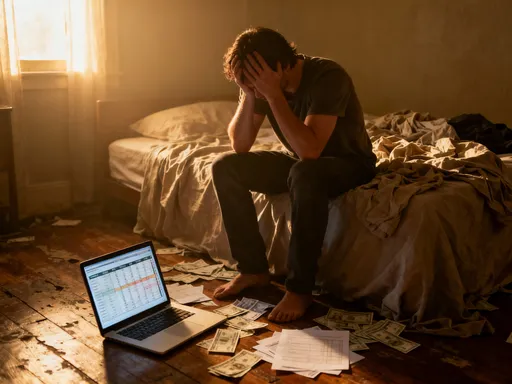

The Hidden Cost of Me Time

On the surface, a $120 massage every other week seems manageable. But when tallied over a year, that single indulgence adds up to $3,120—enough to cover a family vacation, a fully stocked emergency fund, or the down payment on a reliable used car. For many, spa visits are categorized as minor luxuries, harmless treats tucked between grocery runs and utility bills. Yet, these small, recurring expenses form a quiet financial leak, often overlooked because they don’t appear on a single monthly statement. The danger lies not in the expense itself, but in its invisibility. Without tracking, what feels occasional becomes habitual. What feels affordable becomes a structural drain on discretionary income.

Consider the average woman aged 35 to 50 who schedules a facial every six weeks at $90, a manicure monthly at $65, and a full-body massage quarterly at $150. Over one year, that totals $1,170—money that could have been allocated toward a child’s education fund, a home improvement project, or invested in a diversified portfolio. The real cost of these visits isn’t just the price tag; it’s the opportunity cost. That money, if placed in a high-yield savings account earning 4% annually, could grow to over $1,200 in just one year—passively. Over ten years, with consistent contributions, it could exceed $15,000, even without additional deposits. This isn’t to suggest spa visits are wasteful, but rather to highlight that every dollar spent carries the potential for alternative outcomes.

The emotional appeal of self-care is strong, and rightfully so. In the rhythm of daily life—managing households, supporting families, and balancing work—personal wellness matters. But when wellness spending goes unchecked, it can undermine the very stability that enables peace of mind. Financial stress often arises not from large, one-time purchases, but from the accumulation of small, unexamined habits. By bringing awareness to these patterns, individuals gain the power to choose: not whether to care for themselves, but how to do so in a way that aligns with both emotional needs and long-term financial health. This shift in perspective transforms spa visits from passive consumption into deliberate financial decisions.

Why Wellness Spending Deserves a Strategy

Most people approach their finances in two categories: necessary expenses and discretionary spending. Wellness services often fall into the latter, dismissed as indulgences rather than investments. Yet, true financial wisdom lies in recognizing that all spending—whether on groceries or massages—carries implications for long-term security. When approached with intention, wellness spending can deliver both emotional and financial returns. The key is to treat it not as an afterthought, but as a planned component of a balanced budget, one that reflects personal values while protecting financial resilience.

Value-aligned spending is the principle that every dollar should serve a purpose beyond immediate gratification. It asks: Does this expense support my well-being in a meaningful, sustainable way? Can I receive comparable benefits at a lower cost or with added financial protection? For example, a massage that reduces chronic tension may improve sleep and productivity, indirectly supporting career performance and health outcomes. In that sense, it’s not merely a luxury—it’s a form of preventive care. But if the same benefit can be achieved through a lower-cost option, such as a monthly session supplemented by at-home techniques, the smarter strategy becomes clear.

Protecting returns isn’t limited to stock portfolios or real estate ventures. It applies equally to everyday spending. When you view a spa visit as an investment in your physical and emotional state, you naturally seek higher efficiency—better timing, greater value, and minimized waste. This mindset encourages comparison, planning, and optimization. You begin to ask not just “Do I want this?” but “When is the best time to book?” “Can I earn loyalty points?” “Is there a seasonal promotion I can use?” These questions shift the experience from impulsive to strategic, ensuring that every dollar spent delivers maximum benefit. Over time, this approach compounds—not in the form of market gains, but in preserved capital and reduced financial regret.

Shifting from Consumption to Value Optimization

The goal is not to eliminate spa visits, but to enhance their value. Value optimization means extracting the greatest benefit from each dollar without increasing expenditure. This is achieved through timing, loyalty, bundling, and negotiation—tools often overlooked in personal care spending. Many spas offer discounted rates during off-peak hours, such as weekday mornings or early evenings. By shifting appointments to these times, clients can save 15% to 30% without sacrificing service quality. Similarly, seasonal promotions—especially during slower months like January or September—can provide premium packages at reduced rates.

Loyalty programs are another underutilized resource. While many assume these are only for frequent travelers or retail shoppers, high-end spas and wellness centers often have structured rewards systems. These may include free services after a certain number of visits, birthday discounts, or referral bonuses. By enrolling and consistently using the same provider, clients build equity in their wellness spending, much like accumulating interest in a savings account. One woman in her early 40s reported earning a complimentary 90-minute massage every eight months simply by consolidating her services at one location and using their app-based booking system.

Bundling services is another effective tactic. Instead of booking a massage and facial separately, many spas offer combination packages at a lower total price. A standalone massage at $130 and a facial at $110 would cost $240 if purchased individually. However, a bundled “renewal package” might be priced at $200—a 17% savings. Over the course of a year, such efficiencies can save hundreds of dollars. Additionally, some wellness centers allow gift card purchases at a discount during holiday sales, enabling prepayment at a reduced rate. These cards can be used over time, locking in today’s prices and protecting against future increases.

Negotiation, though less common in spa settings, is not impossible. For long-term clients, some providers are open to customized pricing, especially when booking multiple sessions in advance. A simple conversation—“I’ve been a loyal client for three years; would you consider a small discount on a six-session package?”—can yield positive results. Even if the answer is no, the act of asking reinforces a mindset of financial agency. Value optimization is not about cheapness; it’s about fairness, respect for one’s budget, and the intelligent use of available tools.

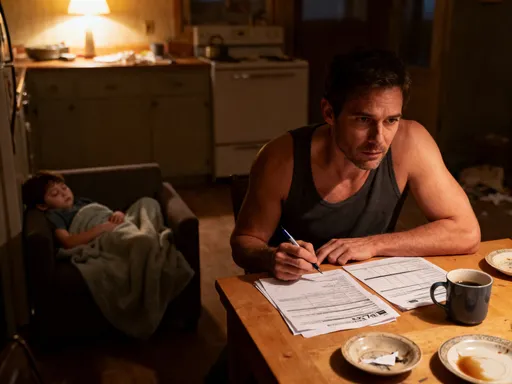

Building a Wellness Reserve: A Proactive Approach

One of the most transformative shifts in my financial approach was creating a dedicated wellness reserve. Instead of paying for spa services out of my monthly budget—often at the last minute and sometimes straining my cash flow—I began setting aside a fixed amount each month into a separate savings account. This “wellness fund” operates like a sinking fund: a small, regular contribution that accumulates over time to cover anticipated expenses. By pre-paying for future treatments, I removed the emotional weight of spontaneous spending and gained greater control over my financial rhythm.

The mechanics are simple. I calculated my average annual spa spending—around $2,400—and divided it by 12, resulting in a $200 monthly transfer. This amount is automatically deposited into a high-yield savings account, where it earns interest while remaining accessible. At no point does this fund dip into emergency reserves or retirement accounts; it exists solely to support intentional self-care. When I book a service, I pay from this account, knowing the money was already set aside. This eliminates guilt, reduces stress, and ensures that wellness spending remains within sustainable limits.

The psychological benefits are significant. Rather than viewing spa visits as impulsive treats, I now see them as planned rewards—earned through discipline and consistency. This shift fosters a sense of ownership and pride, rather than indulgence or regret. Moreover, because the money is already allocated, I’m less likely to overspend or book unnecessary services. The fund acts as a natural boundary, encouraging me to prioritize quality over frequency. I might choose a single, premium massage every six weeks instead of two lower-tier sessions, knowing that the experience will be more restorative and the cost already covered.

For families, this model can be adapted to include multiple members. A couple might establish a joint wellness reserve, contributing $150 each per month to cover massages, skincare, or fitness classes. Children, too, can benefit—perhaps through annual eye exams, dental cleanings, or therapeutic activities framed as wellness investments. The principle remains the same: anticipate needs, save in advance, and spend with confidence. This proactive approach transforms wellness from a financial liability into a structured, sustainable practice.

Pairing Spending with Low-Risk Growth Tactics

What if your self-care budget could grow while you wait to use it? This is the power of pairing wellness spending with low-risk financial instruments. Instead of keeping spa savings in a standard checking account with no interest, placing them in a high-yield savings account or short-term certificate of deposit (CD) allows the money to earn modest returns while remaining secure. For example, a $2,400 annual spa budget, saved in a high-yield account with a 4% annual percentage yield (APY), generates approximately $96 in interest over one year—enough to cover an additional massage or upgrade a service.

Over time, this effect compounds. If the same $200 monthly contribution continues for five years, the total saved would be $12,000. With consistent 4% returns, the interest earned would exceed $1,300—money that was never spent but still contributed to the overall experience. This is not speculative growth; it’s predictable, stable, and accessible. Unlike stocks or cryptocurrencies, these instruments carry minimal risk, making them ideal for funds intended for near-term use.

Another option is laddering short-term bonds. By investing in bonds with staggered maturity dates—say, one, two, and three years—a portion of the wellness fund can earn slightly higher yields while maintaining liquidity. As each bond matures, the proceeds can be used to pay for services, ensuring a steady flow of available funds. This strategy is particularly useful for those planning major wellness events, such as a retreat or medical spa treatment, several years in advance.

The key insight is that money set aside for personal care doesn’t have to sit idle. Even modest returns enhance purchasing power and reduce the net cost of services. This approach reframes self-care as a dual-purpose activity: it nurtures the body and mind while also supporting financial health. By integrating low-risk growth tools into wellness planning, individuals create a system where feeling good and doing well financially are not competing goals, but complementary outcomes.

Avoiding the Traps: Emotional Spending vs. Smart Habits

One of the greatest challenges in managing wellness spending is distinguishing between true self-care and emotional spending. The line is often blurred. A massage after a stressful week can be restorative. But a last-minute booking after an argument, a bad day, or social pressure may be a reaction rather than a choice. Behavioral finance shows that emotional states heavily influence spending decisions, often leading to purchases that feel justified in the moment but regretted later. Recognizing these patterns is the first step toward financial and emotional balance.

Common triggers include stress, boredom, social comparison, and seasonal trends. The “spa season” in January, for instance, is often driven by post-holiday resolutions and marketing campaigns. While starting a wellness routine can be positive, doing so out of guilt or pressure may lead to unsustainable habits. Similarly, seeing friends post about luxury treatments on social media can create a sense of inadequacy, prompting impulsive bookings to “keep up.” These behaviors, while understandable, can erode financial stability if repeated over time.

To counter this, it helps to establish personal guidelines. A simple checklist can serve as a decision filter: Have I planned this visit? Is it part of my wellness reserve? Have I compared options? Will this truly improve my well-being, or am I seeking temporary relief? Taking 24 hours to reflect before booking non-essential services can prevent regret and reinforce intentionality. Journaling about the reasons for each visit also builds self-awareness, revealing patterns that might otherwise go unnoticed.

Alternative coping strategies can also reduce reliance on spending. Deep breathing, walking in nature, or talking with a trusted friend often provide the same emotional relief as a spa visit—without the cost. These practices, when integrated into daily life, build resilience and reduce the need for external fixes. The goal is not to eliminate spa visits, but to ensure they are chosen for the right reasons: not to escape stress, but to enhance well-being in a sustainable, financially sound way.

The Long Game: Sustainable Habits for Lasting Security

Financial well-being is not achieved through drastic cuts or sudden transformations. It is built through consistent, thoughtful choices—especially in areas that seem small or insignificant. The way we manage spa spending reflects a broader relationship with money: one that can either support long-term security or quietly undermine it. By applying strategic thinking to this single category, we cultivate a mindset that extends to all areas of life. We learn to pause, plan, and prioritize. We begin to see every dollar as a tool—one that can either serve us or slip away unnoticed.

The journey from impulsive spending to intentional investment is not about perfection. It’s about progress. It’s understanding that self-care and financial health are not opposing forces, but interconnected elements of a balanced life. When we align our spending with our values, we create a system where we can enjoy life’s pleasures without compromising our future. The spa visit becomes more than a treat; it becomes a symbol of discipline, self-respect, and foresight.

Over time, these habits compound. The money saved through smarter booking, loyalty rewards, and pre-planning doesn’t vanish—it accumulates. It funds future dreams, cushions against unexpected expenses, and builds confidence in financial decisions. More importantly, it fosters peace of mind. Knowing that wellness is both enjoyed and managed responsibly brings a deep sense of control and freedom.

In the end, the goal is not to stop going to the spa. It’s to go with intention, to spend with awareness, and to build a life where feeling good and doing well go hand in hand. This is the essence of sustainable financial health: not deprivation, but alignment. Not fear, but freedom. And not short-term pleasure, but long-term security—earned one thoughtful choice at a time.