How I Mastered the Rhythm of Investing While Switching Careers

What happens when you’re changing jobs but still want your money to work for you? I’ve been there—nervous, unsure, and almost made costly mistakes. Balancing career transition with smart investing isn’t easy, but timing and rhythm can make all the difference. In this piece, I’ll walk you through how to stay financially steady when shifting paths, avoid emotional moves, and build confidence in your decisions—without rushing or freezing up. Career changes bring uncertainty, and that uncertainty can quietly erode even the most thoughtful financial plans. Yet, with the right mindset and structure, this period doesn’t have to mean stepping back from your financial goals. In fact, it can become a powerful opportunity to refine your approach, strengthen discipline, and align your money with long-term values. Let’s explore how to keep your investments moving forward, even when your career path takes a new direction.

The Hidden Financial Pressure of Career Changes

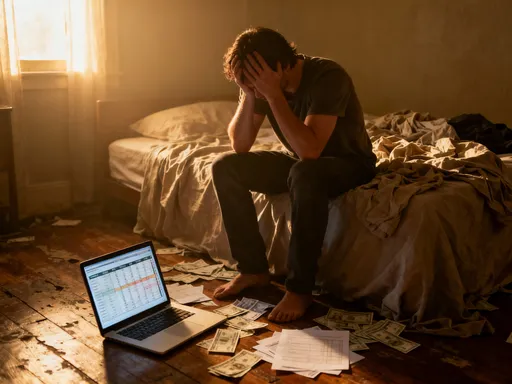

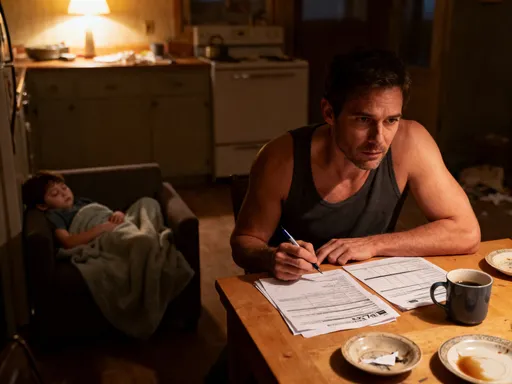

Switching careers is often seen as a professional decision, but its financial implications run deep and wide. While job seekers focus on interviews, networking, and skill development, the underlying money stress can go unnoticed—until it surfaces in damaging ways. One of the most common yet overlooked challenges is the gap in income. Unlike a simple job transfer, a career shift may involve months of reduced earnings, freelance work, or even unpaid internships to gain experience in a new field. During this time, regular paychecks disappear, and with them, the automatic rhythm of saving and investing. This disruption can strain emergency funds, delay retirement contributions, and create pressure to dip into long-term assets.

Consider the case of a mid-career professional leaving a stable corporate role for a position in the education sector. The new job offers greater personal fulfillment but comes with a 20% pay cut and a three-month gap before the first paycheck. Without preparation, this transition could force difficult choices: pausing 401(k) contributions, reducing health insurance coverage, or even selling stocks at a market low to cover rent. These moves, while understandable in the moment, can have lasting consequences. For instance, halting retirement savings for just two years may result in tens of thousands of dollars in lost compound growth over time. The psychological toll compounds the financial one—fear of instability often leads to risk-averse behaviors, such as pulling money from diversified portfolios and parking it in low-yield accounts, which fails to keep pace with inflation.

Another hidden pressure lies in the loss of employer-sponsored benefits. Health insurance, retirement matching, and even wellness programs often vanish during transitions, increasing out-of-pocket costs. A study by the U.S. Bureau of Labor Statistics shows that employer contributions to retirement plans average 4.7% of wages—money that disappears when self-employment or contract work takes over. Additionally, bonuses, stock options, and other forms of compensation may be delayed or eliminated entirely. These shifts don’t just affect cash flow; they alter the foundation of financial planning. Without the safety net of a steady job, every financial decision carries more weight. Yet, this period also presents a unique opportunity: to reassess priorities, build resilience, and create a more flexible financial system that supports both professional growth and long-term security.

Why Investment Rhythm Beats Market Timing

When career uncertainty strikes, many investors fall into the trap of trying to time the market—waiting for the “perfect” moment to buy or sell based on job status or economic news. This approach, while tempting, is notoriously unreliable. Research from DALBAR and other financial analysts consistently shows that individual investors underperform market indices largely due to poor timing decisions, often driven by emotion. During a career change, these emotional triggers intensify. The fear of income loss may prompt someone to sell stocks after a market dip, locking in losses just before a recovery. Conversely, overconfidence after landing a new role might lead to aggressive bets on volatile assets, exposing the portfolio to unnecessary risk.

Instead of chasing short-term gains, a more effective strategy is maintaining a steady investment rhythm. This means continuing to invest regularly, regardless of market conditions or personal career shifts. The principle behind this approach is rooted in dollar-cost averaging—the practice of investing a fixed amount at consistent intervals. Over time, this method naturally buys more shares when prices are low and fewer when prices are high, reducing the average cost per share. For someone in transition, this removes the need to predict market movements and instead focuses on consistency. Even if income fluctuates, adjusting contributions to match cash flow while keeping the habit intact preserves momentum.

Behavioral finance further supports this idea. Studies show that humans are wired to react emotionally to uncertainty, often leading to counterproductive financial behaviors. During a job search, for example, constant checking of portfolio balances can amplify anxiety, creating a feedback loop where stress leads to impulsive decisions, which in turn increase regret and further stress. By committing to a regular investment schedule—say, monthly or quarterly—investors create a buffer against emotional swings. This rhythm acts like a financial anchor, providing stability when other aspects of life feel unpredictable. It’s not about maximizing returns in the short term; it’s about minimizing regret and building discipline that lasts beyond any single career phase.

Building a Flexible Investment Plan for Uncertain Income

Traditional financial advice often assumes a steady paycheck, but career changers face a different reality. Income may come in irregular bursts—freelance gigs, consulting fees, or signing bonuses—making fixed-dollar contributions impractical. A rigid budget can fail under these conditions, leading to missed investment opportunities or overspending during flush periods. The solution lies in designing a flexible investment plan that adapts to changing cash flow without sacrificing long-term goals.

One effective method is percentage-based contributions. Instead of committing to a set dollar amount each month, investors allocate a fixed percentage of their income—say, 10% or 15%—to savings and investments. When income is high, more money flows into the portfolio; when it dips, contributions scale down automatically. This approach maintains proportionality and prevents overextension during lean months. For example, a former marketing executive transitioning to nonprofit work might earn $8,000 in one month from a consulting project and only $3,000 the next from part-time work. A 10% contribution would result in $800 and $300, respectively—adjusting naturally without requiring constant decision-making.

Tiered budgeting is another useful tool. This involves categorizing income into priority levels: essential expenses (rent, utilities, insurance), protected savings (emergency fund, retirement), and discretionary spending. Investments fall into the protected category, ensuring they are funded before non-essential purchases. By structuring finances this way, individuals create a hierarchy that guards against lifestyle inflation during high-earning months and provides clarity during uncertainty. Automated transfers can reinforce this system—setting up rules that move money to investment accounts immediately after a deposit clears, reducing the temptation to spend first.

Negotiating flexible compensation can also support investment continuity. Some employers offer signing bonuses, relocation allowances, or deferred payments that can be timed to align with financial goals. A savvy negotiator might request a portion of a bonus be paid upfront to bolster an emergency fund or seed a new investment account. These strategies don’t eliminate uncertainty, but they create structure within it, allowing investors to stay on track without relying solely on willpower or perfect timing.

Protecting Your Portfolio from Emotional Swings

Job transitions are inherently stressful, and that stress can seep into financial behavior in subtle but damaging ways. The constant checking of bank balances, the urge to react to daily market news, or the temptation to chase trending stocks—all are signs of emotional interference in investing. During periods of professional uncertainty, the brain’s threat detection system becomes hyperactive, interpreting financial volatility as personal danger. This can lead to impulsive decisions that undermine long-term progress.

One of the most effective ways to counter this is through automation. Setting up automatic contributions to investment accounts removes the need for daily decisions, reducing the influence of mood or fear. Even during months with no income, the system remains intact—ready to resume when funds are available. Automation also supports consistency, ensuring that small, regular investments continue regardless of external circumstances. Studies from Vanguard show that investors who use automated plans are more likely to stay the course during market downturns and achieve better long-term outcomes.

Equally important is establishing a defined review schedule. Instead of monitoring portfolios daily or weekly, investors can set quarterly or semiannual check-ins to assess performance and make adjustments. This creates healthy boundaries, preventing obsession with short-term fluctuations. During these reviews, decisions should be based on long-term goals, not recent headlines. For example, a 5% market dip during a job search is not a reason to sell—but it might prompt a reassessment of asset allocation if it reveals excessive risk exposure.

Mental accounting can also help manage emotions. This technique involves mentally separating money into categories—such as “retirement,” “emergency fund,” and “growth investments”—and treating each with different rules. Knowing that retirement savings are meant for decades ahead, not immediate needs, reduces the urge to touch them during a career gap. Similarly, designating a portion of income as “investment capital” reinforces its purpose and protects it from being reclassified as spending money. These cognitive tools don’t eliminate stress, but they provide structure that supports rational decision-making even under pressure.

Strategic Pause vs. Full Stop: When to Adjust Your Investments

There is a crucial difference between pausing investments temporarily and stopping them altogether. A strategic pause—such as reducing contributions during a known income gap—is a thoughtful adjustment that preserves capital for essential needs. A full stop—halting all activity out of fear or uncertainty—can disrupt long-term growth and make it harder to restart later. Understanding when to scale back, and when to keep going, is key to maintaining financial health during a transition.

Triggers for a strategic pause might include an extended job search, major relocation costs, or unexpected medical expenses. In these cases, redirecting funds to cover immediate needs is not only acceptable but responsible. The key is to define the pause in advance—setting a timeline or a financial threshold for when contributions will resume. For example, an investor might decide to suspend new contributions until they secure a job offering at least 70% of their previous income. This clarity prevents indefinite delays and keeps the long-term plan intact.

At the same time, it’s important not to abandon low-cost opportunities. Even during a pause, maintaining a connection to investing—such as leaving existing holdings untouched or continuing small contributions when possible—preserves momentum. Index funds and ETFs that track broad markets require minimal maintenance and can continue growing passively. Stopping entirely risks falling into the “behavioral gap,” where investors miss the best performing days of the market by being out of it at the wrong time. Research shows that missing just the top 10 trading days over a decade can cut returns in half.

Liquidity planning supports this balance. By calculating a “runway”—the number of months one can cover expenses without income—investors gain clarity on how long they can sustain themselves. A six- to twelve-month emergency fund provides a buffer that allows for measured decisions rather than panic-driven ones. With this foundation, temporary adjustments become part of a smart strategy, not a sign of failure.

Tools and Habits That Keep You on Track

Knowledge alone isn’t enough—execution is what separates successful investors from those who struggle. During a career transition, when time and energy are limited, relying on tools and habits becomes essential. These systems reduce decision fatigue, minimize errors, and maintain consistency without constant vigilance.

Automated transfers are among the most powerful tools. Setting up recurring deposits from a checking account to investment accounts ensures that savings happen before spending occurs. Many brokerage platforms allow users to schedule transfers by date or link them to paydays—even irregular ones. This “pay yourself first” approach aligns with behavioral economics, which shows that people are more likely to save when it’s automatic and invisible.

Low-cost index funds and ETFs provide another layer of simplicity. These funds offer broad market exposure with minimal fees, making them ideal for long-term investors who don’t have time to pick individual stocks. They also reduce the risk of emotional trading, as their performance is tied to the overall market rather than volatile single companies. For someone in transition, this passive approach offers peace of mind.

Budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital help track cash flow, categorize expenses, and monitor net worth in real time. These tools provide visibility into financial health, making it easier to adjust spending and protect investment goals. Calendar alerts can also play a role—scheduling quarterly portfolio reviews, contribution checks, or insurance renewals ensures that important tasks don’t fall through the cracks.

Finally, pre-commitment strategies strengthen discipline. Writing down investment rules—such as “I will not sell during a market dip below 10%” or “I will invest 10% of every freelance payment”—creates a personal contract that guides behavior. Sharing these commitments with a trusted friend or advisor adds accountability. Over time, these habits become second nature, allowing investors to stay steady even when life feels anything but.

Looking Back: How Staying Steady Paid Off

Years after making the leap to a new career, the financial benefits of maintaining investment rhythm become clear. The moments of doubt—hesitating to invest during a gap, fearing a market drop, or questioning whether to pause—fade in comparison to the quiet power of consistency. Small, regular contributions, even when modest, compound over time. Avoiding panic-driven sales preserves capital. Staying engaged, even at a reduced pace, keeps the financial engine running.

More than the numbers, what stands out is the sense of control. By building systems that worked during uncertainty, investors develop resilience that extends beyond money. They learn to separate emotion from action, to plan for variability, and to trust their process. There is no promise of overnight wealth, but there is the reward of confidence—the knowledge that they didn’t let a career change derail their future.

Investing during a transition isn’t about maximizing returns in the short term. It’s about alignment—staying connected to long-term goals, protecting peace of mind, and moving forward with intention. The rhythm isn’t perfect; some months contributions are smaller, some years growth is slow. But like a steady heartbeat, it keeps the system alive. And in the end, that steady pulse—calm, consistent, thoughtful—is what carries you through change and into a more secure tomorrow.