How I Navigated Financial Recovery During Rehab — A Planner’s Real Talk

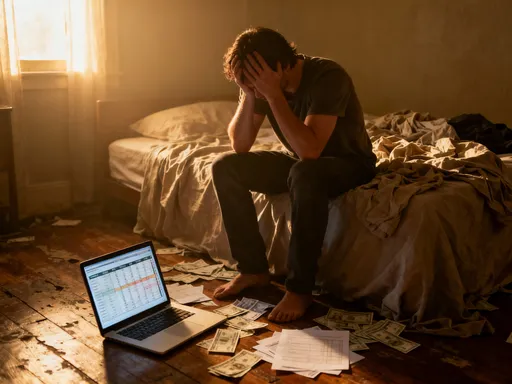

What happens when healing your body means stretching your finances thin? I learned this the hard way. After an unexpected injury led to months of rehabilitation, my focus wasn’t just on physical recovery—it was on surviving financially. Medical bills piled up, income slowed, and stress spiked. But through careful planning, smart choices, and a few lessons the hard way, I rebuilt stability. This is how I managed my finances during rehab, not as a guru, but as someone who’s been in the trenches. My story isn’t unique. Millions face the dual challenge of healing and financial strain every year. What sets some apart isn’t luck, but preparation, clarity, and the courage to make difficult decisions early. This article breaks down the practical steps that helped me regain control—without oversimplifying the struggle or promising unrealistic fixes. It’s about turning survival into strategy.

The Hidden Cost of Healing: When Health Takes a Financial Toll

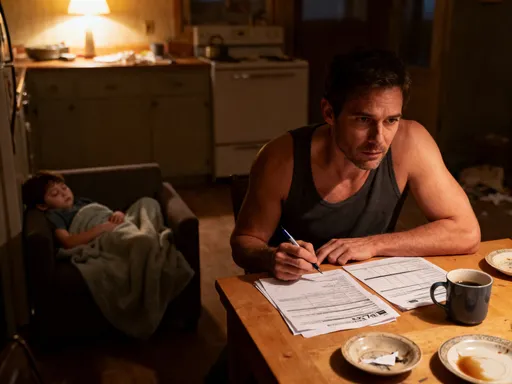

Rehabilitation is often framed as a medical journey, but it is equally a financial one. While doctors focus on mobility, strength, and recovery timelines, few discuss the economic side effects: lost wages, rising out-of-pocket costs, and the invisible expenses that accumulate quietly but powerfully. For many, especially those without robust savings or employer-sponsored disability coverage, a rehabilitation period can quickly become a financial crisis. The truth is, even with health insurance, the cost of recovery extends far beyond co-pays and deductibles. Physical therapy sessions, assistive devices like crutches or braces, transportation to appointments, and home modifications such as installing grab bars or ramps can add hundreds or even thousands of dollars to the monthly burden. These are not luxuries—they are necessities for recovery—but they are rarely covered in full by insurance plans.

Consider a common scenario: a working parent with a back injury requiring three months of physical therapy. At two sessions per week, with an average co-pay of $40, that’s $320 a month—over $900 for the full recovery period. Add in parking fees, gas, or ride-share costs for those unable to drive, and the total climbs. If home exercises require resistance bands, heating pads, or specialized chairs, those are out-of-pocket. If the injury limits mobility, hiring help for housecleaning or grocery shopping may become essential. These indirect costs are often overlooked in financial planning, yet they can be just as draining as medical bills. The emotional toll compounds the strain. Financial stress is proven to slow healing, increase anxiety, and reduce treatment adherence. When people are worried about how they’ll pay next month’s rent, they may skip therapy sessions or delay refilling prescriptions—choices that prolong recovery and ultimately increase total costs.

The key insight is this: recovery is not just a physical event—it’s a financial one. Recognizing this early allows for proactive planning rather than reactive scrambling. It shifts the mindset from seeing rehab as a temporary pause in life to understanding it as a period that requires its own financial framework. This doesn’t mean predicting every expense, but rather acknowledging that healing has a cost, and that cost must be accounted for. For families managing tight budgets, this awareness can mean the difference between temporary strain and long-term financial damage. The first step toward stability is visibility—bringing these hidden costs into the open so they can be managed, negotiated, or mitigated before they spiral.

Why Traditional Budgets Fail in Recovery Situations

Most budgeting advice is built for stability, not crisis. Tips like “cut your coffee subscription” or “cook at home more” assume a baseline of steady income, predictable expenses, and physical ability to carry out daily tasks. But during rehabilitation, that baseline often disappears. Income may drop due to reduced work hours or temporary disability, while essential expenses—especially medical ones—rise. In this context, traditional budgeting models fail because they don’t account for volatility, urgency, or the physical limitations that affect earning and spending. Telling someone in recovery to “just stick to your budget” is like advising a hiker with a sprained ankle to “keep pace with the group”—it ignores the reality of the situation.

What’s needed instead is adaptive budgeting—a flexible, needs-based approach that prioritizes health, safety, and sustainability over rigid categories or guilt-driven cuts. Adaptive budgeting starts with a simple shift: from asking “How can I spend less?” to asking “What must I spend to heal, and how can I protect the rest?” This reframing removes the shame often associated with increased spending during illness and focuses on strategic allocation. For example, someone in rehab may need to spend more on transportation or home care but can pause non-essential subscriptions, defer large purchases, or temporarily reduce retirement contributions. The goal isn’t austerity—it’s reallocation.

One practical method is to divide expenses into three tiers: critical, flexible, and deferrable. Critical expenses include medical care, housing, utilities, and basic groceries—these must be protected at all costs. Flexible expenses, like internet, phone, or insurance premiums, can be adjusted—switching to a cheaper plan or negotiating payment terms. Deferrable expenses, such as travel, entertainment, or non-urgent home repairs, can be paused without immediate consequence. This tiered system allows for quick decision-making when energy and focus are limited. It also creates space for temporary income changes without triggering full financial collapse. Adaptive budgeting isn’t about perfection; it’s about resilience. It acknowledges that recovery is unpredictable and that financial plans must be able to bend without breaking.

Building a Rehab-Ready Financial Safety Net

While no one plans for injury or illness, preparing for financial disruption is one of the most powerful forms of self-care. A rehab-ready safety net isn’t about having a perfect emergency fund—it’s about having accessible resources and systems in place that can be activated quickly when crisis strikes. The cornerstone of this safety net is the health contingency fund—a dedicated portion of savings set aside specifically for medical and recovery-related expenses. Even a small amount, such as $1,000 to $2,000, can prevent the need to rely on high-interest credit cards or loans during the initial phase of rehab. This fund should be kept in a liquid, easily accessible account, separate from general emergency savings, so it’s not tempted for non-medical use.

Beyond personal savings, understanding available benefits is crucial. Many employers offer short-term disability insurance, but employees often don’t realize they’re enrolled—or don’t know how to file a claim. The process typically requires medical documentation and timely application, so acting early is essential. Similarly, some jobs provide paid sick leave or allow the use of vacation days during medical recovery. These benefits can bridge income gaps and reduce financial pressure. It’s also worth exploring whether government programs, such as state disability insurance (in applicable states), could provide partial wage replacement. While these programs vary by location and employment status, they are often underutilized simply because people don’t know they exist.

Another key element is communication. Informing your employer, HR department, or union representative about your situation can open doors to accommodations, flexible scheduling, or temporary remote work options. Some companies have hardship assistance programs or employee support networks that offer financial counseling or emergency grants. These resources aren’t always advertised, so asking the right people at the right time can make a significant difference. The goal is not to rely on others, but to use available systems as tools for stability. A rehab-ready safety net is not built overnight, but even last-minute actions—like calling your benefits coordinator or setting up a separate savings bucket—can reduce the financial shock of recovery.

Managing Cash Flow When Income Slows

One of the most immediate challenges during rehabilitation is the drop in income. Whether due to reduced hours, temporary leave, or complete work stoppage, the loss of regular pay creates a ripple effect across all financial obligations. Rent or mortgage payments, car loans, insurance premiums—these don’t pause just because income does. Without a plan, this imbalance can lead to missed payments, late fees, and mounting stress. The solution lies in proactive cash flow management: aligning reduced income with adjusted expenses through negotiation, prioritization, and temporary income strategies.

The first step is communication. Many creditors and service providers offer hardship programs that allow for payment deferrals, reduced rates, or extended terms. For example, mortgage lenders may offer forbearance, utility companies may have budget billing options, and credit card issuers might lower interest rates or waive fees for a period. These options are rarely advertised, so calling and asking is essential. The same applies to medical providers—many are willing to set up no-interest payment plans if asked. The key is to reach out early, before bills become delinquent, and to provide documentation of income changes when possible. This demonstrates responsibility and increases the likelihood of cooperation.

At the same time, identifying temporary income sources can help bridge the gap. Remote freelance work—such as writing, virtual assistance, or online tutoring—can be done from home with minimal physical effort. Selling unused items, renting out a spare room (if accessible), or offering services like meal prep or errands for neighbors can also generate cash. These aren’t long-term solutions, but they provide breathing room during recovery. The goal isn’t to overwork, but to maintain enough liquidity to cover essentials without derailing healing. Cash flow management during rehab is less about earning and more about balancing—ensuring that money moves in a way that supports both physical and financial recovery.

Smart Spending Without Sacrificing Recovery

Cutting costs is often a necessity during financial strain, but it must be done wisely—especially when health is at stake. The danger lies in false economies: choices that save money today but cost more tomorrow. Skipping therapy sessions to avoid co-pays, using outdated or ineffective equipment, or choosing cheaper providers without verifying credentials can delay recovery, lead to complications, and ultimately increase total expenses. Smart spending in rehab means prioritizing value over mere price—investing in care that supports long-term healing rather than short-term savings.

One effective strategy is to compare in-network versus out-of-network providers. In-network therapists and clinics have negotiated rates with insurance companies, which significantly reduces out-of-pocket costs. Before starting treatment, it’s worth calling your insurer to confirm coverage and get a list of approved providers. Telehealth options can also reduce transportation costs and time, making it easier to attend sessions consistently. Some studies show that virtual physical therapy is just as effective for certain conditions, especially when combined with at-home exercises. This doesn’t replace hands-on care when needed, but it can be a cost-effective supplement.

When purchasing therapy tools, look for quality without overpaying. Many effective items—like resistance bands, foam rollers, or posture supports—are available at reasonable prices from reputable retailers. Some physical therapists even offer loaner programs or discounts through their clinics. Avoiding impulse buys from medical supply websites with inflated prices is key. Additionally, asking for itemized bills allows you to spot overcharges or duplicate fees. Sometimes, a single session is billed multiple times due to clerical errors. Reviewing statements carefully and disputing inaccuracies can save hundreds. Smart spending isn’t about cutting corners—it’s about making informed choices that protect both health and finances.

Protecting Your Credit and Long-Term Financial Health

Medical debt is one of the leading causes of damaged credit and bankruptcy in many countries. Unlike other types of debt, it often arises unexpectedly, accumulates quickly, and can be difficult to dispute due to complex billing systems. A single hospital visit or extended rehab program can result in thousands in charges, even with insurance. When payments are delayed or disputed, these accounts may be sent to collections, which can severely impact credit scores. Because credit affects everything from loan approvals to insurance rates, protecting it during recovery is not optional—it’s essential.

The first line of defense is understanding your rights. In many regions, patients have the right to receive clear, itemized bills, to dispute errors, and to negotiate payment terms before debt is reported to credit bureaus. Always request an itemized bill and review it for inaccuracies—duplicate charges, services not received, or incorrect coding are common. If errors are found, submit a written dispute with supporting documentation. Many billing departments will correct mistakes if challenged promptly. Additionally, if paying in full is not possible, request a payment plan directly from the provider. These are typically not reported to credit agencies as long as payments are made on time.

Medical credit cards, such as those offering “no interest if paid in full within 12 months,” can be risky. While they may seem helpful, missing a single payment can trigger retroactive interest on the entire balance. For this reason, they should be used only if repayment is certain. A safer approach is to use a standard credit card with a low interest rate or, if available, a personal loan with fixed payments. The goal is to avoid compounding stress with financial penalties. Monitoring your credit report during and after recovery is also important. Many services offer free weekly checks, allowing you to catch errors or unauthorized collections early. Protecting your credit isn’t about perfection—it’s about prevention. A strong credit score after recovery makes it easier to regain financial footing, secure housing, or qualify for future loans without excessive costs.

Rebuilding Financial Confidence After Recovery

Recovery doesn’t end when therapy stops. Just as the body needs time to regain strength, finances need time to rebuild stability. The transition back to regular work and routine spending can be overwhelming, especially if debt has accumulated or savings have been depleted. This final phase is not about returning to “normal,” but about integrating the lessons of the experience into a more resilient financial life. It’s an opportunity to reassess goals, strengthen safeguards, and build confidence that future setbacks won’t lead to collapse.

Start by revisiting your budget with fresh eyes. What worked during rehab? What didn’t? Many people discover that cutting non-essentials revealed unnecessary spending they can permanently eliminate. Others realize the value of having even a small emergency fund. Use this insight to restart savings, even if it’s just $25 a week. Set a new goal—perhaps rebuilding the health contingency fund or paying down medical debt over 12 to 18 months. Automating transfers makes consistency easier. Reassess insurance coverage: does your current plan include disability benefits? Could you benefit from additional protection? These questions help turn crisis into preparation.

Most importantly, recognize that financial recovery is part of overall wellness. Just as physical therapy rebuilt strength, thoughtful financial habits rebuild security. The experience of navigating rehab—both physically and financially—can be a catalyst for smarter, more intentional living. It fosters empathy, resilience, and a deeper understanding of what truly matters. You don’t have to be perfect. You just have to be prepared. And in that preparation lies the greatest form of empowerment: the peace of mind that comes from knowing you can handle whatever comes next.