How I Turned My Debt Crisis Around with Smarter Cost Control

I used to feel trapped—every bill arrival was a punch to the gut. I wasn’t just struggling to pay; I was drowning in decisions I thought I couldn’t change. Then I realized the real problem wasn’t income, it was control. By shifting focus from earning more to spending smarter, I rebuilt my financial foundation. This is how I did it, step by painful step—and how you can too, without gimmicks or empty promises. The journey wasn’t fast, and it wasn’t easy, but it was possible. And the most surprising part? It didn’t require a promotion, a windfall, or a radical lifestyle overhaul. It began with a single shift in mindset: that lasting financial healing starts not with how much you earn, but with how you manage what you already have.

The Breaking Point: When Debt Stops Being Manageable

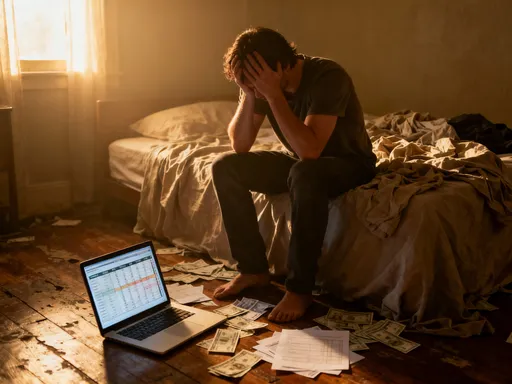

For years, I told myself I was just one paycheck away from being okay. Then, one month, I wasn’t. The credit card minimums grew heavier, the due dates tighter, and the excuses thinner. I remember sitting at my kitchen table, surrounded by envelopes, trying to decide which bill to pay and which to delay—again. That moment wasn’t just stressful; it was humbling. The illusion of control had shattered. I had been treating debt like a temporary condition, something that would fade once I earned a little more. But the numbers didn’t lie. My expenses consistently outpaced my income, and every new charge was a debt I hadn’t truly agreed to pay.

This kind of breaking point is more common than many admit. It often starts quietly: a missed payment here, a balance carried there. Over time, these small oversights accumulate into a crisis that feels impossible to reverse. The emotional toll is just as real as the financial one. Anxiety becomes a constant companion. Sleep suffers. Relationships strain. You begin to avoid opening statements, checking balances, or even talking about money. Denial feels safer than facing the truth. But the truth, however uncomfortable, is the only place where change can begin.

What finally shifted for me wasn’t a sudden windfall or a career breakthrough—it was awareness. I realized that I could no longer afford to ignore the pattern. The turning point came when I stopped asking, How can I make more? and started asking, Where is my money going? That simple question changed everything. It moved me from passive frustration to active investigation. I wasn’t broken; I was just misinformed. And once I saw the full picture, I could start drawing a new one. This moment of clarity is the first real step toward recovery—not because it solves the debt, but because it restores agency. You begin to see that while you didn’t cause every financial hardship, you are responsible for how you respond to it.

Mindset Over Math: Why Cost Control Beats Income Hikes

Most people believe that the solution to debt is more income. A raise, a side hustle, a bonus—something that boosts the top line. It’s an understandable assumption. After all, if you have more money coming in, surely you can pay off what you owe faster, right? In theory, yes. But in practice, the relationship between income and debt relief is often misleading. Without a shift in behavior, extra income tends to fill the same spending gaps that created the debt in the first place. This is known as lifestyle inflation—the tendency to spend more as you earn more. The result? You end up in the same place, just with a higher salary and larger bills.

The real leverage in financial recovery isn’t in increasing inflows; it’s in managing outflows. Cost control builds discipline, and discipline builds long-term stability. When you focus on spending less, you develop a deeper awareness of value, necessity, and consequence. You start to see money not as something to be used immediately, but as a tool to be allocated wisely. This mindset shift is more powerful than any raise because it changes your relationship with money at the core. It’s the difference between reacting to financial pressure and proactively shaping your future.

Consider two scenarios. In the first, someone earning $4,000 a month gets a 10% raise, bringing their income to $4,400. If their spending increases to match—say, by upgrading their phone plan, eating out more, or leasing a newer car—their financial position remains unchanged. In the second scenario, the same person keeps their spending at $4,200 and uses the extra $200 to pay down debt. Even without a raise, simply reducing monthly spending by $200 would have the same impact. But here’s the key: cutting costs doesn’t require waiting for approval from an employer or landing a new client. It’s entirely within your control.

Behavioral psychology supports this approach. Studies show that people who focus on spending reduction report higher levels of financial well-being than those who focus solely on earning more. Why? Because control over spending creates a sense of mastery. You’re not waiting for external validation or opportunity; you’re making consistent, measurable progress. That progress builds confidence, which in turn reinforces good habits. Over time, this creates a positive feedback loop—small wins lead to bigger ones, and financial discipline becomes second nature.

Tracking the Leak: Mapping Your True Spending Patterns

The first step in gaining control is understanding where your money actually goes. Most people have a general sense of their expenses, but without tracking, those assumptions are often inaccurate. I was shocked when I started recording every dollar I spent for 30 days. The small, frequent purchases—coffee, snacks, online subscriptions—added up to hundreds each month. These weren’t luxuries I thought of as significant, but together, they represented a major leak in my financial foundation.

Tracking isn’t about judgment; it’s about clarity. The goal is to see your spending without shame, so you can make informed decisions. Start by gathering bank statements, credit card bills, and receipts from the past month. Categorize each expense: housing, utilities, groceries, transportation, dining, entertainment, subscriptions, and miscellaneous. Use a simple spreadsheet or a budgeting app to organize the data. The act of recording makes invisible spending visible. You might discover that you’re paying for three streaming services you rarely use, or that your weekly takeout habit costs as much as a car payment.

One of the most revealing aspects of tracking is identifying emotional spending. These are purchases made not out of need, but in response to stress, boredom, or habit. For me, it was late-night online shopping when I felt overwhelmed. For others, it might be impulse buys at the grocery store or using food delivery when too tired to cook. These patterns don’t disappear overnight, but tracking exposes them. Once you see the connection between mood and spending, you can begin to address the root cause rather than just the symptom.

Consistency is key. Tracking for one week isn’t enough. It takes at least a full month to capture recurring bills, variable expenses, and occasional purchases. Over time, trends emerge. You’ll notice which categories grow unexpectedly and which remain stable. This data becomes the foundation for your cost control strategy. Instead of guessing where to cut, you can make targeted changes based on real information. Knowledge isn’t just power—it’s protection. When you know exactly where your money goes, you’re far less likely to fall back into old habits.

Cutting Costs Without Cutting Dignity

Cost control doesn’t mean living in deprivation. It’s not about giving up everything you enjoy or making yourself miserable in the name of saving money. That kind of extreme approach rarely lasts. Instead, the goal is to make thoughtful, sustainable choices that preserve your quality of life while redirecting resources toward financial health. The most effective cost reductions are those that go unnoticed because they align with your values and priorities.

One of the most impactful changes I made was renegotiating recurring bills. Many people don’t realize that services like internet, phone, and insurance are often negotiable. A simple phone call to ask for a better rate or mention a competitor’s offer can result in significant savings. I reduced my monthly internet bill by 25% just by asking. Similarly, switching to a lower-tier service plan—without sacrificing reliability—can free up funds. The key is to evaluate what you truly need versus what you’re simply accustomed to.

Groceries are another area where small adjustments yield big results. Meal planning, buying in bulk, and using store brands can reduce food costs by 20% or more. But this doesn’t mean eating bland, repetitive meals. I found that preparing simple, balanced dishes at home actually improved my diet. And when I did eat out, I made it special—something to look forward to, not a daily convenience. The same principle applies to entertainment. Instead of canceling all subscriptions, I kept one or two that I genuinely used and canceled the rest. I also explored free community events, library programs, and outdoor activities that provided enjoyment without expense.

Perhaps the most empowering realization was that cutting costs could coexist with generosity and social connection. I used to think that hosting dinner meant expensive ingredients and takeout. But I discovered that friends appreciated home-cooked meals even more. A potluck or game night at home became a new tradition—one that strengthened relationships without straining my budget. Cost control, when done right, isn’t isolating; it’s intentional. It allows you to spend more on what truly matters by spending less on what doesn’t.

Building Your Financial Firewalls: Preventing Relapse

Progress is fragile. After months of careful spending and consistent debt payments, it’s easy to relax—especially when you start to feel comfortable again. But financial recovery isn’t complete until you’ve built systems to protect it. Without safeguards, a single unexpected expense—a car repair, medical bill, or home issue—can undo months of work. That’s why creating financial firewalls is essential.

The first and most important firewall is an emergency fund. This isn’t about saving thousands overnight; it’s about starting small. Aim for $500, then $1,000, then three to six months of essential expenses. The goal is to have a buffer that prevents you from relying on credit when life throws a curveball. I started by setting up an automatic transfer of $25 from each paycheck to a separate savings account. It wasn’t much, but it grew over time. More importantly, it created a habit of paying myself first.

Automation is a powerful tool. Beyond savings, you can automate bill payments, debt contributions, and even spending limits. Many banks offer alerts when your balance drops below a certain threshold. Budgeting apps can categorize transactions in real time and send notifications when you exceed a category limit. These systems reduce the need for constant vigilance. Instead of relying on willpower, you build infrastructure that supports your goals.

Another effective strategy is implementing mental triggers. For example, I adopted a 24-hour rule for any non-essential purchase over $50. This pause gave me time to reflect on whether I really needed the item or was just reacting to emotion. Over time, this simple habit prevented countless impulse buys. I also set up a “spending review” night once a month, where I reviewed my transactions and adjusted my budget as needed. These routines turned financial management from a source of stress into a routine practice.

The Ripple Effect: How Cost Control Fuels Debt Paydown

Every dollar saved through cost control becomes a dollar available for debt reduction. This is where momentum begins to build. As your spending decreases, you free up cash flow that can be redirected toward outstanding balances. Even modest savings—$100 or $200 a month—can accelerate payoff timelines significantly when applied consistently.

Consider a credit card balance of $8,000 at 18% interest. With a minimum payment of $160, it would take over 13 years to pay off and cost nearly $8,000 in interest. But by adding just $100 in monthly savings to that payment, the payoff time drops to under five years, and total interest paid falls by more than half. This isn’t magic—it’s math. But the psychological impact is profound. Watching your balance shrink faster than expected creates motivation. Each payment feels like progress, not punishment.

There are different strategies for applying extra payments. The debt snowball method focuses on paying off the smallest balance first, regardless of interest rate. This builds quick wins and emotional momentum. The debt avalanche method prioritizes the highest-interest debt, minimizing total interest paid. Both approaches work; the best one is the one you’ll stick with. The key is consistency. As your cost control efforts generate surplus funds, commit them to debt repayment without delay. Avoid the temptation to spend the “extra” money elsewhere. Let it work for you by eliminating obligations.

Over time, the ripple effect grows. As one debt disappears, its minimum payment becomes available to put toward the next. This creates a compounding effect—like rolling snowball gaining size as it moves. The financial pressure eases. The mental burden lightens. You begin to see possibilities instead of problems. This isn’t just about numbers; it’s about transformation. Each payment is a declaration of independence from past mistakes.

From Survival to Strength: Rebuilding Financial Confidence

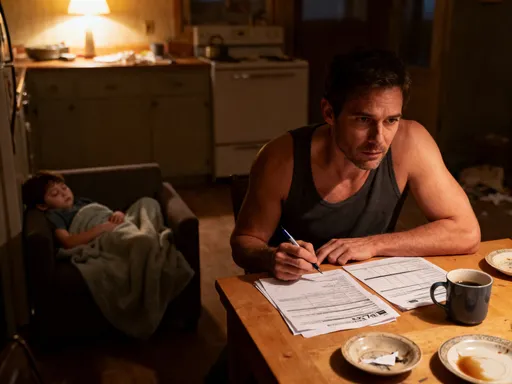

Debt recovery isn’t just about balancing a budget; it’s about rebuilding trust—in yourself. For years, I doubted my ability to manage money. I felt ashamed, anxious, and powerless. But as I made consistent, thoughtful choices, something shifted. I began to believe that I could handle financial challenges. Not because I had all the answers, but because I had developed the discipline to find them.

This confidence opens doors. Once debt is under control, you can start thinking beyond survival. You might begin saving for a home, investing in a retirement account, or funding a dream that once seemed impossible. These goals don’t require large sums to start. Even $50 a month invested consistently can grow significantly over time. The difference now is that you approach them with calm, not fear. You know you have the tools to manage risk, avoid overspending, and stay on track.

Financial strength isn’t measured by wealth alone; it’s measured by resilience. It’s the ability to face uncertainty with preparation rather than panic. It’s knowing that a setback won’t destroy your progress because you have systems in place. This kind of confidence doesn’t come from luck or inheritance. It comes from practice—from making the right choice, again and again, even when it’s hard.

And perhaps most importantly, it allows you to model healthy financial behavior for your family. Children learn money habits by watching adults. When they see you budgeting calmly, saving intentionally, and making thoughtful purchases, they absorb those values. You’re not just securing your own future; you’re shaping theirs.

Emerging from debt isn’t about a single win—it’s about repeated, quiet choices. Cost control isn’t punishment; it’s power. By mastering what you spend, you reclaim what matters most: peace of mind and the freedom to choose your future.