The Quiet System That Keeps My Budget Bulletproof

Ever felt like your budget is a leaky boat—no matter how hard you bail, it never stays dry? I’ve been there. After one too many surprise bills and sleepless nights, I built a no-drama system that actually works. It’s not about cutting lattes or living small. It’s about designing a financial shield that handles the unexpected. This isn’t a quick fix or a trendy money hack. It’s a structured, repeatable method that treats money like a tool, not a source of stress. For years, I chased balance by tracking every dollar, only to fall behind when life changed. Then I realized: the problem wasn’t my willpower—it was my system. A real budget doesn’t react. It anticipates. It doesn’t rely on perfect behavior. It’s built to endure imperfection. Here’s how I turned chaos into calm—and how you can too.

The Budget Trap Everyone Falls Into (And How to Escape It)

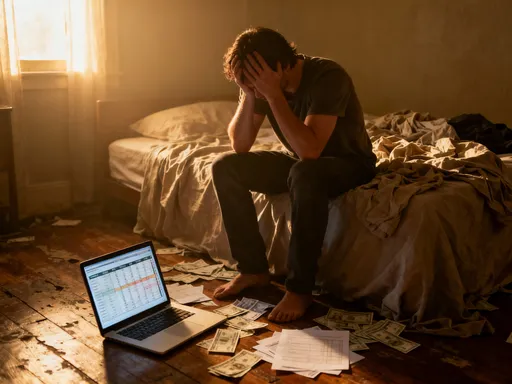

Most people approach budgeting the same way: they list their income, track their spending, and hope it balances by month’s end. When it doesn’t, they feel guilty. They cut back on small pleasures—skipping coffee, delaying haircuts, saying no to family outings—only to overspend again the next month. This cycle isn’t a failure of discipline. It’s a failure of design. The traditional budget assumes life is predictable, but real life is full of surprises. A car tire blows out. A child needs new glasses. The water heater fails on a Tuesday. These aren’t outliers. They’re routine. And when your budget has no room for them, every unexpected expense becomes a crisis.

The flaw in conventional budgeting is that it’s reactive. It waits for problems to appear before trying to solve them. It treats money as a static number rather than a dynamic flow. This leads to constant adjustments, emotional decision-making, and a sense of being perpetually behind. The truth is, no amount of spreadsheet precision can protect you from a $400 emergency room co-pay if your system wasn’t built to absorb it. What’s needed isn’t more tracking—it’s better structure. A budget that works doesn’t just record what happened. It prepares for what might happen. It includes margins, rules, and safeguards before the storm hits. That shift—from tracking to designing—is what transforms budgeting from a chore into a strategy.

Escaping this trap starts with redefining success. Instead of aiming for a perfectly balanced ledger, aim for resilience. A successful budget isn’t one where every dollar is assigned and spent exactly as planned. It’s one where you can handle a surprise without panic, without debt, without derailing your goals. This means accepting that variability is normal and building systems that expect it. The first step is to stop fighting reality and start designing for it. That means mapping your true financial landscape—not just your ideal one.

Building Your Financial Foundation: What a Real System Looks Like

A strong financial system isn’t built on willpower. It’s built on structure. Think of it like a house: no matter how beautiful the interior, if the foundation is weak, the whole thing can collapse. The same is true for money. Most people focus on the surface—where they spend, how much they save—but ignore the underlying framework. A real budget system has four key components: income mapping, expense zoning, buffer layers, and rule-based triggers. Each plays a specific role in creating stability.

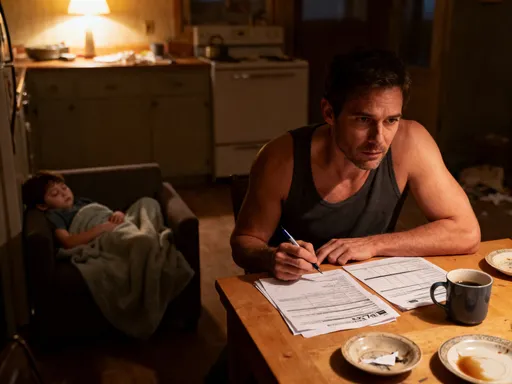

Income mapping means understanding exactly when and how money comes in. For those with steady paychecks, this seems simple. But even regular income can be mismanaged if it’s not aligned with expenses. The goal is to match cash flow timing with bill due dates. For example, if your rent is due on the 1st but you’re paid on the 15th, you need a plan to cover that gap. This might mean adjusting payment dates or building a short-term float. The point is to eliminate timing mismatches before they cause stress.

Expense zoning is about organizing spending into functional categories with clear boundaries. Instead of vague labels like “entertainment” or “miscellaneous,” create zones that reflect how money is actually used. Fixed expenses include rent, insurance, and loan payments—costs that don’t change much month to month. Flexible expenses cover groceries, gas, and household items—things that vary but are necessary. Future-focused zones include savings, investments, and debt repayment. Each zone gets a specific purpose and a funding plan. This prevents money from drifting into the wrong areas.

Buffer layers are small reserves built directly into the budget for variable costs. These aren’t emergency funds—they’re tactical cushions for things like car maintenance, medical co-pays, or seasonal bills. By pre-funding these categories, you avoid being caught off guard. Rule-based triggers are simple guidelines that dictate how money moves. For example: “If income exceeds budget by $100, 50% goes to debt, 50% to savings.” These rules automate decisions, reducing the need for constant oversight. Together, these four elements form a system that works whether you’re paying close attention or not.

Risk Isn’t Rare—Why Your Budget Must Expect the Unexpected

Many financial plans are built on the myth of the “average month.” They assume stable income, predictable expenses, and no major disruptions. But data shows this is far from reality. According to consumer finance surveys, the average household faces at least one significant unexpected expense every three months. These aren’t extreme events like job loss or major illness—though those happen too. They’re everyday surprises: a broken appliance, a dental filling, a last-minute flight for a family event. When your budget doesn’t account for these, each one feels like a crisis.

The problem isn’t the expenses themselves. It’s the assumption that they’re rare. This leads to under-preparation. People save for big goals like vacations or retirement but leave no room for mid-sized shocks. The result? They dip into savings, use credit cards, or delay other payments. Over time, this creates a cycle of financial whiplash. One month you’re ahead. The next, you’re scrambling. This isn’t sustainable, and it’s not necessary.

Psychological research shows that humans are wired to underestimate risk. We focus on what’s likely, not what’s possible. We remember the months when everything went smoothly and forget the ones that didn’t. This optimism bias makes us believe we’re safer than we are. But in personal finance, optimism without preparation is dangerous. The solution is to normalize uncertainty. Instead of planning for the best-case scenario, plan for the most likely range of outcomes. That means accepting that some months will cost more than others—and designing your budget to handle it.

Expecting the unexpected doesn’t mean living in fear. It means building flexibility into your system. It means acknowledging that variability is part of life, not a flaw in your planning. When you stop treating surprises as exceptions, you stop reacting to them. You start managing them. This shift in mindset is the foundation of financial resilience. It allows you to stay calm when things go wrong because you know your system can handle it.

The Buffer Strategy: Your Money’s Shock Absorbers

Imagine driving over a bumpy road with no shock absorbers. Every bump jars the car, stresses the engine, and makes the ride unbearable. That’s what it’s like to manage money without buffers. Every unexpected expense hits full force, disrupting your balance and increasing stress. Buffers are the shock absorbers of your budget. They’re small, targeted reserves that absorb variability in specific spending categories. Unlike a general emergency fund, which is for major crises, buffers are for the frequent, mid-sized costs that drain your peace of mind.

Creating a buffer starts with analyzing past spending. Look at your last 12 months of expenses in categories like utilities, auto costs, medical, and home maintenance. Find the average, then identify the high point. The difference between average and peak is your variability gap. For example, if your electric bill averages $120 but jumps to $200 in summer, that $80 difference is what your buffer should cover. By setting aside $80 per month during lower-use months, you smooth out the cost and avoid a cash crunch when the bill spikes.

Buffers work best when they’re pre-funded and category-specific. This means allocating money to them every month, even when you don’t need it. It’s not extra spending—it’s forward-looking allocation. For instance, instead of paying car repairs as they happen, you fund a “car maintenance” buffer each month. When a tire needs replacing, the money is already there. No decision fatigue. No stress. No debt. This method turns unpredictable costs into predictable allocations.

The emotional benefit of buffers is just as important as the financial one. Knowing you have a cushion for common surprises reduces anxiety and builds confidence. You stop dreading the phone call from the mechanic or the notice from the dentist. You’re prepared. This sense of control is what makes budgeting sustainable. It’s not about deprivation. It’s about empowerment. Over time, well-managed buffers can even evolve into larger savings, as unused funds roll over and grow. They become a quiet engine of financial progress.

Rule-Based Spending: How to Automate Good Decisions

Willpower is a terrible financial strategy. It’s inconsistent, depletes over time, and fails under stress. Yet most people rely on it to stick to their budgets. They promise themselves they’ll “be better” next month, only to face the same temptations and pressures. A better approach is to remove the need for willpower altogether. That’s where rule-based spending comes in. By creating simple, written rules, you automate decisions and reduce the mental load of managing money.

Rules work because they’re clear, consistent, and emotion-free. They don’t change based on how you feel. For example, a rule like “no non-recurring purchases over $100 without a 48-hour wait” prevents impulse buys without banning them entirely. It gives you time to reflect. Another rule might be “every bonus or tax refund is split 50/50: half to debt, half to savings.” This ensures windfalls improve your financial position instead of disappearing into daily spending.

Rules can also govern how money flows between accounts. “When my checking account exceeds $500, $200 automatically transfers to savings” is a simple way to grow reserves without thinking. Or “if a bill is more than 10% higher than usual, pause and verify it before paying.” This protects against errors or fraud. The key is to make rules specific enough to be actionable but flexible enough to last.

Households that use rule-based systems report fewer impulse purchases, less financial conflict, and greater confidence in their decisions. The rules aren’t about restriction. They’re about clarity. They answer the question “What should I do?” before the moment of choice arrives. This reduces internal negotiation and prevents emotional spending. Over time, these small, consistent actions compound into significant financial progress. Rules turn good intentions into automatic behavior.

Tracking Without Obsessing: The Light-Touch Monitoring Method

There are two extremes in budget tracking: ignoring it completely or obsessing over every transaction. One leads to chaos. The other leads to burnout. The sweet spot is light-touch monitoring—a method that keeps you informed without consuming your time. The goal isn’t perfection. It’s awareness. It’s knowing when to act, not tracking for the sake of tracking.

The light-touch method involves a weekly 15-minute review focused on exceptions and triggers. Instead of logging every coffee or grocery run, you check for deviations from your plan. Are any buffers running low? Did a rule get triggered? Is a bill unusually high? This is where a simple color-coded system helps: green for on track, yellow for caution, red for action needed. You don’t need to see every detail—just the signals that matter.

Tools can support this without complicating it. A basic spreadsheet, a budgeting app, or even a paper ledger works, as long as it highlights key metrics. The best tools show your zone balances, buffer levels, and rule triggers at a glance. They don’t require daily input. They summarize what you need to know. The focus is on progress, not precision. Did you stay within your flexible spending zone? Did your buffers cover their costs? Did your rules guide your decisions? These are the questions that matter.

Monitoring should feel like a check-in, not an audit. It’s a moment to adjust if needed, celebrate small wins, and stay aligned with your goals. When tracking is light and purposeful, it becomes sustainable. You’re not chained to your budget. You’re in control of it. This balance is what makes the system last. It respects your time and energy while keeping your finances on track.

From Survival to Strength: How This System Builds Long-Term Wealth

A budget designed for stability doesn’t just prevent crises. It creates the conditions for long-term wealth. When you stop losing money to surprises, you free up cash for what truly matters. That extra $200 a month that used to vanish into emergency repairs or medical bills can now go toward debt payoff, retirement, or a future home. This isn’t about earning more. It’s about keeping more. And it starts with a system that protects your income instead of leaking it.

The habits built into this approach compound over time. Consistent buffering turns into real savings. Rule-based decisions lead to smarter spending. Light-touch monitoring ensures you stay on course without burnout. Together, these practices create a feedback loop of financial strength. As your buffers grow, your confidence grows. As your confidence grows, you make bolder moves—investing, starting a side business, taking a career risk—because you know you’re protected.

This system reframes budgeting from limitation to liberation. It’s not about saying no to everything. It’s about saying yes to what matters by being prepared for what doesn’t. It allows you to sleep better, plan further, and live with more control. The quiet power of this method is that it works in the background, handling the chaos so you don’t have to. It’s not flashy. It doesn’t promise overnight riches. But it delivers something better: peace of mind, resilience, and steady progress toward a stronger financial future. That’s not just a budget. It’s a foundation for life.