How I Survived a Debt Crisis and Took Control of My Money

Ever felt like your debts were drowning you? I’ve been there—staring at bills, stressed and stuck. It wasn’t just about money; it was about control. What changed? A shift in mindset and a real strategy for managing cash flow. No magic tricks, just practical steps that actually work. This is the approach that saved me from financial freefall and rebuilt my confidence—one smart move at a time. The journey wasn’t fast, and it wasn’t easy, but it was possible. And if you’re feeling overwhelmed by debt, know this: you’re not alone, and recovery is within reach. The first step isn’t about earning more or winning the lottery—it’s about taking an honest look at where your money goes and deciding to make a change.

Hitting Rock Bottom: The Moment I Realized I Was in a Debt Trap

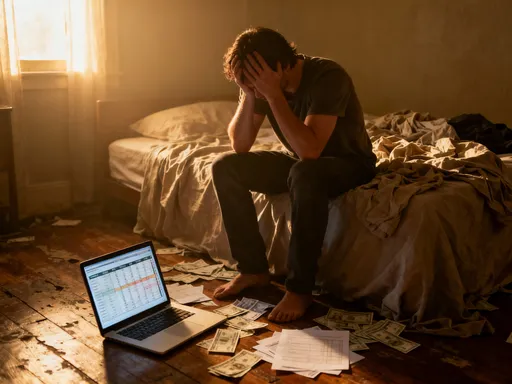

There was a time when opening the mailbox felt like facing a judge. Each envelope brought another reminder of what I couldn’t pay. Credit card statements piled up, medical bills arrived with stern warnings, and even the utilities seemed to carry a tone of accusation. I wasn’t living paycheck to paycheck—I was living payment to payment, scrambling to cover one bill by moving money from another. The stress seeped into everything: sleepless nights, tense conversations with family, and a constant undercurrent of shame. I had a stable job, a roof over my head, and no extravagant habits, yet I couldn’t seem to get ahead. That’s when it hit me—my income wasn’t the problem. My relationship with money was.

The turning point came on a Tuesday, of all days. I had to choose between paying the credit card minimum or covering the internet bill. The internet won, because I needed it for work. But skipping the payment triggered a late fee, which pushed my balance over the limit, which increased the interest rate. It was a domino effect I couldn’t stop. That’s when I realized I wasn’t just behind—I was trapped. The debt wasn’t just a number; it was a system working against me, growing silently while I struggled to keep up. The emotional toll was just as heavy as the financial one. I felt powerless, as if my choices no longer mattered. But in that moment of clarity, something shifted. I understood that if I didn’t take control, no one else would. And that realization, painful as it was, became the foundation of my recovery.

What made the situation worse was the illusion that I could handle it alone. I didn’t talk to anyone—not my family, not a financial advisor, not even a close friend. I thought asking for help meant admitting failure. But secrecy only deepened the cycle. Without outside perspective, I kept making the same mistakes: paying the wrong bills first, ignoring high-interest accounts, and using one card to pay another. The truth is, unmanaged debt doesn’t discriminate by income level. It thrives on inattention, avoidance, and poor cash flow management. And mine was a textbook case of all three. The wake-up call wasn’t dramatic—it was quiet, persistent, and impossible to ignore any longer. I had to stop surviving and start strategizing.

Facing the Numbers: Why Ignoring Debt Only Makes It Worse

The first real step toward recovery was the one I’d been avoiding: looking at every single debt, all at once. I sat down with a notebook, pulled out every statement, and listed every balance, interest rate, and minimum payment. The total was worse than I thought. Seeing it on paper was painful, but also strangely liberating. For the first time, I wasn’t guessing—I knew exactly where I stood. That moment of transparency was the beginning of control. Because here’s the truth: debt doesn’t disappear when you ignore it. In fact, it grows. Interest compounds, fees accumulate, and late payments damage credit scores, making future borrowing more expensive. Avoidance doesn’t buy time—it steals it.

Many people delay this step because they’re afraid of the number. But fear only gives debt more power. When you don’t know what you owe, you can’t make a plan. And without a plan, you’re just reacting—paying what feels urgent instead of what’s actually important. For example, I was making the minimum on a high-interest credit card while paying off a low-interest personal loan ahead of schedule. It felt productive, but mathematically, it was backwards. I was saving less on interest than I was paying on the card. That kind of misalignment is common when emotions drive decisions instead of data.

Creating a full financial snapshot isn’t about judgment—it’s about clarity. It allows you to see patterns: which debts are growing fastest, which payments are draining your cash flow, and where you might have room to adjust. This isn’t a one-time exercise. Revisiting your debt list monthly helps track progress and maintain motivation. Some find it helpful to use spreadsheets or budgeting apps, but pen and paper work just as well. The goal is honesty, not perfection. You don’t need to solve everything at once. You just need to start with the truth. And once you do, the path forward becomes clearer. Knowledge isn’t just power—it’s protection. It keeps you from making decisions in the dark and helps you prioritize what truly matters.

Building a Realistic Budget: The Backbone of Debt Recovery

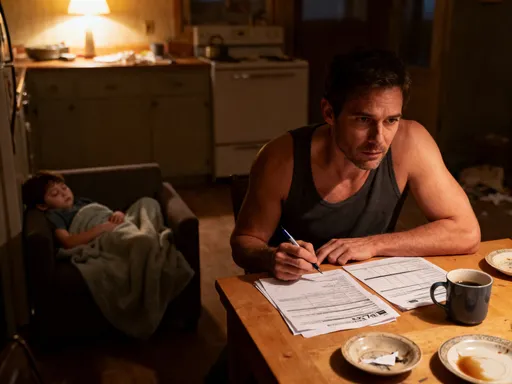

Budgeting isn’t about punishment. It’s about planning. Before I created a real budget, I thought I knew where my money went. I was wrong. Tracking my spending for just one month revealed surprises: recurring subscriptions I’d forgotten about, frequent small purchases that added up, and impulse buys disguised as necessities. A budget isn’t a restriction—it’s a map. It shows you where you are, where you want to go, and how to get there without getting lost. The key is making it realistic. A budget that’s too strict will fail because it doesn’t account for real life. One that’s too loose won’t free up enough money to make a difference. The sweet spot is balance.

To build mine, I started with income—my take-home pay after taxes and deductions. Then I listed all fixed expenses: rent, utilities, insurance, loan payments. Next came variable costs: groceries, transportation, household items. I reviewed three months of bank statements to find averages, which helped smooth out fluctuations. Only then did I look at discretionary spending: dining out, entertainment, gifts. This wasn’t about cutting everything—I just needed to see where I could reduce without feeling deprived. For instance, I switched to a cheaper phone plan, bought groceries in bulk, and paused a streaming service I rarely used. These weren’t drastic changes, but together, they freed up over $200 a month.

The most important part of the budget was the debt repayment line. I treated it like any other bill—non-negotiable. By assigning a specific amount to debt each month, I ensured progress even when other expenses fluctuated. I also built in flexibility. Life changes—car repairs, medical visits, family needs—and a good budget can adapt. I set aside a small ‘miscellaneous’ category for unexpected costs, so I wouldn’t have to raid my debt payment. Consistency mattered more than perfection. Some months I overspent in one area, but I adjusted the next. The goal wasn’t to follow the budget rigidly, but to stay aware and in control. Over time, it became less of a chore and more of a habit—a quiet confidence that I knew where my money was going.

The Debt Snowball vs. Avalanche: Which Strategy Fits Your Life?

Once I had a budget in place, I needed a strategy to pay off my debts. Two methods stood out: the debt snowball and the debt avalanche. Both are proven, but they work in different ways and suit different personalities. The snowball method focuses on paying off the smallest debt first, regardless of interest rate. Once that’s gone, you roll the payment into the next smallest, creating momentum. The avalanche method, on the other hand, targets the debt with the highest interest rate first, saving more money over time. Mathematically, the avalanche is more efficient. But psychology matters just as much as math when you’re in debt.

I chose the snowball method, not because it was optimal, but because I needed wins. My smallest debt was a $150 medical bill. I redirected every spare dollar toward it and paid it off in three weeks. That small victory gave me energy. Next was a $400 credit card. Then a $900 store card. Each payoff felt like a weight lifting. The payments I’d been making on the first debt didn’t disappear—they moved to the next, increasing my repayment power. It wasn’t the fastest way, but it was the most motivating. For someone who felt defeated, that sense of progress was priceless.

The avalanche method would have saved me more in interest, but it might have cost me my resolve. My largest debt had the highest rate, but paying it down slowly, with no quick wins, could have felt like running in place. The snowball gave me visible results. That doesn’t mean the avalanche isn’t valuable. If you’re disciplined, patient, and motivated by long-term savings, it may be the better fit. Some people even combine both—using the snowball for small debts to build momentum, then switching to the avalanche for larger ones. The point isn’t to follow a rigid rule, but to choose a strategy that aligns with your temperament and keeps you moving forward. Because in debt repayment, momentum is everything.

Boosting Cash Flow: Simple Ways to Earn More and Spend Less

A budget helps you manage your money, but sometimes you need more of it. Increasing cash flow isn’t about getting rich overnight—it’s about creating breathing room. I looked at two levers: earning more and spending less. On the spending side, I went deeper. I negotiated my internet bill by calling customer retention and asking for a better rate. I switched to generic brands at the grocery store. I canceled duplicate subscriptions and switched to off-peak energy use to lower utility costs. These weren’t sacrifices—they were adjustments that added up without changing my lifestyle.

On the income side, I explored side opportunities that fit my schedule. I sold unused items online—electronics, clothes, furniture. The extra few hundred dollars went straight to debt. I also took on freelance work in my area of expertise, using weekends and evenings. It wasn’t glamorous, but it was effective. Some people tutor, drive for rideshare services, or offer home-based services like baking or repairs. The key is sustainability. A side hustle that burns you out isn’t worth it. I limited mine to ten hours a week, which added about $300 monthly without overwhelming my family time.

Another option I considered was refinancing. I looked into balance transfer cards with 0% introductory rates, but only used one after reading the terms carefully. I knew the rate would revert after 18 months, so I made a plan to pay it off before then. I also refinanced a personal loan at a lower rate, which reduced my monthly payment and total interest. These moves required research and discipline, but they made a real difference. The goal wasn’t to take on more debt, but to optimize what I already had. Every dollar saved or earned wasn’t just a number—it was a step toward freedom. And over time, those steps added up to real progress.

Protecting Progress: How to Avoid Falling Back Into Crisis

As my debts shrank, I had to guard against complacency. It’s easy to relax once the pressure eases, but that’s when setbacks happen. Lifestyle inflation—spending more as income increases—is a common trap. I saw people pay off debt only to buy a new car or take an expensive vacation, then end up right back where they started. I made a rule: any extra money would go toward debt or savings, not spending. It wasn’t forever—just until I was stable. That discipline kept me on track.

Another danger was emotional spending. Stress, boredom, or celebration could all trigger impulse buys. I developed a 24-hour rule: if I wanted something non-essential, I waited a day. Most of the time, the urge passed. I also unsubscribed from marketing emails that tempted me. These small habits protected my progress. But the most important safeguard was building a buffer fund. I started with $500, then $1,000. It wasn’t a full emergency fund yet, but it was enough to cover small surprises—a flat tire, a vet bill, a broken appliance—without using a credit card.

This buffer changed everything. Before, any unexpected expense sent me into crisis mode. Now, I had a cushion. It reduced anxiety and made me less reactive. I also stress-tested my budget by imagining worst-case scenarios: What if I lost income for a month? What if a major repair came up? Planning for those possibilities helped me strengthen my financial resilience. I wasn’t just paying off debt—I was building a system that could withstand real life. That shift, from survival to stability, was the real victory.

Long-Term Freedom: Turning Survival Into Sustainable Money Mastery

Today, I’m debt-free—not because I earned more, won the lottery, or made drastic cuts, but because I changed my habits. The journey taught me that financial control isn’t about perfection. It’s about persistence. It’s about making better choices, one day at a time. I still budget, still track spending, and still save. But now, it’s not a struggle—it’s a practice. I’ve built an emergency fund, started saving for retirement, and even set aside money for occasional treats without guilt.

The real transformation wasn’t in my bank account—it was in my mindset. I no longer feel controlled by money. I manage it. I’ve learned to anticipate needs, plan for surprises, and make decisions with confidence. And I know I’m not immune to setbacks—life happens. But now I have tools, habits, and resilience. The same principles that got me out of debt now help me build wealth: awareness, consistency, and intentionality.

If you’re in debt, know this: your situation doesn’t define you. What matters is what you do next. Start small. Face the numbers. Make a budget. Pick a strategy. Build momentum. Protect your progress. And keep going. Financial freedom isn’t a single event—it’s a series of choices. And each one brings you closer to a life where you’re in charge, where stress gives way to peace, and where your money works for you, not against you. That’s not a dream. It’s possible. And it starts today.